Top 10 Pivot Point Indicators for MT4 – The Best of All

Pivot points are an excellent leading indicator in technical analysis. Most importantly, is based on mathematical calculation and allows no room for error due to the manual calculation of the trader. They answer the two most important questions for technical forex traders. What is the current market trend? Where are the support and resistance located?

Though the heart of this MT4 indicator is to identify the pivot point that identifies the bullish or bearish market trend. The identification of the pivot point leads us to the location of the support and resistance. Indeed, traders can calculate multiple levels of support and resistance.

Pivot levels are calculated by using the 4 important price points of the previous day. The open, high, low, and close prices of the previous day determine the current day’s pivot point. Based on the previous day’s values traders can anticipate if the current day’s trend will be bullish or bearish.

The market is expected to be in a bullish price trend if it moves higher than the pivot point. Similarly, traders anticipate a bearish market if the price moves lower than the pivot point. Thus, forex technical traders establish the market trend using the pivot point.

Generally, a pivot point is the best entry point. While the best exit is the first available support or resistance based on the trend direction. Additionally, the additional support and resistance levels are the best candidates for further take profit and stop loss levels.

The pivot point calculation methods have evolved many times with traders adding various calculation methods and formulae to derive the pivots. However, most pivot point calculation methods are based on the open, high, low, and close values of the previous day. In many cases, the support and resistance levels are calculated using various methods.

In this article, we will discuss the best pivot indicator for MetaTrader. As mentioned earlier, these indicators use various calculation methods like Fibonacci, Camarilla, and Woodie to name some. Furthermore, let’s try to understand how forex traders use these indicators to trade successfully.

Top 10 Indicators For Day Trading

- Pivot Points All-In-One Indicator

- Daily Pivot Points Indicator

- Fibonacci Pivots Indicator

- FiboPiv V2 Indicator

- All Pivot Points Indicator

- Camarilla Pivots Indicator

- Pivot Points Daily Shifted Indicator

- Pivot Custom Indicator

- Pivot Indicator

- Daily Weekly Monthly HiLo Pivot Points Indicator

Pivot Points All-In-One Indicator

Let’s start with the first indicator of our list of the best pivot point MT4 indicators with the Pivot points all in one indicator. The Pivot point All in one indicator for MT4 is the Swiss knife for forex traders using the pivot points. Because the indicator has multiple methods of pivot point calculation built-in.

The following calculation methods are available in this indicator Classical, Woodie, Fibonacci, Camarilla, and Central Pivot Range (CPR). So, forex traders should choose carefully and buy and sell accordingly. The Classical method is widely used by forex traders and is clearly the favorite. However, the Woodies add more weightage to the closing price, hence is sensitive to trend changes.

Fibonacci introduces the famous Fibo percentages into the calculation of support and resistance levels. It further helps forex traders to trade trend continuations. Day traders and scalpers can look at the Camarilla pivot points as they tend to provide shorter support and resistance levels.

Though the important aspect of CPR is to identify the trend direction. It works well in identifying the support and resistance levels too. In most cases, the mere identification of the trend is enough for most traders. Obviously, the support and resistance levels act as take profit, stop loss, and applying the trailing stop loss.

Forex traders can choose their desired pivot calculation method to identify trend reversals, trend continuation, best entry point, support, and resistance levels. Though, the indicator provides you with multiple methods of pivot points. It is important for forex traders to choose the calculation method according to their requirements.

Daily Pivot Points Indicator

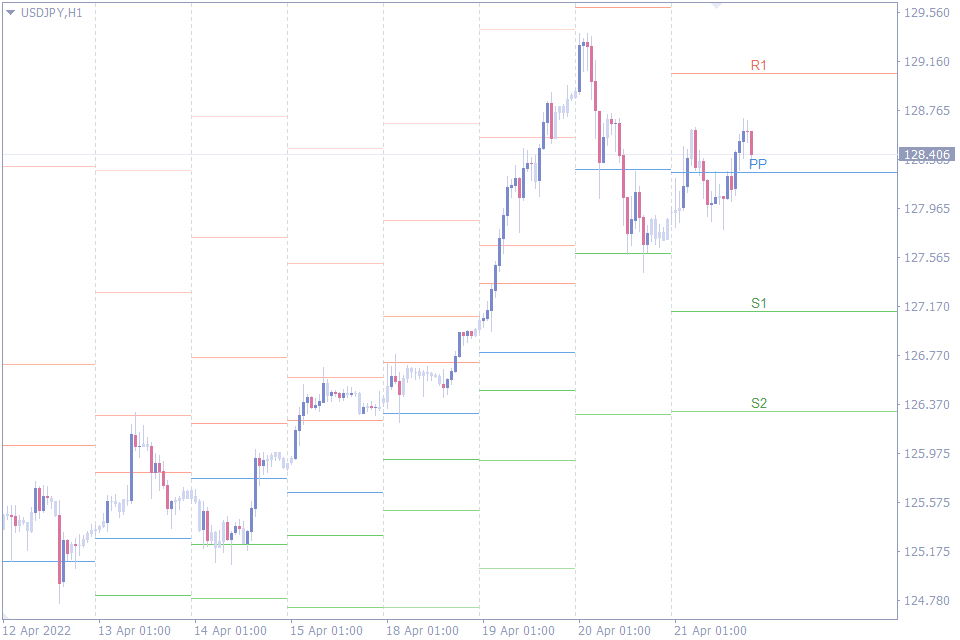

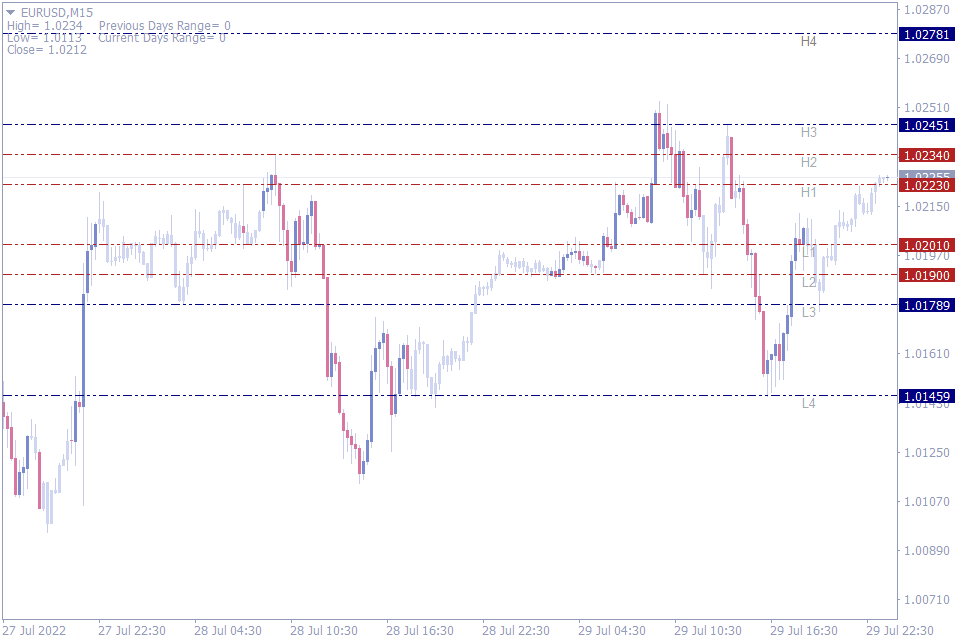

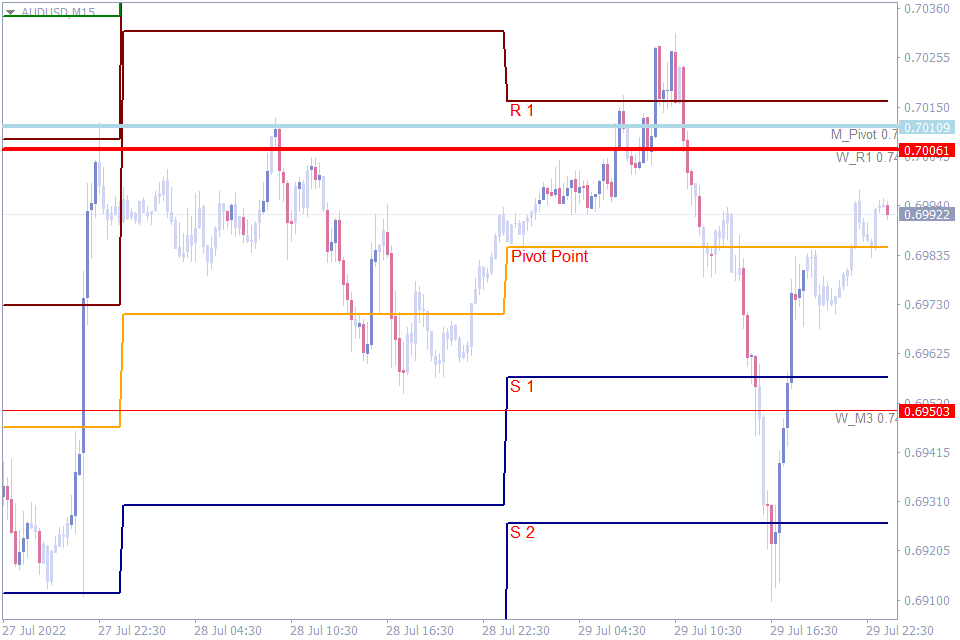

Now it’s time to look at our second indicator in this list. This indicator provides 13 levels at any given chart and makes it prudent for intraday traders and short-term forex traders. The major difference between this pivot point indicator and other indicators is the mid-line between the support and resistance levels.

Firstly, the indicator automatically calculates the pivot point and then plots three support levels S1, S2, and S3. Furthermore, it plots three resistance levels R1, R2, and R3 like other pivot point indicators. It differs in plotting additional lines between pivot and R1, R1 and R2, R2 and R3. Similarly, it plots additional lines between Pivot and S1, S1 and S2, and S2 and S3.

These additional lines provide much closer support and resistance levels. So, intraday forex traders can identify the trend reversal points. Normally, when the price hits the extreme levels of resistance 3 or support 3, traders anticipate a reversal.

The indicator uses the previous day’s close, high and low prices to calculate the pivot points. When the market is range bound, range traders look to sell at resistance and buy at a support level. However, when the market is trending, technical traders look at the breakout of support or resistance level for a trend continuation.

So, the daily pivot points indicator specifically helps the intraday forex traders to identify the support and resistance points.

Fibonacci Pivots Indicator

The third indicator on the list of best pivot point indicators combines the pivots and the classic Fibonacci ratios. This unique combination of both mathematical calculations adds more weightage and value to the support and resistance lines. Thus, forex traders use them and trade with additional confirmation of the Fibonacci numbers.

The indicator calculates and plots the pivot lines using the same formulae as other indicators, by using the high, low, and close. However, the S1 and R1 are calculated using 0.382. Furthermore, the S2 AND R2 are formulated using 0.618, while the S3 and R3 are identified using 0.764.

Generally, forex traders identify the bullish and bearish market conditions once the price opens above or below the pivot point. The opening of the trading day above the pivot shows that the price is bullish, considering the previous day’s movement.

Similarly, if the opening of the day is below the pivot it indicates the bearish nature of the market. The pivot point indicator uses the previous day’s trend to identify the current day’s trend. So, traders using this trend information prepare to place BUY or SELL trades using the support or resistance levels.

Like other indicators, the support and resistance levels are used as trend reversal points.

FiboPiv V2 Indicator

The next indicator FiboPiv V2 also calculates the pivot points using the Fibonacci ratios. Let’s now look at the indicator and its trading method in detail. The indicator applies 38%, 50 %, and 62% to identify the support and resistance levels. The R1 and S1 are calculated using the 38%, while the R2 and S2 are identified by the 50% Fibonacci ratio. Finally, the indicator plots the R3 and S3 using the 62% Fibo ratio.

As the name of this MT4 indicator suggests FboPiv applies the Fibonacci ratios to the Pivot levels to identify the support and resistance levels. Initially, the indicator calculates the pivot level using the standard formulae by using the high, low, and close values of the previous day.

The FiboPiv V2 MetaTrader indicator plots the charts in all intraday chart time frames. Though the indicator uses the daily close, high and low values for pivot point calculation. The pivot lines, support, and resistance lines are visible in all charts at the respective price values.

The FiboPiv V2 indicator can be applied the same way as the other pivot point indicator to trade the ranging and trending markets.

All Pivot Points Indicator

The fifth indicator in the best list of pivot points is the All-Pivot Points indicator. As the name suggests the indicator plots various types of pivot points automatically. So, forex traders should not have to be bound by a single type of pivot point. Rather, traders can calculate the pivot points using various methods and choose their preferred calculation method.

The All-pivot points indicator provides the technical forex trader with the following options. Classic, Fibonacci, Woodie, Camarilla, Floor, and Fibonacci retracement options are available in this indicator.

Another unique method included in this indicator is the display of historical pivot points. Most pivot point indicators only display the current day’s pivot using the previous day’s price values. However, forex traders can use the All-pivot points indicator to plot the pivot points for any given previous day.

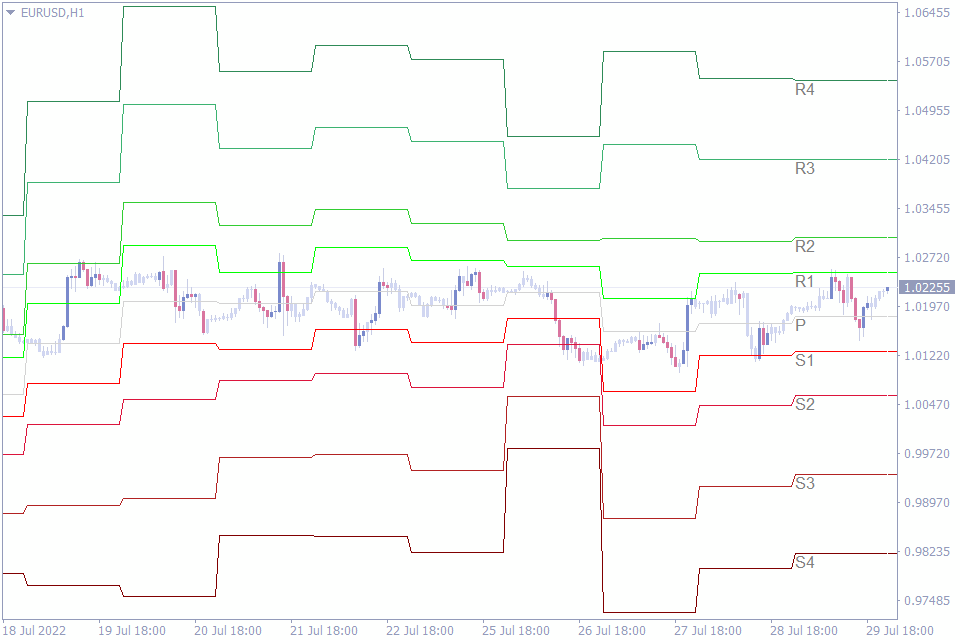

Another important aspect that differs from other pivot point indicators is the number of support and resistance levels. The All-pivot points indicator plots 4 support and 4 resistance levels. However, compared to the 3 support and 3resistance levels this provides an additional opportunity for forex traders.

This indicator is very helpful for new traders, who are beginning to use the pivot points to understand and approach the market. Since the indicator houses multiple calculations, traders can experiment with them before going LIVE.

The All-pivot points indicator provides additional support and resistance as S4 and R4. So, this indicator is indeed helpful for all types of traders, particularly new forex traders.

Camarilla Pivots Indicator

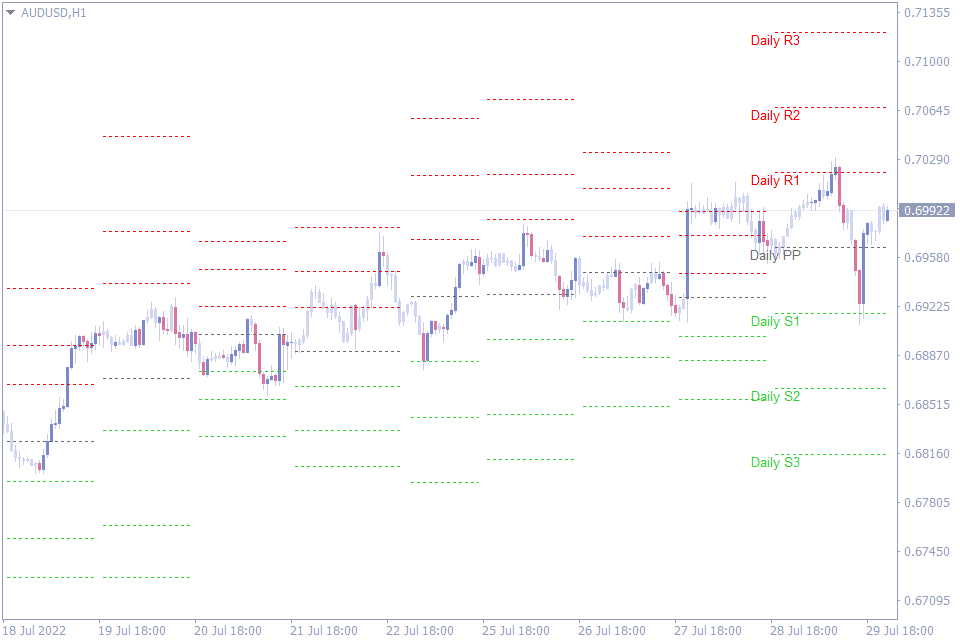

Our next indicator in this list composed of the best pivot points indicator for MetaTrader is the Camarilla pivots indicator. The Camarilla pivot indicator was derived by Nick Scott in 1989. Nick Scott was a successful bond trader. The indicator calculates the pivot point using the high, low, and close prices of the previous day.

The indicator automatically calculates and plots 4 different support and resistance levels. Forex traders can apply the indicator and trade both trending and ranging markets. The support S3 and S4 and the resistance R3 and R4 are considered the most important levels. Most action is expected to happen around these levels.

Traders can anticipate price reversals from S3 or R3 based on the trend direction. So, S3 and R3 are the price levels to watch for counter-trend trading. Forex technical traders can place a trade at these levels and place a stop loss at one higher level.

On the other hand, if the price breaches the S4 or R4 levels. Then, forex traders should consider the break of these support and resistance levels as a trend continuation signal. So, forex traders should enter the market with a trend continuation trade and place a stop loss one level lower.

The Camarilla pivots indicator helps forex traders to focus on a couple of resistance and support levels to base their trading and focuses on short and long-term trading.

Pivot Points Daily Shifted Indicator

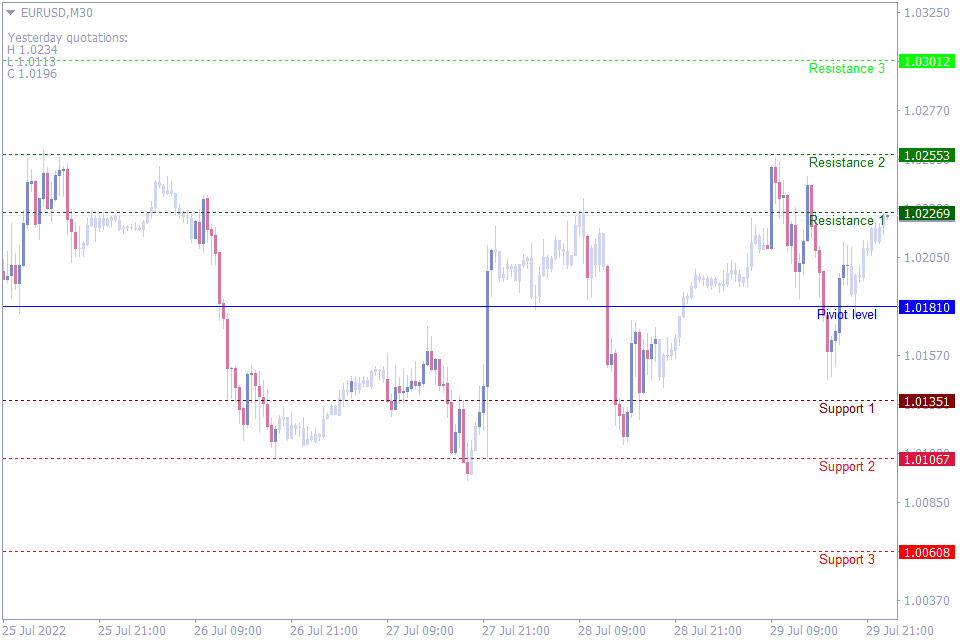

Our seventh indicator in the list of the best pivot point indicators list is the Pivot points daily shifted indicator for MT4. Generally, pivot point indicators plot the current day’s pivot point and the support and resistance levels only. However, the Pivot points daily shifted MetaTrader indicator displays the pivots and support and resistance lines for the history too.

The important feature is that all these lines are plotted in a non-intrusive manner. The indicator plots the lines in a manner that is clearly defined within the day and does not overlap the previous or the next day. As a result, technical forex traders can look at the charts and identify the market movement based on the pivots and the support and resistance lines.

The indicator automatically calculates the pivot point and the support and resistance levels in the classic method. This indicator is very helpful for traders to easily identify and study the performance of the market vs the indicator and to sharpen their trading skills using the pivot points.

Pivot Custom Indicator

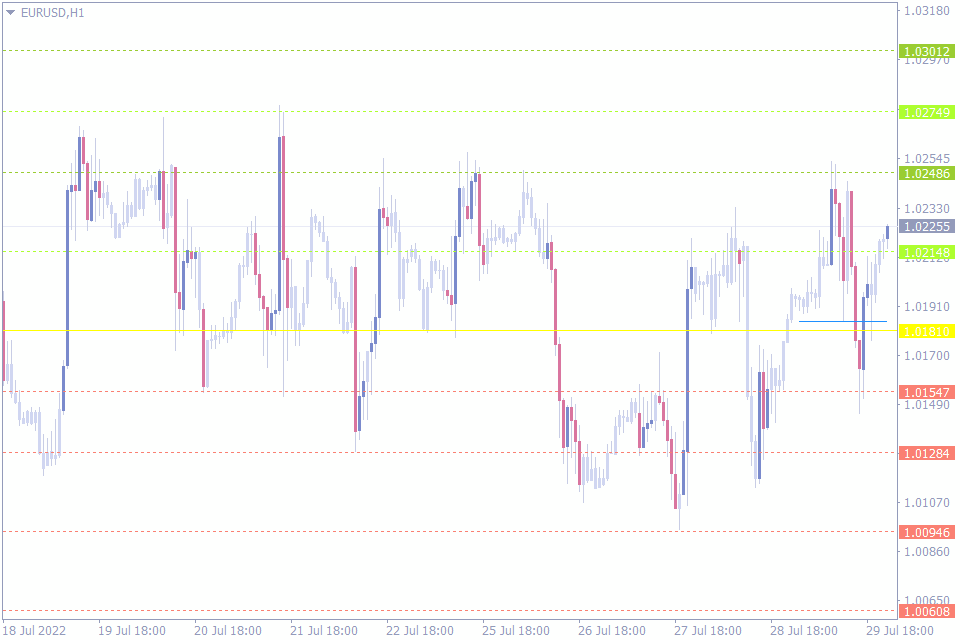

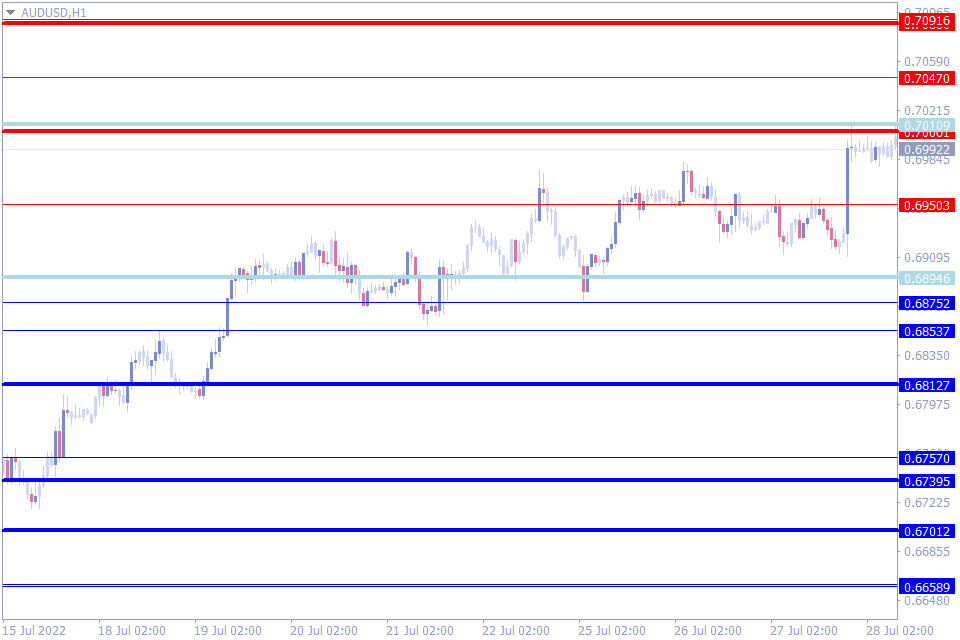

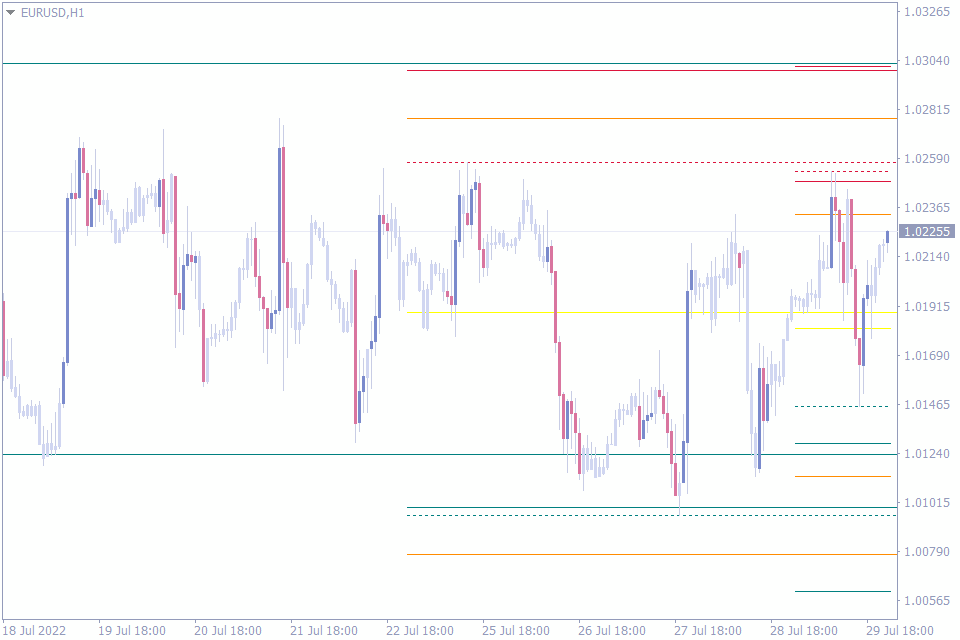

Now we are moving to the final few indicators in the list of best pivot points indicators. The next indicator in our list is the Pivot Custom indicator for MT4. This MetaTrader indicator plots the pivot points and support and resistance lines. Additionally, the indicator plots the daily, weekly, and monthly pivot points and support and resistance lines.

Generally, the Pivot point indicator plots only the daily pivots. However, if traders would like to understand the weekly, and monthly pivot points to identify the trend direction on a higher time frame price chart. This indicator helps them, to enter trades using the daily pivot keeping the higher time frame trend direction in mind.

Thus, the Pivot custom MetaTrader indicator helps the trend traders to stay in the higher time frame trend. This indicator is well suitable for forex traders looking to apply pivot points in multiple time frames.

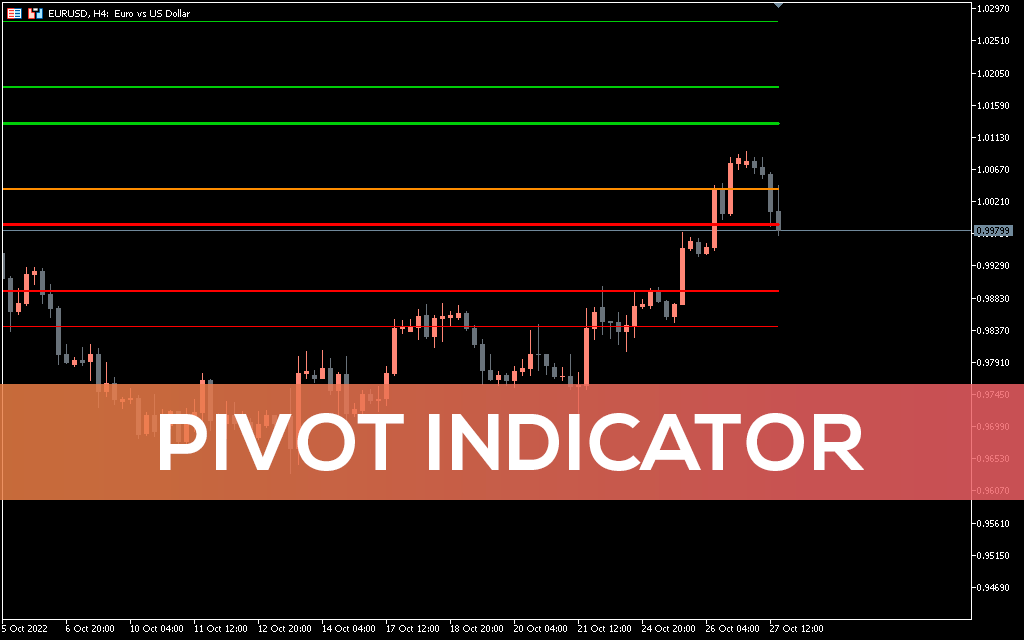

Pivot Indicator

The ninth indicator on our list is the Pivot indicator for MT4. The indicator plots the pivot lines and the support and resistance lines as a continuous line. It connects the historical lines with the current day’s pivot and support and resistance lines.

The indicator uses the classic pivot formulae to calculate the pivot points and the support and resistance lines. Additionally, the indicator plots three support lines as S1, S2, and S3. Similarly, the resistance lines of R1, R2, and R3 are plotted on the price charts.

Support and resistance lines are the lifeline for most technical forex traders. The Pivot indicator helps the traders to effectively identify them automatically. Most traders like to use auto trading strategies. In fact, the pivot point indicators can add much value to the automated trading strategies to identify the trend direction and validate the buy and sell trading signals.

This pivot indicator is another helpful tool for pivot point traders.

Daily Weekly Monthly HiLo Pivot Points Indicator

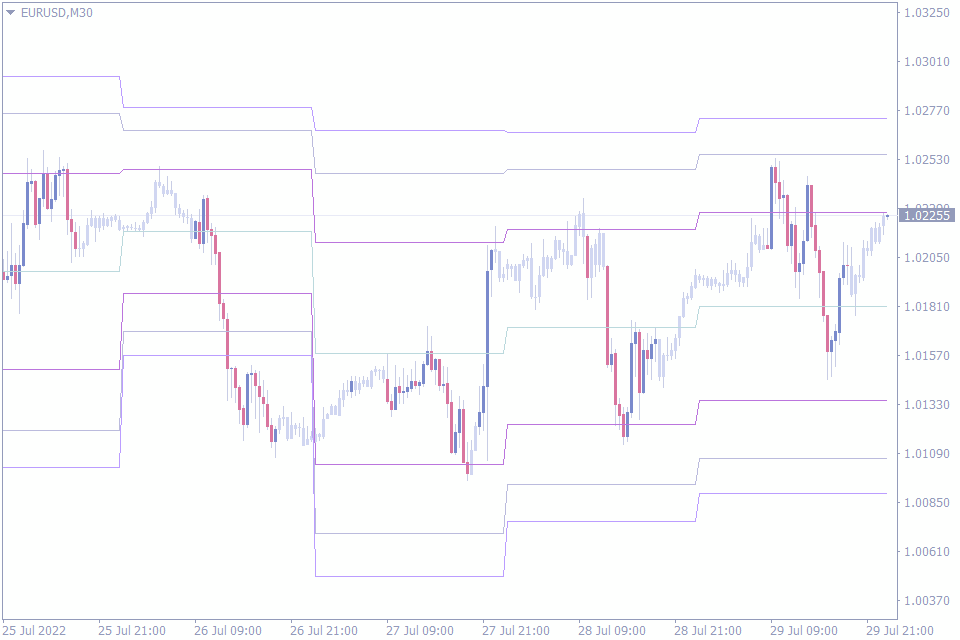

The last indicator on our list of the best pivot point indicator is the Daily Weekly Monthly HiLo Pivot Points indicator for MT4. As mentioned in the name of the indicator it automatically calculates and plots the pivots of multiple time frames (mtf). So, forex pivot point traders using multi-timeframe trading strategies benefit the most from this indicator.

This indicator plots a pivot point and three support and resistances for daily, weekly and monthly chart time frames. Additionally, the indicator displays the high and low of the daily, weekly, and monthly time frames. As a result, technical forex traders can easily identify the price ranges.

So, forex traders can look at the monthly price trend and then tune up to the weekly price trend. Once the trend direction of the weekly and monthly charts is identified. Traders can now look for precise entry points using the daily pivot point to establish a buy or sell position.

In effect, the daily weekly monthly hilo pivot point MetaTrader indicator may require some basic understanding and knowledge about the multi-timeframe chart analysis.

Conclusion

This brings us to the list of the best pivot point indicators with some of the well-functioning and easy-to-use pivot point indicators. Though pivot points are the best tool to identify the daily trend and to plot the best trend reversal points. For best trading results, forex traders should trade in confluence with other indicators.

However, the best confirmation method is to use price action.

Comments (3)

Hello, I would need an indicator that, in addition to the classic pivots, also plots the mid point, do you have something like that?

I am typically to blogging and i actually respect your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.