The Inside Bar Strategy Simplified

The Inside Bar strategy is a powerful technical analysis tool used by many traders in the Forex market. This article will delve into the fundamentals of the Inside Bar strategy, explaining what it is, why it’s important, and how it can be identified on a price chart. We will discuss the psychological implications behind the formation of an Inside Bar and why it can signal a potential market reversal or continuation.

Spotting the Inside Bar in Forex Trading

Spotting an Inside Bar on a Forex chart is akin to uncovering a hidden gem that signals the market’s imminent move. An Inside Bar is characterized by its smaller size in comparison to the previous bar, fully contained within the latter’s high and low range, resembling a bar nestled within the embrace of its predecessor. This pattern typically indicates market consolidation and can be a precursor to a significant breakout. To identify an Inside Bar, traders must scrutinize the price action, looking for a candle that is completely ‘inside’ the range of the previous candle, known as the ‘Mother bar’. Technical traders pay close attention to Inside Bars that form near key levels of support and resistance or follow a strong directional move, as these setups often lead to high-probability trading opportunities. Whether you’re engaged in scalping, day trading, or swing trading, recognizing an Inside Bar can provide a strategic edge, offering clues to the currency pairs next directional thrust.

Dimensions and Proportions

The relative dimensions of the Inside Bar compared to the Mother Bar can greatly influence the precision of the trading signal. A diminutive Inside Bar, nestled snugly within the confines of the Mother Bar, often suggests a stronger and more reliable market signal. The ideal scenario is when the Inside Bar is situated within either the top or bottom half of the Mother Bar’s range, as this can be indicative of a more potent and actionable trading setup.

Adapting the Inside Bar Strategy Across Different Time Frames

Adapting the Inside Bar strategy across different time frames is crucial for traders who operate with varying trading styles and objectives. For day traders, focusing on shorter time frames such as 15-minute or 1-hour charts can provide more frequent Inside Bar opportunities, albeit with potentially smaller moves. These traders must be nimble and ready to act quickly as the market unfolds. On the other hand, swing traders may prefer to analyze daily or weekly charts where Inside Bars can signal more significant trend-following or reversals, with trades that may last several days to weeks. It’s important to note that while Inside Bars on higher time frames may occur less frequently, they often carry more weight and can lead to larger price movements due to the increased market information each bar represents. Regardless of the time frame, traders should adjust their risk management and trade sizing accordingly.

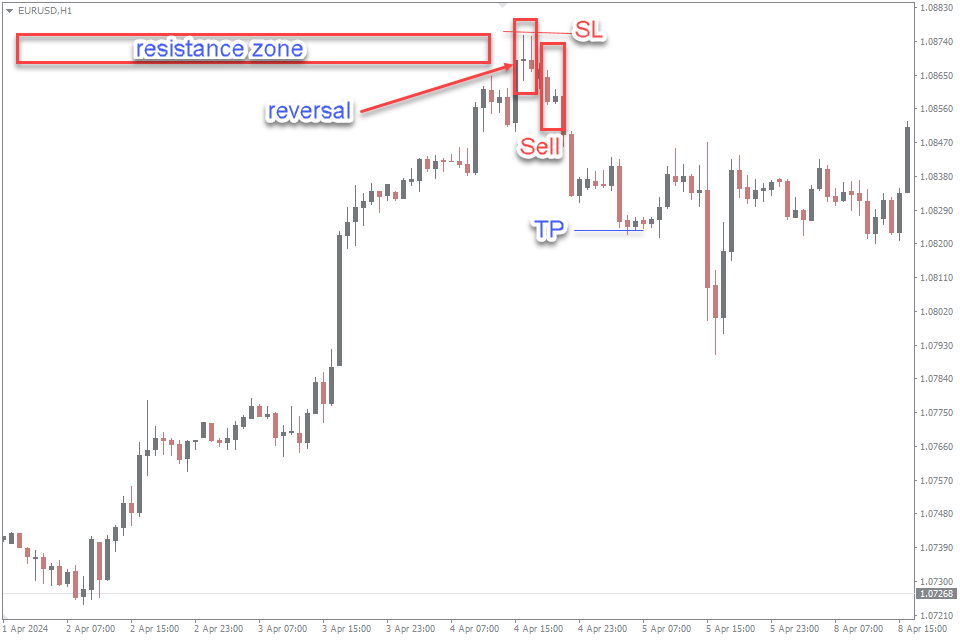

Trading with the Inside Bar Strategy

Trading with the Inside Bar strategy is a methodical approach that requires a keen eye for detail and a disciplined execution plan. It’s crucial to consider the overall market trendline and other contextual factors, as Inside Bars can signify both reversal and continuation patterns.

Although the Inside Bar is fundamentally a two-candle pattern, the third candle following the baby candle is of significant importance. In fact, the trading decision is typically made after the completion of this third candle.

Pinpointing the Breakout Threshold

The emergence of an Inside Bar often signals a period of market consolidation, suggesting a possible shift or reversal of the current trend. Assess whether an upward breakout is on the horizon during a bearish trend or a downward breakout during a bullish trend. A breakout contrary to the prevailing trend, preceding price consolidation, may indicate a potential trend reversal.

Best Mid-Term Chart Analysis

For the most dependable insights, it is advisable to trade the Inside Bar pattern on mid-term time frames, such as the daily chart. These chart pattern offer a broader data set, capturing Inside Bars at critical junctures where the market is more likely to experience a shift.

Initiating Trades Based on Inside Bar Parameters

After spotting an Inside Bar, consider opening a trade in alignment with the ongoing or anticipated market direction. If the price hovers within the high and low boundaries of the Mother Bar, it may be prudent to trade with the expectation of a trend continuation. Conversely, you might place an entry order slightly above the Inside Bar’s upper limit if you anticipate a market turnaround. The greater the disparity between the Mother Bar and Inside Bar, the greater the probability of a market reversal, and vice versa.

A price movement beyond the confines of the Inside Bar indicates an opportune moment to execute a trade, with the expectation that the price will follow the direction of the breakout. Here you can enter to deal in the forex market. Use Buy Stop order for long position or Sell Stop for sell position.

Stop-Loss Strategy

The final and crucial step in leveraging the Inside Bar pattern is to always set a stop-loss order. Given that Inside Bars may signal either a breakout or a trend continuation, market movements may not always align with your forecast. Therefore, stop-loss orders are essential for mitigating trading risks.

For long position, set the stop-loss just beneath the Inside Bar’s lowest price point.

For short position, place the stop-loss just above the Inside Bar’s highest price point.

Take Profit Strategy

For profit targets, traders might aim for a previous lines of significant support or resistance, or employ a risk-reward ratio, such as 2:1, or choose a certain number of pips, ensuring that the potential upside justifies the risk taken.

For exits, savvy traders might implement trailing stops to safeguard gains. The straightforward nature and adaptability of the Inside Bar pattern equip traders with the means to time their market entries and exits.

Regardless of the chosen strategy, it is imperative to employ stop-loss and take-profit orders as a defensive measure. The Inside Bar candlestick pattern, while useful, is not immune to false signals, and traders must always account for such possibilities in their risk management plans. More about candlestick patterns can be found here

Combining the Inside Bar Strategy with Other Technical Tools

Find inside bars with a very useful indicator – Inside Bar Indicator. It is free to download and use.

Combining the Inside Bar strategy with other technical analysis tools can significantly enhance a trader’s ability to make informed decisions. For instance, overlaying moving averages on a chart can help identify the prevailing trend, providing context for Inside Bar signals. Traders might look for Inside Bars that form after a pullback to a moving average in a trending market, which can indicate a potential trend continuation. Additionally, incorporating oscillators like the Stochastic or RSI can offer insights into market momentum and overbought or oversold conditions, further refining entry and exit points. Support and resistance zones on the candlestick charts also play a critical role; an Inside Bar forming near these key levels could signal a strong breakout potential. By using these complementary tools, traders can filter out fewer probable trades and focus on those with higher chances of success, thereby improving the efficacy of the Inside Bar strategy within their trading repertoire.

The Psychological Aspect of Trading Inside Bars

The psychological aspect of trading Inside Bars cannot be overstated, as it requires traders to exercise patience and discipline in the face of market uncertainty. The Inside Bar pattern represents a period of consolidation, often testing a trader’s resolve to wait for the right moment to enter the market. Succumbing to the temptation of premature entry or the fear of missing out can lead to suboptimal trades. Successful Inside Bar traders maintain emotional equilibrium, resisting the urge to trade on impulse and instead relying on a predefined set of rules for entry and exit. This mental fortitude, coupled with a clear understanding of the Inside Bar’s implications within the current market context, helps traders to execute their strategy with confidence, minimizing the impact of emotions and maximizing the potential for consistent results.

Conclusion

In conclusion, the Inside Bar strategy stands as a testament to the power of simplicity in the complex world of Forex trading. This pattern, a subtle indicator of market consolidation and potential breakouts, offers traders a versatile tool for navigating the ebbs and flows of currency price trends. By understanding how to identify and interpret Inside Bars, traders can make more informed decisions, whether in a stable market seeking confirmation of balance or on the cusp of a significant price movement.

When combined with other technical analysis tools, the Inside Bar strategy becomes an even more potent component of a trader’s arsenal, allowing for refined entries and exits. However, it is the trading psychology discipline that truly unlocks the strategy’s effectiveness. The ability to maintain patience, to wait for high-probability setups, and to manage emotions is what distinguishes successful traders in the long run.

As with any trading strategies, there is no one-size-fits-all approach, and the Inside Bar strategy is no exception. It requires adaptation to the market’s changing rhythms and personal trading style. Whether applied to intraday trading or longer-term swing trading, the Inside Bar strategy, with its focus on money management and strategic planning, can provide a solid foundation for those seeking to achieve consistent trading success.

Remember, the key to mastering the Inside Bar strategy lies not only in the technical execution but also in the psychological resilience and continuous learning.

Time to Reflect

Have you incorporated Inside Bars into your trading strategy? After exploring the insights from this lesson, do you envision modifying your method when trading Inside Bars?

I invite you to share your questions or thoughts in the comments section below. Your feedback is valuable, and I’m eager to engage in a discussion with you.

Leave a Reply