BOS and CHOCH Trading Strategy: Your Comprehensive Guide

Description

Dive into the depths of the BOS and CHOCH Trading Strategy – a robust and technical approach to conquering the forex market. With its arsenal of signals, arrows, bars, and more, this strategy is your key to navigating the intricate world of forex trading with precision.

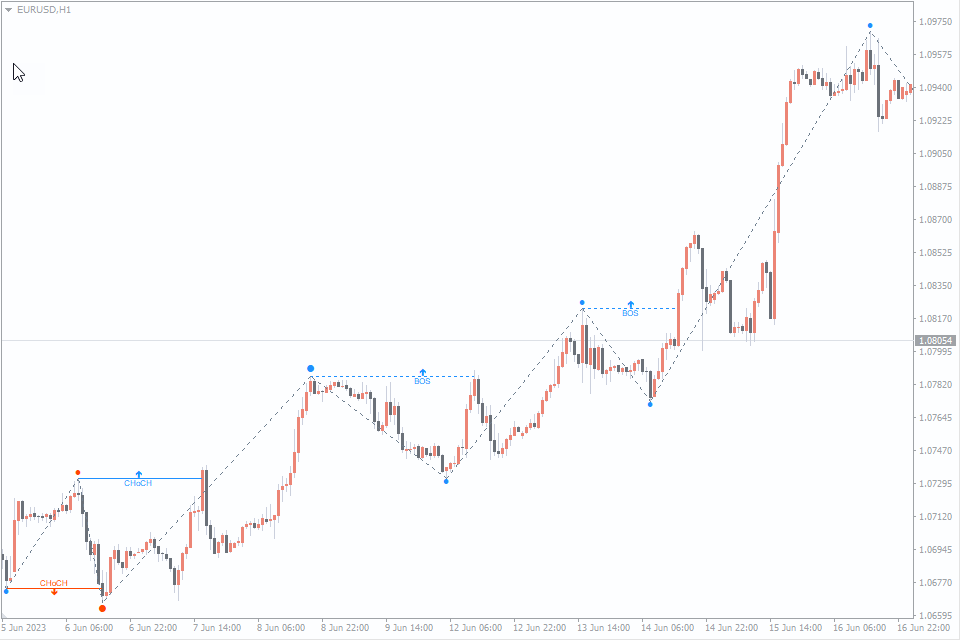

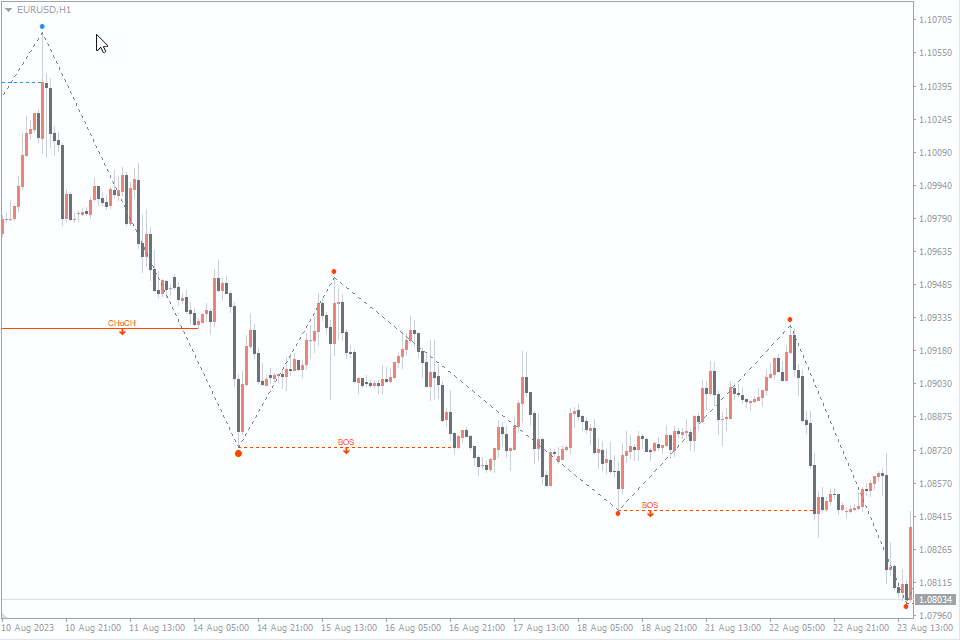

Understanding the Break of Structure (BOS): The BOS signifies the juncture at which a pivotal support or resistance level is breached. In the realm of technical analysis, support and resistance levels are critical zones on a price chart where historical buying or selling pressure has manifested. The rupture of a support or resistance level can suggest a possible alteration in market sentiment and the commencement of a fresh trend.

Understanding the Change of Character (CHOCH): The CHOCH signifies a shift in market sentiment, representing a transition from bearish to bullish, or vice versa. This concept finds extensive use in technical analysis strategies, particularly in order block trading.

Traders in both the forex and cryptocurrency markets rely on CHOCH to identify potential reversals. This occurs when the price fails to establish a new higher high or lower low, subsequently breaking the existing pattern and embarking on a new directional movement.

Features

Harness the power of automatic alerts signals that improve your trading decisions. The BOS and CHOCH Strategy seamlessly integrates both bullish and bearish signals, providing a clear path for executing well-timed buy and sell positions. Its advanced breakout detection ensures you never miss a lucrative opportunity.

Break of Structure (BOS) Signal: The indicator places special emphasis on two pivotal signals, with the BOS signal taking the lead. When the price breaches significant support or resistance levels, the BOS signal signifies the continuation of the existing trend. This powerful insight guides traders to remain aligned with the prevailing price direction.

Change of Character (CHOCH) Signal: The second essential signal provided by the indicator is the CHOCH signal. Triggered when the price reverses and surpasses the high or low of the preceding swing, this signal hints at potential trend reversals. It alerts traders to potential shifts in market sentiment, enabling them to prepare for possible trend changes.

Trend Reversal Identification: Combining the BOS and CHOCH signals, the indicator equips traders with a robust tool for recognizing trend reversals. This feature is particularly invaluable in fast-paced markets, allowing traders to adapt swiftly and adjust strategies to seize emerging opportunities effectively.

Simplicity and User-Friendly Interface: simple and convenient for both beginners and professional forex traders

Customizable Parameters: The indicator offers traders the flexibility to customize certain parameters to align with their unique trading styles and objectives. This customization ensures that the indicator seamlessly integrates with your trading strategy, enhancing its effectiveness.

Informed Decision-Making: With its in-depth analysis of market swings and pivotal signals, the BOS and CHOCH Indicator empowers traders to make informed decisions. By shedding light on market structure shifts and potential trend reversals, the indicator becomes a reliable ally in the dynamic Forex market.

Buy and Sell Strategies

Harness the power of the BOS and CHOCH Indicator with strategic buy and sell approaches:

Buy Signal

Uptrend Identification: Search for a series of three or more consecutive ascending swings, denoted by blue dots on the chart, indicating an ongoing uptrend.

BOS Confirmation: Await a significant breach of resistance during this uptrend. The BOS signal serves as confirmation that the upward trend persists.

Optional CHOCH Validation: To further fortify the buy signal, consider a CHOCH confirmation. Look for instances where the price reverses, breaking through the high of the preceding descending swing.

Entry Point: Execute the trade once the BOS signal is confirmed, and any optional confirmation indicators align with the buy signal.

Sell Signal

Downtrend Identification: Recognize a succession of three or more consecutive descending swings, marked by red dots, indicating a prevailing downtrend.

BOS Confirmation: Exercise patience for the price to breach significant support levels while in the midst of this downtrend. The BOS signal verifies the continuation of the downward trend.

Optional CHOCH Validation: To further reinforce the sell signal, consider a CHOCH confirmation. Keep a lookout for instances where the price reverses, breaking through the low point of the previous ascending swing.

Entry Point: Initiate the trade once the BOS signal is validated, and any optional confirmation indicators align with the sell signal.

Price Target Estimation

Utilizing the magnitude of the preceding swing provides a valuable reference point for establishing price profit targets. By gauging the extent of the previous swing, you can employ it as a benchmark for determining potential profit objectives or positioning stop-loss orders.

Nonetheless, it is imperative to implement sound risk management practices and establish a well-defined trading plan when engaging with BOS and CHOCH signals.

Conclusion

The BOS and CHOCH Trading Strategy unveils the intricacies of forex trading with a technical edge.

BOS and CHOCH indicators is powerful on its own, but it can be further enhanced by combining it with other technical indicators and tools. For example, you can use FXSSI.ProfitRatio to confirm changes of trend direction, trendlines to identify support and resistance levels, and to pinpoint potential entry and exit points and etc.

Also this indicator is freely available for use and download.

Whether you’re a fledgling trader or a seasoned pro, the BOS and CHOCH Trading Strategy unlocks a comprehensive approach that empowers you to anticipate trends and capitalize on opportunities. Embrace this strategy to elevate your trading acumen and achieve consistent success in the challenging world of forex trading.

Leave a Reply