Exploring the Most Trendy Currency Pairs of the Year

In the Forex market, the concept of ‘trend’ is a fundamental aspect that drives the trading strategies of countless investors. A trending currency pair, characterized by a consistent upward or downward trajectory, can be a beacon for traders looking to capitalize on sustained movements. However, identifying these trends is more an art form than a mere by-the-numbers approach, often influenced by a trader’s time frame and analytical tools. This article aims to demystify the process of spotting currency pairs that are currently trending, whether they are riding the wave of a bullish uptrend or navigating the depths of a bearish downtrend. We will explore the technical indicators that serve as the compass for trend identification, delve into the impact of economic events on currency trends, and profile the currency pairs that are exhibiting strong trend characteristics at present. Moreover, we will provide strategies tailored for trading these trends, discuss the role of volatility in assessing the strength of a trend, and highlight the importance of adaptability as trends can shift with the market’s ever-changing tides. Whether you are a seasoned trader or just starting, understanding how to identify and capitalize on trending currency pairs is an invaluable skill in the Forex market. Let’s embark on this journey to navigate through the currents of the world’s most liquid market and uncover the most trending currency pairs.

Understanding Trendy Currency Pairs in Market Cycles

In the Forex market, the allure of trendy currency pairs is undeniable, as they often signify robust market cycles that seasoned traders keenly exploit. These pairs, caught in the ebb and flow of bullish uptrends or bearish downtrends, signal the market’s pulse, offering insights into trader sentiment and economic vigor. Identifying these trends requires a keen eye on technical analysis, chart patterns, and a thorough understanding of market sentiment. Currency pairs like EUR/USD, GBP/USD, and USD/JPY often take the spotlight, oscillating between periods of rally and retreat, driven by interest rate differentials, GDP growth figures, and geopolitical events. Meanwhile, exotic pairs provide a more adventurous terrain, with price action influenced by emerging market economies’ monetary policies and commodity price flux. Traders must navigate these cycles with precision, leveraging forex signals, economic calendars, and trading sessions to harness the potential of these trendy pairs. As they ride the waves of market volatility and liquidity, traders employ strategies like scalping, day trading, and swing trading, all while keeping a vigilant eye on the risk-reward ratio, money management, and the ever-important trading psychology. Understanding the nuanced dance of trendy currency pairs within market cycles is a skill that, when mastered, can lead to a bounty of trading opportunities.

Key Indicators for Spotting Trending Pairs

To effectively spot trending currency pairs within the Forex market, traders rely on a suite of key indicators that act as navigational beacons. Moving averages, with their smoothed price data, provide a clear visual of the direction and strength of trends, while the MACD (Moving Average Convergence Divergence) offers a deeper dive into momentum shifts. The RSI (Relative Strength Index) and Bollinger Bands gauge market extremes, signaling potential reversals in overbought or oversold zones. Traders also employ the ADX (Average Directional Index) to quantify trend strength, ensuring they’re not caught in the deceptive calm of a range-bound market. Candlestick patterns and Fibonacci retracements further aid in pinpointing entry and exit points, aligning with the prevailing trend. These technical analysis tools, when combined with a solid understanding of forex news, economic announcements, and market sentiment, can sharpen a trader’s ability to discern which currency pairs, from the major EUR/USD to the volatile USD/ZAR, are poised for significant moves. Mastery of these indicators is essential for traders aiming to execute successful forex strategies, from intraday scalping to long-term trend following, all while managing risk and adapting to the fluidity of the Forex trading sessions. You can find more useful information in my articles List of the Best TOP 7 Trend Forex Indicators and BOS and CHOCH Trading Strategy.

The Impact of Economic Events on Currency Trends

Economic events wield considerable influence over currency trends in the Forex market, often serving as catalysts for significant movements in trendy pairs. Central bank decisions on interest rates, for example, can swiftly alter the trajectory of currency pairs such as EUR/USD or USD/JPY, while GDP growth figures may bolster or dampen trader sentiment toward a particular economy’s currency. Employment data, inflation reports, and trade balance figures are also pivotal, as they offer insights into an economy’s health, subsequently swaying the forex market’s liquidity and volatility. Currency pairs can react dramatically to geopolitical developments or shifts in commodity prices, affecting commodity-driven currencies like AUD/USD and USD/CAD. Traders must stay attuned to the economic calendar, parsing through forex news and market sentiment to forecast and capitalize on the price trends that these economic indicators provoke. By integrating fundamental analysis with technical tools like forex signals, support and resistance levels, and chart patterns, traders can better navigate the impact of economic events on currency trends, enhancing their trading strategies, whether it involves scalping, day trading, or swing trading, and improving their risk management practices.

Profiles of Currently Trending Currency Pairs

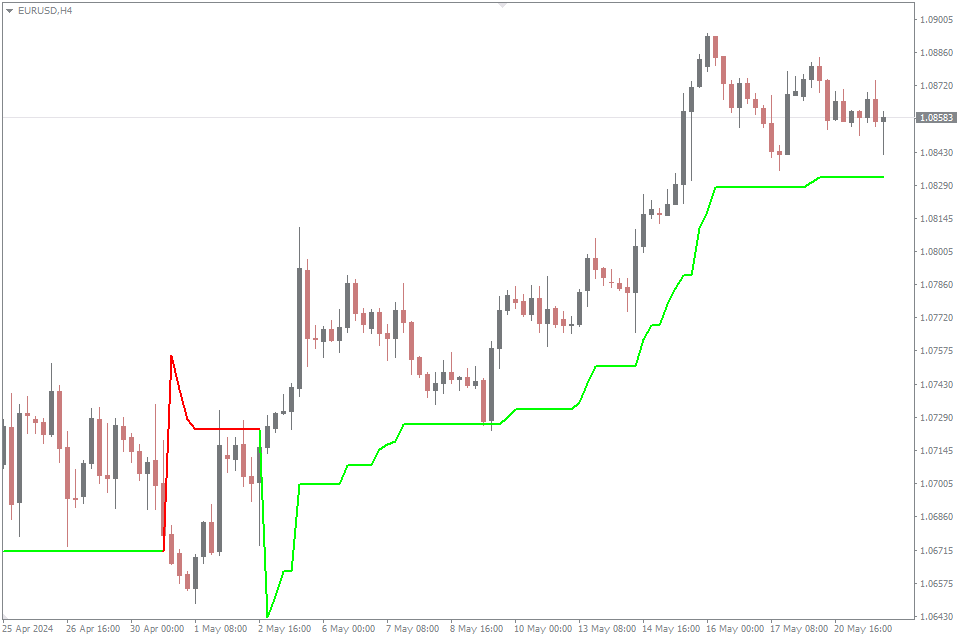

EUR/USD

Currently, the EUR/USD pair is exhibiting an uptrend, indicating a slight increase over the past 24 hours. This uptrend can be attributed to various factors, including economic data releases from the Eurozone and the United States that may have influenced trader sentiment. The strength of the euro against the dollar in this period suggests that traders may be favoring the European currency, potentially due to positive economic indicators or shifts in monetary policy expectations.

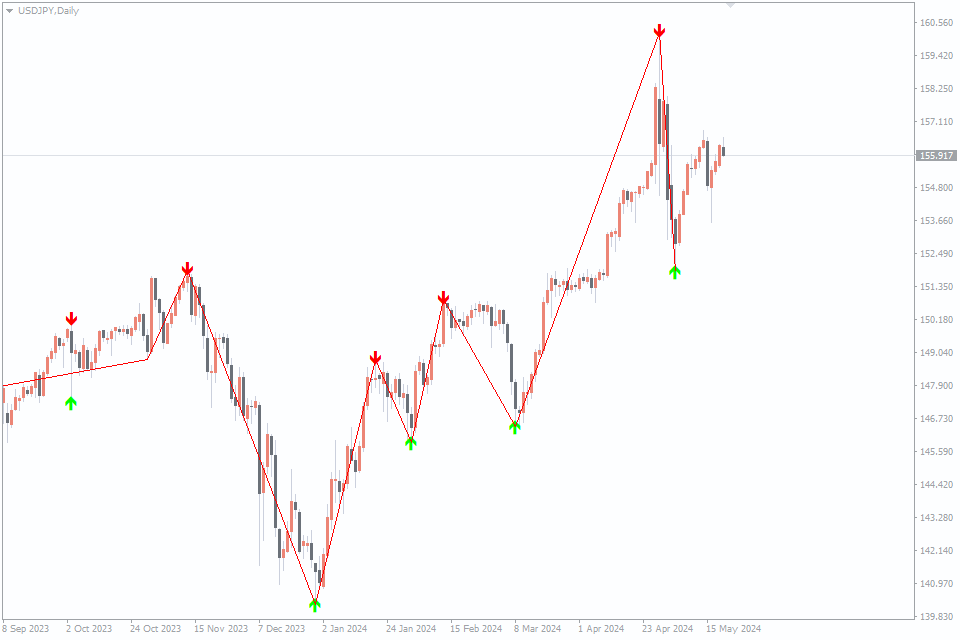

USD/JPY

For the USD/JPY pair, traders would typically look at the influence of both the US dollar and the Japanese yen’s status as a safe-haven currency. Fluctuations in this pair could be driven by changes in risk sentiment, where a flight to safety often sees the yen appreciate against the dollar, while risk-on environments could boost the USD against the JPY.

GBP/USD

The GBP/USD pair’s trend is likely impacted by the latest economic reports from the UK and ongoing negotiations or developments regarding trade post-Brexit. Any sign of economic resilience or political stability could contribute to an uptrend, while uncertainty or negative outcomes might result in a downtrend. In this screenshot I used an excellent free trend indicator AutoTrendChannels from the company FXSSI.

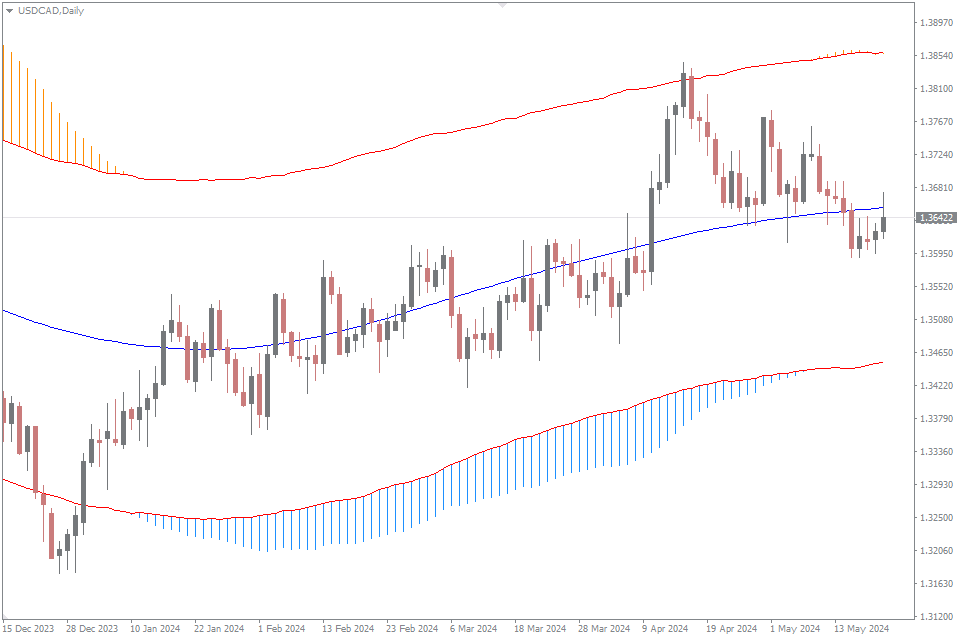

AUD/USD and USD/CAD

In the case of commodity currencies like the AUD/USD and the USD/CAD, trends are often closely tied to commodity prices such as oil and metals. Australia’s economic links to China also mean that Chinese economic performance can influence the AUD/USD pair. Similarly, Canada’s economy, being heavily reliant on oil exports, sees the USD/CAD pair often move in response to oil market dynamics.

NZD/USD

Lastly, the NZD/USD pair, another commodity currency heavily influenced by dairy exports, can trend based on global commodity prices and trade data. New Zealand’s economic indicators, such as GDP growth and interest rate decisions by the Reserve Bank of New Zealand, also play a significant role in the pair’s trend. To gain a more detailed and up-to-date analysis of these currency pairs, traders would typically consult real-time charting tools and financial news sources, considering the latest market data and trends to guide their trading decisions.

Strategies for Trading Uptrends and Downtrends

For pairs in a bullish trend, traders might seek entry points during a pullback to a key support level or after a breakout above resistance. Utilizing tools like Fibonacci retracement or moving averages can pinpoint these potential entry zones. Setting a stop-loss just below the recent swing low or a predefined percentage from the entry point can help manage downside risk. Conversely, when trading a currency pair in a bearish downtrend, one might consider shorting on a retest of a significant resistance level or following a confirmed breakdown below support. Here, a stop-loss could be placed just above a recent swing high or a technical threshold to mitigate risk exposure. In both scenarios, traders can employ trailing stops to lock in profits while allowing positions to run during strong trends. This technique adjusts the stop-loss level in the direction of the trade as the currency pair moves, securing gains and safeguarding against reversals. Additionally, scaling out of positions by gradually taking profits at different levels can balance the desire to capture more upside with the prudence of realizing gains. Implementing risk-to-reward ratios that favor potential profits over losses, typically aiming for at least a 1:2 ratio, is key to long-term success. Risk management is paramount, hence, never risking more than a small percentage of the trading capital on a single trade is a golden rule. Combining these strategies with a thorough analysis of forex signals, economic news, and market sentiment can empower to effectively harness the momentum of trendy currency pairs, optimizing their trading outcomes in the Forex market’s ebb and flow.

Time Frame Analysis for Trend Identification

The identification of trends in the Forex market is profoundly influenced by the time frame on which the analysis is conducted. Short-term intraday trading, such as scalping or day trading, typically involves examining minute-to-minute or hourly charts. These shorter time frames can reveal quick, transient trends that require rapid decision-making and quick execution of trades. Traders operating on this scale must be adept at interpreting forex signals and volatility liquidity spikes, employing technical analysis tools like candlestick charts, price action, and support and resistance levels to make timely entries and exits. On the other end of the spectrum, long-term trend following is anchored in the study of daily, weekly, or even monthly charts. This approach provides a broader view of the market, allowing traders to identify more sustained and potentially more reliable trends. Long-term traders focus on macroeconomic trends, currency correlation, and fundamental analysis, often incorporating economic calendar events and market sentiment into their strategy. They tend to use trading indicators such as moving averages, MACD, or ADX to filter out the noise and focus on significant price trends. Each time frame requires a different risk management strategy. Short-term traders may employ tighter stop-loss orders and take-profit targets due to the condensed nature of their trading window, while long-term traders may allow for greater fluctuations, using wider stop-loss orders to accommodate the larger expected price movements over time. Ultimately, the choice of time frame is a reflection of a trader’s trading psychology, risk tolerance, and lifestyle. It’s crucial for traders to align their time frame with their trading plan and goals, ensuring that their approach to identifying trends is consistent with their overall trading strategy and the specific characteristics of the currency pairs they are analyzing.

The Role of Volatility in Trending Markets

Volatility is a key factor in the Forex market, directly impacting the strength and duration of currency pair trends. It reflects the intensity of price fluctuations and can be measured using indicators like the Average True Range (ATR) or Bollinger Bands. High volatility suggests strong market interest and momentum, which can lead to sustained trends in pairs such as EUR/USD or GBP/USD. However, it also increases the risk of sharp reversals.

Adapting to Shifts in Market Trends

Adaptability is crucial in Forex trading, as currency pair trends can shift rapidly due to economic updates and market sentiment changes. Traders must engage in ongoing market analysis, staying alert to technical signals and news that could affect trend direction. Flexibility in strategy is key-be prepared to adjust your approach, whether that means shifting time frames, altering technical setups, or pivoting to different currency pairs that offer more promising trends. Embracing change and maintaining the ability to quickly respond to new market conditions is essential for managing risk, securing profits, and minimizing losses in the fluid world of Forex trading.

Conclusion

Capitalizing on trending currency pairs in the Forex market hinges on a disciplined, well-rounded approach. Key takeaways for traders include the critical importance of consistent trend analysis, integrating both technical indicators and fundamental insights to gauge market direction and momentum. A combination of tools like moving averages, MACD, and RSI, alongside economic data and news analysis, provides a robust framework for identifying and following trends. Moreover, an understanding of risk management strategies, such as setting appropriate stop-loss orders and taking profits at strategic levels, is essential to protect against market volatility. Continuous education and staying updated with the latest market developments enable traders to refine their strategies and adapt to new trends as they emerge. In conclusion, the successful trading of trending currency pairs requires a blend of analytical skills, strategic planning, and an adaptive mindset. By committing to ongoing learning and staying agile in their trading practices.

Trend is your friend!

Leave a Reply