TOP List of Currency Pairs with High Volatility

In the fast-paced realm of forex trading, volatility is often seen as a double-edged sword. While it can present increased risks, high volatility also opens the door to potentially lucrative trading opportunities. Traders who can navigate currency pairs with high volatility effectively may find themselves well-positioned to capitalize on price fluctuations and generate substantial profits.

Understanding Volatility in Forex Trading

Volatility in forex refers to the degree of variation in a currency pair’s trading price over time. High volatility signifies larger price movements within shorter periods, offering traders the chance to enter and exit positions rapidly. In contrast, low volatility suggests smaller price swings, which may present challenges for traders seeking significant profit opportunities.

Factors Influencing Volatility

Several factors contribute to volatility in the forex market, including economic indicators, geopolitical events, central bank decisions, and market sentiment. Major economic releases, such as employment reports, GDP figures, and interest rate decisions, often trigger sharp movements in currency prices. Geopolitical tensions, trade disputes, and unexpected political developments can also fuel volatility by altering investor confidence and risk appetite. To ensure you don’t overlook such news, utilize a dedicated FXSSI.Calendar indicator designed for this purpose for trading platform MT4/MT5.

In addition to the aforementioned factors influencing volatility, it is worth noting that market activity also depends on trading sessions, especially during their intersections. The increase in trading volumes and the number of participants is the main driving force. The special and very useful indicator of trading sessions is FXSSI. Trading Sessions

How to Measure the Volatility

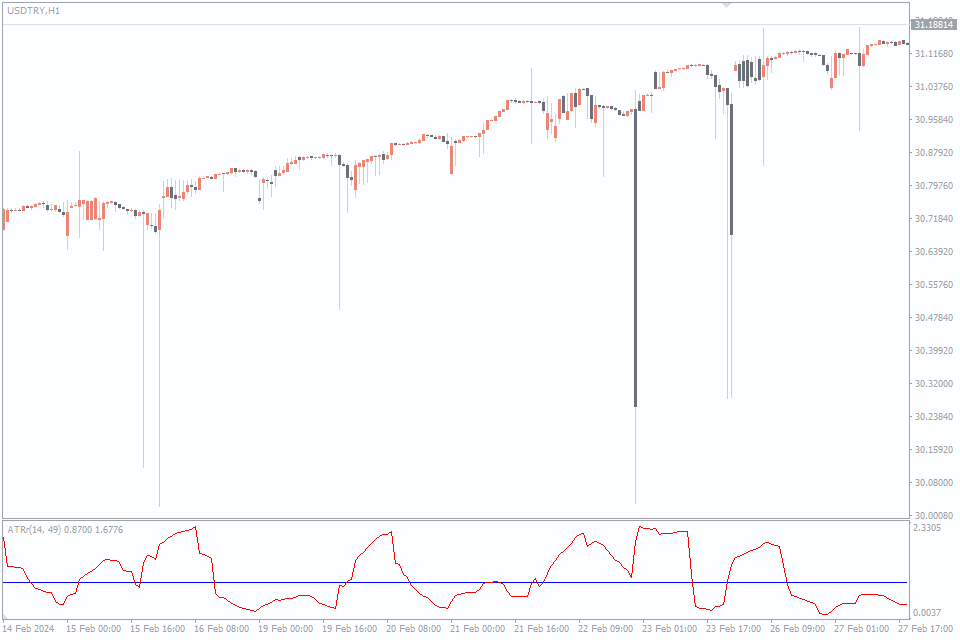

When gauging the volatility of currency pairs, traders often rely on various indicators and metrics to assess price fluctuations. One common method is to calculate the average true range (ATR), which measures the average price range of a currency pair over a specific period. A higher ATR value indicates greater volatility, while a lower value suggests lower volatility.

Additionally, traders may use volatility indicators such as Bollinger Bands or the Average Directional Index (ADX) to track changes in price volatility and identify potential trading opportunities. Bollinger Bands expand during periods of high volatility and contract during low volatility, while the ADX measures the strength of a trend, which can indirectly reflect volatility levels.

Volatility can also be analyzed using historical price data and statistical measures such as standard deviation. By examining price movements over time and assessing deviations from the mean, traders can gain insights into the level of volatility within a currency pair.

My choice for measuring volatility today is ATR Ratio Indicator. It is free for download and use. Also, it is simple for use and setting on Meta Trader platforms (MT4 or MT5).

Popular Currency Pairs with High Volatility

Compiling an exhaustive inventory of the most volatile currency pairs proves challenging due to the dynamic nature of market conditions and times. Volatility can fluctuate across various currency pairs depending on a multitude of factors. Nevertheless, certain currency pairs have demonstrated consistently high volatility over time.

Major currency pairs

The major currency pairs, including USD/JPY, USD/CHF, USD/CAD, AUD/USD, GBP/USD, and EUR/USD, are renowned for their high volatility and liquidity, attracting significant trading volumes in the forex market. Here’s a closer look at each pair:

USD/JPY (US Dollar/Japanese Yen): Often referred to as the “Ninja,” USD/JPY is among the most traded currency pairs worldwide. Its volatility is influenced by geopolitical tensions, economic data releases from the US and Japan, and market sentiment towards risk. The Japanese Yen’s status as a safe-haven currency makes USD/JPY a barometer of global risk sentiment.

USD/CHF (US Dollar/Swiss Franc): Also known as the “Swissie,” USD/CHF reflects the value of the US Dollar against the Swiss Franc. Factors impacting its volatility include interest rate differentials between the US and Switzerland, geopolitical developments, and market high risk appetite. The Swiss Franc’s safe-haven status adds to the currency pair’s volatility during times of market uncertainty.

USD/CAD (US Dollar/Canadian Dollar): Dubbed the “Loonie,” USD/CAD represents the exchange rate between the US Dollar and the Canadian Dollar. Its high volatility is affected by fluctuations in crude oil prices (a major Canadian export) and economic indicators from both countries, particularly those related to employment, inflation, and trade.

AUD/USD (Australian Dollar/US Dollar): Known as the “Aussie,” AUD/USD mirrors the value of the Australian Dollar against the US Dollar. Its volatility is influenced by commodity prices, particularly gold and iron ore, as well as economic data releases from Australia and the US. The currency pair serves as a proxy for global risk sentiment due to Australia’s export dependence, especially to China.

GBP/USD (British Pound/US Dollar): Nicknamed the “Cable,” GBP/USD represents the exchange rate between the British Pound and the US Dollar. Its volatility is driven by Brexit developments, monetary policy decisions from the Bank of England (BoE), economic data from the UK and the US, and geopolitical factors. GBP/USD is historically high volatility liquidity, particularly during significant political events and economic announcements.

EUR/USD (Euro/US Dollar): Referred to as the “Eurodollar,” EUR/USD is the most traded currency pair globally, reflecting the Euro against the US Dollar. Its high volatility liquidity is influenced by monetary policy decisions from the European Central Bank (ECB) and the Federal Reserve (Fed), economic indicators from the Eurozone and the US, and geopolitical developments. EUR/USD serves as a benchmark for assessing the strength of the US Dollar and the stability of the Eurozone economy.

Minor currency pairs

Minor currency pairs, which exclude the US Dollar but involve at least one of the world’s other major currencies, offer unique trading prospects in the forex market. Among them, minor currency pairs with notable volatility, such as EUR/GBP, GBP/JPY, and CAD/CHF, present intriguing opportunities. Let’s explore each pair in detail:

EUR/GBP (Euro/British Pound): Known as the “Euro Sterling,” EUR/GBP showcases the Euro’s value against the British Pound. Influenced by various factors including economic data releases from the Eurozone and the UK, Brexit developments, monetary policy decisions from the European Central Bank (ECB) and the Bank of England (BoE), and forex news towards both currencies. Renowned as a popular cross-currency pair due to the close economic ties between the Eurozone and the UK.

GBP/JPY (British Pound/Japanese Yen): Dubbed the “Geppy,” GBP/JPY represents the exchange rate between the British Pound and the Japanese Yen. Notorious for its volatility and wide intraday fluctuations, this pair’s volatility is affected by factors such as risk sentiment, economic indicators from the UK and Japan, geopolitical tensions, and monetary policy decisions by the Bank of Japan (BoJ). Regarded as a gauge of global risk sentiment due to the Japanese Yen’s safe-haven status and the Pound’s sensitivity to market developments.

CAD/CHF (Canadian Dollar/Swiss Franc): Also referred to as the “Loonie Swissie,” CAD/CHF illustrates the Canadian Dollar’s value against the Swiss Franc. Influenced by various factors including crude oil prices (a significant Canadian export), economic indicators from Canada and Switzerland, interest rate disparities between the Bank of Canada (BoC) and the Swiss National Bank (SNB), and market sentiment towards both commodity currencies and safe-haven assets.

Exotic pairs (Emerging Markets)

Exotic currency pairs are renowned for their heightened volatility, offering both lucrative opportunities and formidable challenges for traders. Let’s delve deeper into each exotic currency pair mentioned:

USD/TRY (US Dollar/Turkish Lira): The USD/TRY pair represents the exchange rate between the US Dollar and the Turkish Lira. Turkey’s geopolitical landscape, economic instability, inflation rates, and political developments significantly sway this pair’s high volatility. The Turkish economy’s susceptibility to external shocks, coupled with government interventions in monetary policy, contribute to sharp price fluctuations.

USD/MXN (US Dollar/Mexican Peso): USD/MXN mirrors the exchange rate between the US Dollar and the Mexican Peso. Influences such as US economic indicators, geopolitical tensions, US-Mexico trade relations, and Mexico’s reliance on oil exports dictate its volatility. Economic instability, political uncertainties, and shifts in US immigration policies can also impact the pair’s volatility.

EUR/RUB (Euro/Russian Ruble): EUR/RUB portrays the exchange rate between the Euro and the Russian Ruble. Geopolitical tensions, economic sanctions, oil prices (a major Russian export), and interest rate decisions by the Central Bank of Russia affect its volatility. Russia’s dependence on energy exports, coupled with exposure to global commodity markets, contributes to significant price swings.

USD/ZAR (US Dollar/South African Rand): USD/ZAR illustrates the exchange rate between the US Dollar and the South African Rand. Influences include South Africa’s economic data releases, commodity prices (particularly gold and platinum), political developments, and the nation’s credit rating. Mining strikes, shifts in global risk sentiment, and domestic political instability also contribute to sharp price action.

USD/BRL (US Dollar/Brazilian Real): USD/BRL depicts the exchange rate between the US Dollar and the Brazilian Real. Economic indicators from the US and Brazil, commodity prices (especially soybeans), political developments, and Brazil’s fiscal and monetary policies influence its volatility. Brazil’s vulnerability to external economic shocks, domestic political uncertainties, and fluctuations in commodity markets add to its high volatility.

USD/SEK (US Dollar/Swedish Krona): USD/SEK reflects the exchange rate between the US Dollar and the Swedish Krona. Influences include economic data releases from the US and Sweden, interest rate decisions by the Swedish Riksbank, global risk sentiment, and geopolitical developments. Sweden’s export-driven economy, alongside exposure to global trade dynamics and economic uncertainties, contribute to significant price action.

Developing a Trading Strategy for High-Volatility Currency Pairs

Trading high-volatility currency pairs requires a robust strategy that accounts for rapid price movements and increased market uncertainty. Here are some essential tips for navigating volatile forex markets effectively.

Risk Management: Implementing strict risk management practices is crucial when trading volatile currency pairs. Set stop-loss orders to limit potential losses and adhere to position sizing rules to protect your trading capital.

Technical Analysis: Utilize technical indicators and chart patterns to identify potential entry and exit points in volatile markets. Common technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands can help gauge price momentum and overbought/oversold conditions.

Fundamental Analysis: Stay informed about economic events, central bank decisions, and geopolitical developments that could impact currency prices. Economic calendars and news sources provide valuable insights into market-moving events and their potential effects on currency pairs.

Volatility-Based Strategies: Consider employing volatility-based trading strategies, such as breakout trading or range trading, to capitalize on price movements in high-volatility currency pairs. These strategies involve entering positions when prices break through key support or resistance levels or trading within established price ranges.

Adaptability: Remain flexible and adaptable in your trading approach to navigate changing market conditions. Volatility levels can vary over time, so be prepared to adjust your strategy accordingly and capitalize on evolving opportunities.

Diversification: To effectively trade volatile currencies, it’s advisable not to engage in trading too many pairs within a single session. While diversification can be beneficial, it’s more prudent to concentrate on a select few currency pairs and trade them consistently. This approach allows traders to develop a deep understanding of each pair’s unique characteristics and the factors influencing their price movements, facilitating more informed trading decisions.

Conclusion

Trading currency pairs with high volatility presents both opportunities and risks for traders. Whether you’re an experienced trader or just starting out, engaging in trading high volatility forex pairs requires careful consideration of various factors. Conducting thorough research, implementing effective risk management strategies, and staying informed about geopolitical events, economic data releases, and market sentiment are essential for navigating the volatility successfully.

Making informed decisions about trading volatile forex pairs should always involve comprehensive analysis, a thorough understanding of volatility dynamics, and prudent risk management practices. By diligently applying all components of a well-developed trading strategy, traders can approach trading with the most volatile currency pairs cautiously and confidently, maximizing their chances of success while minimizing potential risks.

Leave a Reply