Best Oscillator Indicators for MT4

Oscillators are an important part of technical analysis. Most of the forex traders use an oscillator in one way or other in their daily trading routine. Though, the oscillators look wormy and creepy at the first sight. They provide an exciting insight about the underlying asset.

Oscillators can be derived from any data source or any indicator for that matter. Primarily, they may contain histograms, oversold and overbought ranges. Though, oscillators reflect the data of an indicator. The way the oscillators present the data to the trader is important; it provides a different view of the indicators data.

The oscillator data can be easily used by an auto trading system. So, oscillators make way into auto trading systems pretty easily. The auto trading systems can detect the changes in the oscillator’s data and act upon them accordingly.

Most of the oscillators reflect the oversold and overbought condition of an asset. Additionally, a midline provides the general trend direction. Moreover, the oscillators reflect chart patterns like the head and shoulders, triangles. Furthermore, they find themselves quite popular with the divergence and convergence traders.

Forex technical traders find the oscillators interesting to trade as they have both lagging and leading properties. The divergence and convergence in combination with price action makes it a leading indicator.

In this article we will look at the 10 best oscillator indicators and understand the application of them. Most importantly we will discuss the features and the usefulness from a trader’s perspective and also discuss the features those stand out from the rest. However, it depends upon a trader to identify the indicators that work for them according to their trading style.

Best Oscillator Indicator

- Heiken Ashi Oscillator Indicator

- Wave Trend Oscillator Indicator

- Awesome Oscillator Indicator

- SMI Ergodic Oscillator Indicator

- Elliott Wave Oscillator Indicator

- Wilders DMI Oscillator Indicator

- Point Zero Oscillator Indicator

- Derivative Oscillator Indicator

- Percentage Price Oscillator Indicator

- Gator Oscillator Indicator

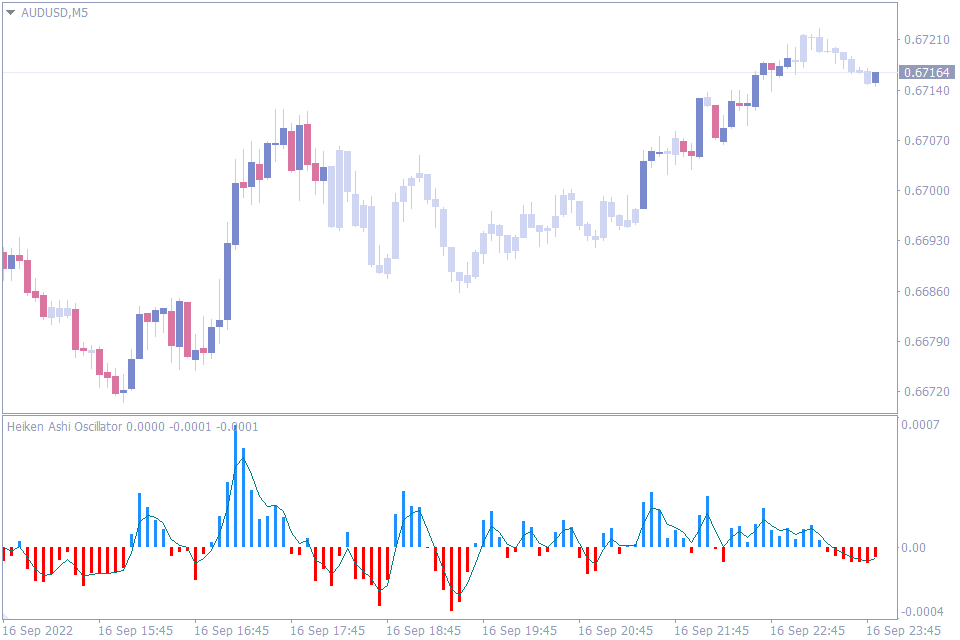

Heiken Ashi Oscillator Indicator

Let’s start to discuss the list with our first indicator. This oscillator is based on the classic Heiken Ashi Metatrader4 indicator and provides trading signals. The important aspect of this indicator is, it allows the trader to stay in the current trend and squeeze the maximum profit from the trend.

The indicator smoothens the data using the moving average. So, the combination of the Heiken Ashi oscillator and the moving average indicator provides excellent entry and exit signals. The search for trend direction is answered by the histogram.

The histogram provides the trend direction as a rule of thumb. Trend is considered upwards if the indicator values are above the zero line of histogram. On the other hand, trend is down if the indicator stays below the histogram’s zero line.

Divergence and convergence forex traders can use the histogram to identify the divergence and trade the signals. On the other hand, the direction of the histogram indicates the trend weakness or trend strength. A rising histogram indicates a strengthening trend, while a falling histogram depicts trend weakness.

Another important application is the multi time frame trading approach. The indicator works well in intraday time frames and daily, weekly and monthly price charts. Thus, the Heiken Ashi oscillator helps the forex traders as both leading and lagging indicator and can be traded using multiple technical trading strategies.

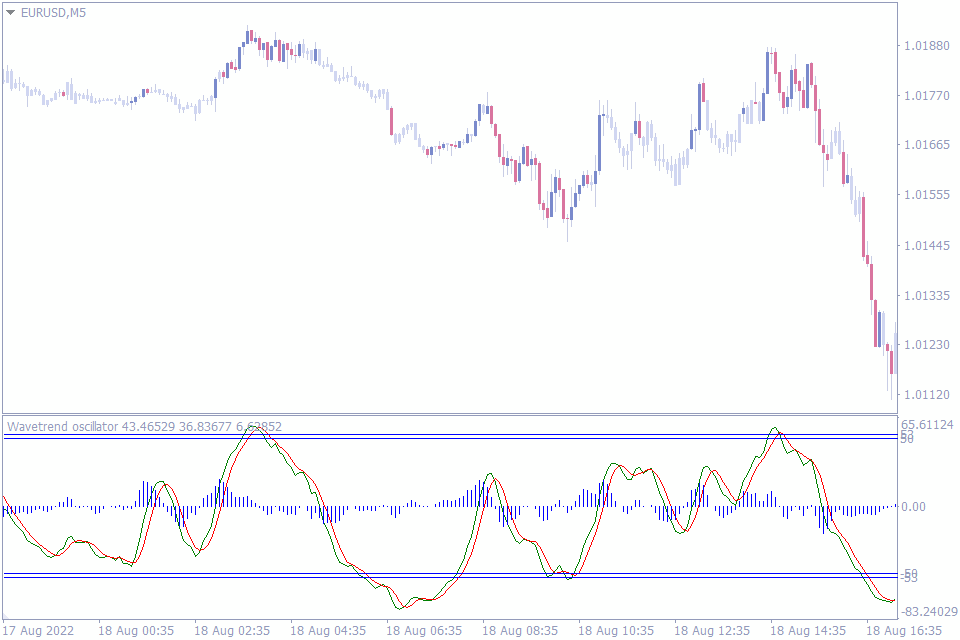

Wave Trend Oscillator Indicator

Our next indicator in the list of the best oscillators is the Wave trend oscillator. As the name suggests this indicator helps forex traders to identify the trend reversals. Moreover, the indicator provides a package of other features that provide reliable trading signals.

Primarily, this oscillator monitors and tracks the price momentum. As the case of most of the oscillators, this indicator also requires smoothing and has it incorporated. A falling indicator indicates a weakening momentum, while rising indicator values point the opposite.

Like all oscillators, this indicator comes with overbought and oversold levels. So, technical forex traders can anticipate a price reversal. However, price reversal signals near established support and resistance provides additional importance to the trading signal.

Generally, trend reversal trading signals generated near trend lines, support and resistance zones, channels are traded by most of the forex traders. These reversal signals generated by the wave trend oscillator indicator tend to provide maximum results. These trades are mostly anticipated as the indicator approaches overbought and oversold levels.

The next method to derive trading signal is the crossover of the indicator lines. The upward crossover indicates an uptrend, while a downward crossover indicates a potential downtrend. The indicator is very simple to interpret and is very handy for new forex traders.

The wave trend oscillator for MT4 provides best trend reversal points and in turn results in higher winning trades.

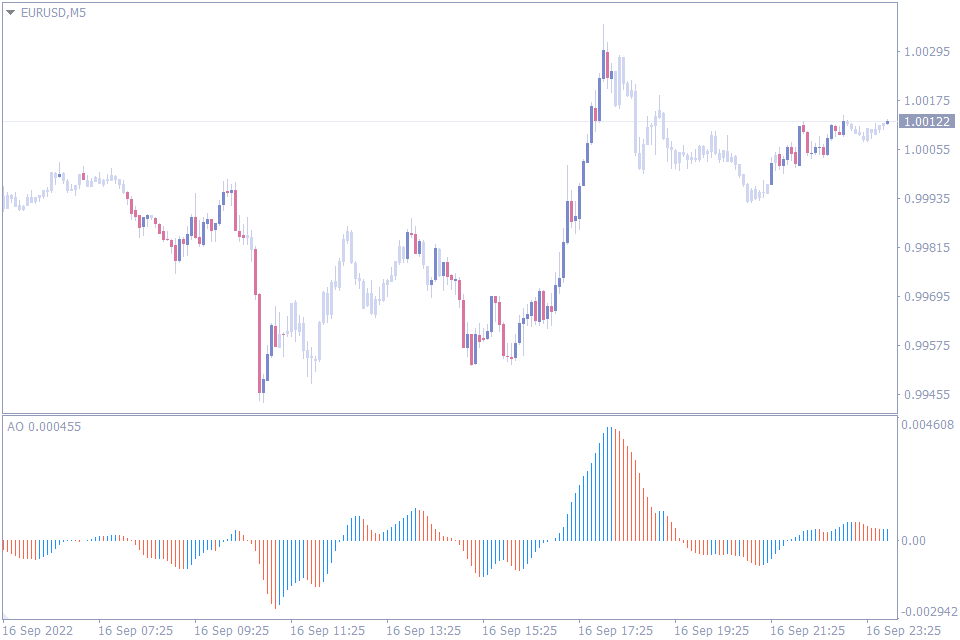

Awesome Oscillator Indicator

Let’s now move on to the third indicator in the list of best oscillator indicator. The Awesome oscillator indicator provides a multi color histogram that reflects various market conditions. Moreover, this indicator helps forex traders to formulate long and short term technical trading strategies.

The important component of the AO oscillator is the dual colored histogram. Forex traders can derive trading signals in multiple methods using the histogram. The midline and the color of the histogram bars combine together to paint the picture of the price momentum and helps the trader to identify the best entry and exit trading signals.

The changes in the Awesome oscillator indicator reflects the changes in the market trend direction. These changes demonstrate changes in market strength and weakness. So, forex traders can identify the best exit points based on the trend changes.

The AO MT4 indicator is widely used by forex traders as it is very sensitive to the trend changes. So, the indicator provides forex traders with a clear insight in to the present market condition. Moreover, it provides an opportunity to assess the possibility of future trend reversals.

If the histogram provides an opposite colored bar it indicates a potential trend weakness. A blue histogram bar below the zero line and the red histogram bar above the zero line indicate a potential trend reversal signal.

The Awesome oscillator is helpful for both trend and swing trading forex traders. It is a essential tool in technical analysis for trend following and anticipation.

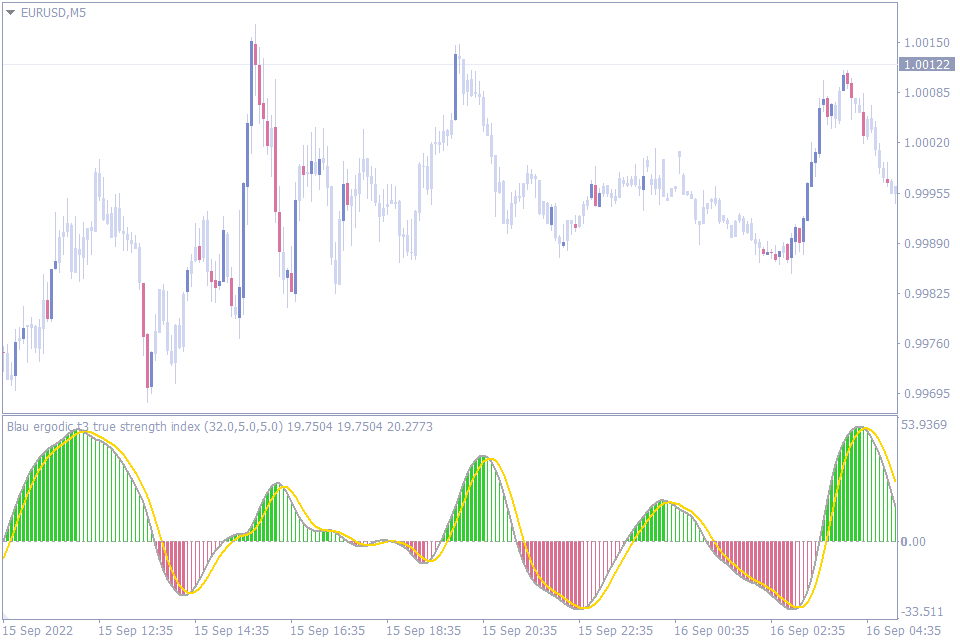

SMI Ergodic Oscillator Indicator

This brings us to the forth indicator in our list of best oscillator indicator. The SMI Ergodic oscillator indicator for MT4 that does not repaint and provides alerts automatically. The Stochastic Momentum Index or SMI uses the TSI – True Strength Index and provides a multi colored histogram and a signal line.

The SMI Ergodic oscillator assists the technical forex traders to identify the highs and lows. Thus traders can buy low and sell high and trade successfully. Moreover, the indicator alerts the forex traders and assists traders to stay tuned with the market movements. Additionally, the indicator signals can be incorporated with automatic trading systems.

SMI Ergodic oscillator MT4 indicator can be universally applied to forex, stocks and other financial markets. The indicator can be traded in multiple methods such as histogram above or below zero level and crossover of the indicator and signal lines. Furthermore, the indicator acts a leading indicator and provides divergence and convergence trading signals in advance.

The histogram provides multi colored bars that alert the technical trader to identify the rising and falling momentum. The rising histogram bar color and falling bar color above the zero line are provided in different colors. The same is true while the histogram is below the zero line.

Thus, the SMI Ergodic oscillator MetaTrader indicator provides multiple trading opportunities and signals. Most importantly, it does not repaint.

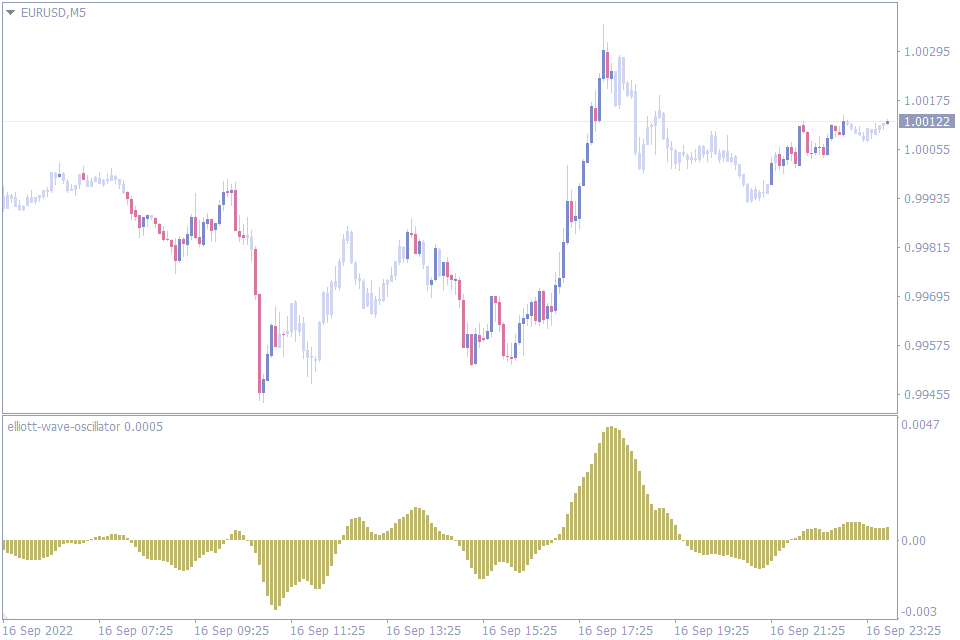

Elliott Wave Oscillator Indicator

We will now discuss the fifth indicator in our list of best oscillator indicator. The Elliott wave oscillator MT4 indicator is based on the Elliott wave theory discussed by Ralph Nelson Elliott. As per Elliott, market moves in five waves consisting of three impulsive waves and two corrective waves.

Elliott wave oscillator is a technical tool for trading the Elliott waves. The indicator is an ideal tool for detecting trend reversal and provides early entry points. Moreover, it provides early warning signals if the trend is approaching the end.

The Elliott wave oscillator indicator detects the impulsive and corrective moves as plots them on the oscillator. The oscillator values and the price movements can be matched to look for divergence and convergence between the price and the indicator values. Thus, the indicator acts as a leading indicator before the price starts a new wave cycle.

In simple words, if the indicator makes higher highs while the price makes lower highs a divergence is formed. Similarly, a divergence is formed during a downtrend. This indicates that the current wave cycle is ending.

Forex traders can use divergence trading strategy while using the Elliott wave oscillator. However, traders should confirm the beginning of the new wave with price action.

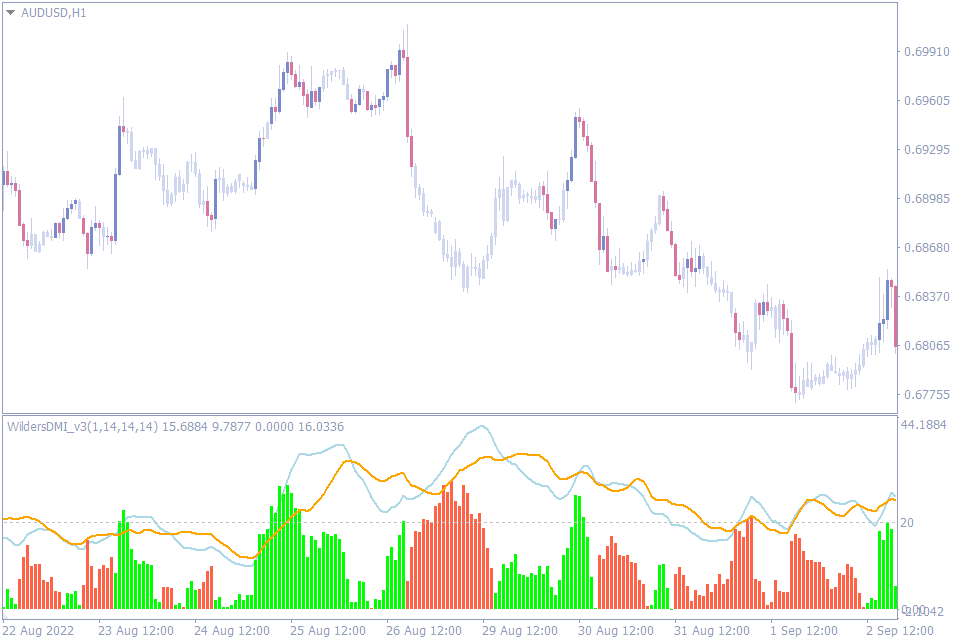

Wilders DMI Oscillator Indicator

We are now half way in our list of best oscillator indicators. Our sixth indicator in the list is the Wilders DMI Oscillator indicator. This MetaTrader indicator measures a vital component of technical analysis, the trend strength and direction.

Frequently, traders place a trade in a trend direction only to find that there’s not enough trend strength. In other words, forex traders identify the trend direction successfully, but may not understand the real trend strength behind and end up closing the trades at a loss.

The Wilders DMI oscillator measures the price momentum using the D+ and D- lines. These lines are futher validated by the histogram. A histogram value above 20 indicates the presence of a strong trend. So, traders can identify the trend using the indicator lines and confirm the trend strength using the histogram value and confirm the trading signal.

On the other hand, Forex traders can avoid entering a trade if there is lack of trend strength. Thus, the indicator helps the traders to filter the trading signals and identify the best trades. Furthermore, the indicator is easy to apply and is suitable for new forex traders.

Thus, the Wilders DMI oscillator helps the traders to identify the trend direction and it’s strength.

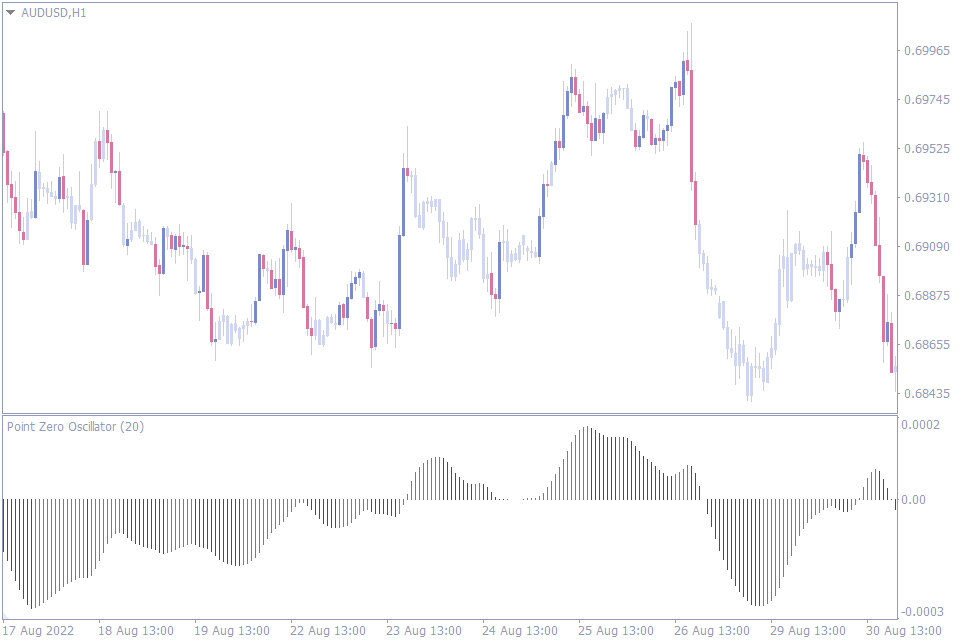

Point Zero Oscillator Indicator

We will now discuss the seventh indicator in this list. The Point Zero Oscillator indicator is similar to the classic MACD – Moving average convergence and divergence indicator. The major difference between the two indicators is in the speed and the number of trading signals generated. In simple words the point zero oscillator indicator provides early signals than the MACD.

Though the indicator looks like the MACD , they both are calculated using different methods. The major component of the point zero indicator is the histogram. The price is in uptrend if the histogram bars are above the zero line. Similarly, the trend is down, if the bars are below the zero line.

Now that we have identified the trend direction using the zero line and the histogram bars. Let’s now see how to identify the trend strength. A blue histogram bar below the zero line and a red bar above the zero line indicate counter trend strength.

This MT4 indicator does not repaint and is available as a free download, it is pretty simple to install. Additionally, the default indicator settings work well. However, forex traders can adjust the settings and fine tune according to their personal preferences.

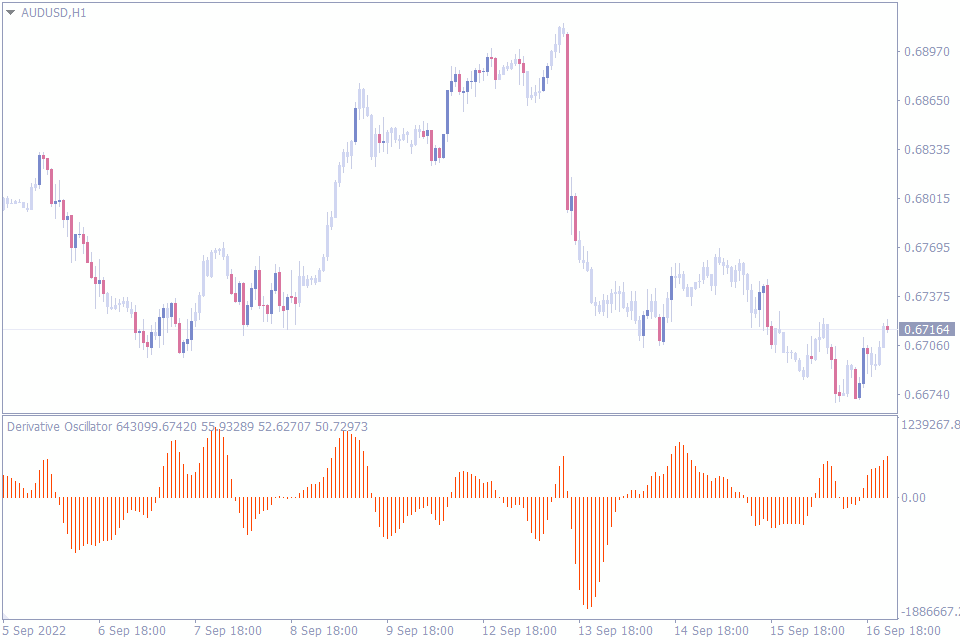

Derivative Oscillator Indicator

We have almost reached the last few indicators on the list of best oscillators. Our eighth indicator in the list is the Derivative oscillator indicator. The indicator combines an enhanced version of RSI – Relative strength index and MACD to identify the trend direction and strength. Since the indicator combines two best indicators, it provides pretty reliable trading signals.

The indicator provides trading signals by the crossover of the zero line and the histogram bars. If the histogram bars are above the zero line they indicate a bullish market trend. Oppositely, the appearance of the histogram bars below the zero line indicates a bearish price trend.

The next important trading method is to use the slope of the bars to identify the trend strength. A positive slope indicates a bullish market trend, while a negative slope indicates bearish price trend. A greater slope angle indicates a stronger trend.

Like other oscillators, forex traders can use the derivative oscillator indicator to trade divergences and acts as a leading indicator. By incorporating the RSI and

MACD we get an indicator which helps forex traders to identify trend direction and strength.

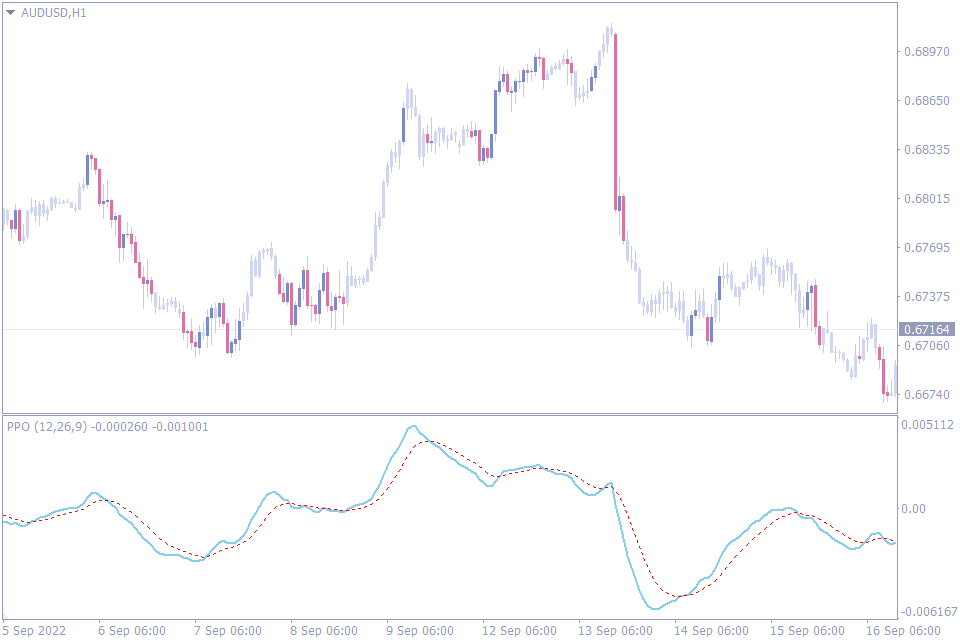

Percentage Price Oscillator Indicator

We will now discuss the ninth indicator in this list of best oscillator indicator. The percentage price oscillator indicator is a simple oscillator that combines EMAs – Exponential Moving Averages to provide forex trading signals.

It’s a well know fact that moving averages are good trend following indicators. The PPO – percentage price oscillator indicator combines a fast EMA and a slow EMA. The crossover of the fast and slow EMA does generate trading signals in the direction of crossover.

If the fast EMA crosses the slow EMA upwards it indicates a bullish trading signal. Likewise, if the fast EMA crosses the slow EMA downwards it provides a bearish trading signal. Thus, the percentage price oscillator indicator – PPO provide forex trading signals based on EMA crossover.

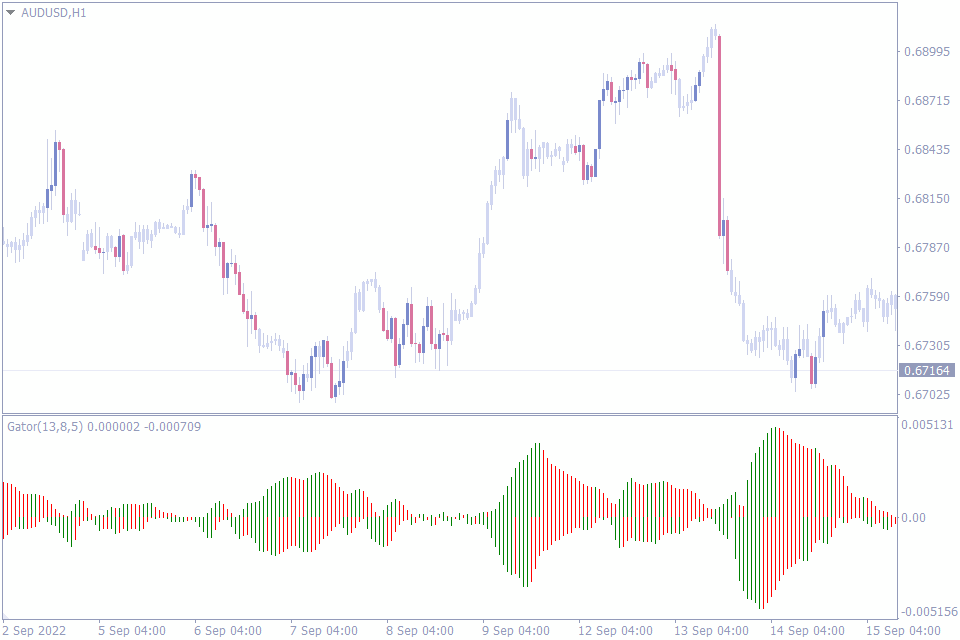

Gator Oscillator Indicator

We have now reached the end of the list of best oscillator indicators. The final indictor on our list is the Gator Oscillator indicator. This oscillator is based on the classic Gator MetaTrader indicator and displays the stages of the Gator indicator as an oscillator and provides the market condition from a different perspective.

The indicator displays the the four phases of the Gator namely the sleeping phase, the awakening phase, the eating phase and the sated phase. The important part of the indicator is the histogram and the color of the histogram bars.

Infact, the gator indicator is a combination of moving averages and hence is a lagging indicator. Forex traders using the gator indicator will agree that they should confirm the trading signals using other technical indicators or price action.

The shift of the Gator from sleeping phase to the awakening phase is represented by the appearance of green histogram bars on either side of the zero line instead of the red ones. During the eating phase the green histogram bars appear on both sides of the zero line. Finally, in the sated phase the green bars begin to change to red.

Thus the Gator oscillator indicator provides the traders with different phases of the Alligator MT4 indicator and helps identify the current market phase. So, forex traders can enter and exit the market accordingly.

Conclusion

In this article we discussed the top ten best oscillator indicator of MT4. The best method is to apply them and familiarize with the indicator before LIVE trading. The above oscillators are derived from other MT4 indicators and rely on the basis of those indicators for calculation. However, it depends upon the individual forex trader to identify the best one to trade.

Price action is the best method to confirm trading signals of an oscillator. As a general rule, technical forex traders should trade in confluence with multiple technical indicators for best trading results.

Leave a Reply