The Fundamentals of Forex Market Analysis

It is not a secret that the Forex market is one of the largest and most liquid that attracts a lot of people worldwide. But what many traders don’t know is how to properly analyze the market in order to make successful trades.

In this article, we’ll explore the forex analysis fundamentals and understand how to analyze it effectively. So whether you’re a new trader or an experienced one, make sure to read on for some tips.

The concept of forex analysis

Forex analysis is the practice of examining the changes in currency pair prices and trying to determine why they are changing. It is used by traders who purchase and sell currencies with the goal of making a profit.

There are 2 main types of analysis that are used in forex trading – fundamental analysis and technical analysis. Many traders use a combination of these 2 techniques, called a hybrid approach.

How does forex analysis work?

The Forex market is an important part of global finances, with trillions of dollars being traded on a daily basis. Retail traders and firms both use forex analysis to try to make money from this massive marketplace. The market is open 24 hours a day, 5 days a week, with activity concentrated in global trading hubs such as London, Tokyo, and New York. The trades are usually carried out due to brokerage companies. In order to find out more about it see fbs review.

The source of profit in this market is trading currency pairs – when someone buys one currency, they automatically sell the other currency. Forex analysis is the study of how different currencies will do over time. When somebody does this, they learn which currency in a pair is more likely to go up or down. Then, they can use this information to carry out the trading processes.

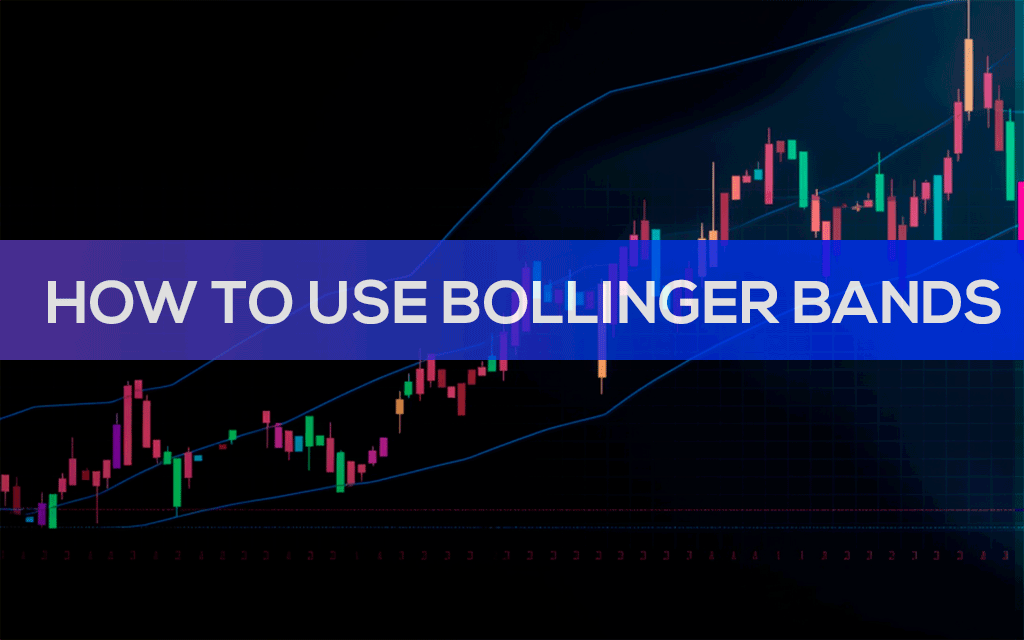

To help with these predictions, traders look at different things like how well the economy is doing in different countries, what commodities cost, and any big news events related to international economics. They also look at technical factors, like how the price of a currency has been doing lately compared to its average price over time.

Let’s take a closer look at 2 most popular analysis types for a deeper understanding:

Technical analysis

In a nutshell, technical analysis is a way to figure out how to trade investments. People use it to see what the statistics say about what people are trading and whether or not it is a good idea. Unlike fundamental analysis, which looks at how well a company is doing, technical analysis looks at prices and volumes.

Fundamental analysis

Fundamental analysis is a method of analyzing changes in the Forex market by monitoring economic data from different countries. For example, traders might focus on interest rates, unemployment rates, and GDP when conducting their fundamental analysis.

Conclusion

To sum up, fundamental and technical analysis are 2 effective methods used when analyzing the Forex market. By understanding both forms of analysis, traders can be better equipped to make smarter trading decisions.

Now that you know a bit more about how to analyze the Forex market, you can start putting this knowledge into practice and make smarter, better-informed trades.

Leave a Reply