How To Identify Divergence In Forex

The forex market is a dynamic and ever-evolving landscape, offering traders a myriad of opportunities. To navigate this complex terrain successfully, traders employ various technical analysis tools and strategies. One powerful technique that traders use to gain an edge in the forex market is identifying divergence. In this article, we’ll delve into what divergence is, how to recognize it, and how to use it to make informed trading decisions.

Understanding Divergence

In the intricate realm of forex trading, it emerges as a fundamental concept steeped in the principles of technical analysis. It manifests when the price movement of a currency pair takes a divergent path, deviating from the trajectory of a technical indicator. This signals a potential weakening of the prevailing trend, hinting at the prospect of an impending reversal or correction. As a discerning trader, understanding and harnessing can be the key to precision in identifying optimal entry and exit points.

Types of Divergence

Types of Divergence

It unfurls in two primary dimensions: regular (often termed classic) and hidden (referred to as continuation).

Regular

Regular materializes when the price action of a currency pair charts higher highs or lower lows, yet the corresponding technical indicator fails to validate these fresh peaks or troughs. There are two subtypes of regular type:

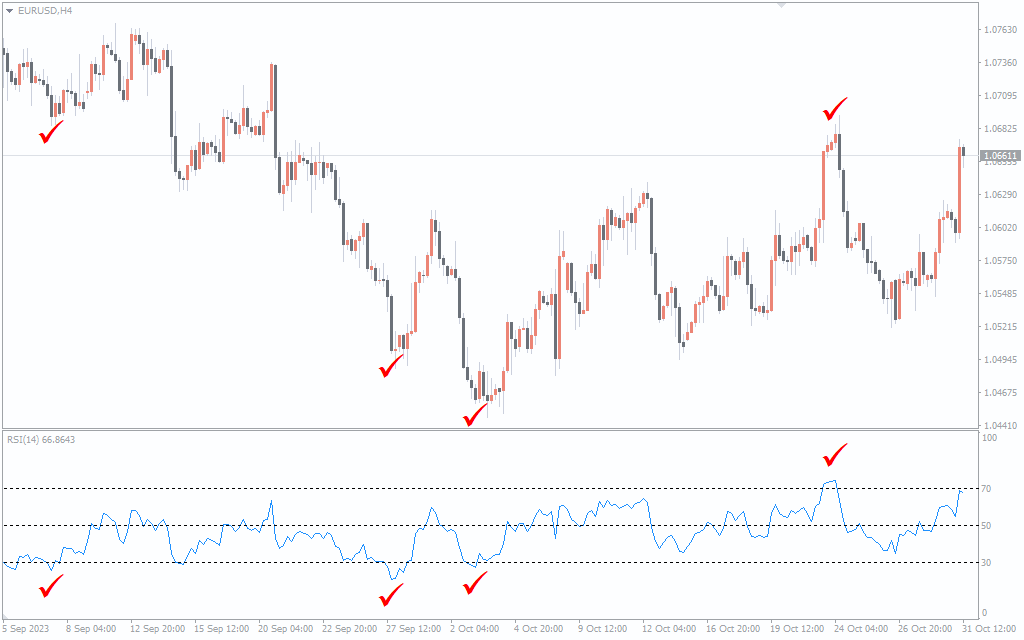

- Bearish: One facet of regular materializes when the price chart paints a picture of higher highs, standing in stark contrast to the indicator, which crafts a canvas of lower highs. This scenario unfurls as a potential alarm bell for traders, suggesting a forthcoming transformation from an ongoing uptrend to an impending downtrend.

- Bullish: On the flip side, bullish regular takes center stage when the price action showcases lower lows, while the accompanying indicator traces a path of higher lows. This intriguing scenario provides traders with a glimmer of hope, as it signifies a potential shift from a prevailing downtrend to an imminent uptrend resurgence.

Hidden

Hidden, on the other hand, suggests that the current trend is likely to continue. It occurs when the price makes higher highs or lower lows, and the indicator also forms higher highs or lower lows. There are two subtypes of hidden type:

- Bearish: This happens when the price makes higher highs, and the indicator also forms higher highs. It suggests a potential continuation of a bearish trend.

- Bullish: Conversely, bullish hidden occurs when the price makes lower lows, and the indicator also forms lower lows. It implies a potential continuation of a bullish trend.

Identifying Divergence

Recognizing it in your trading charts is a multi-step process:

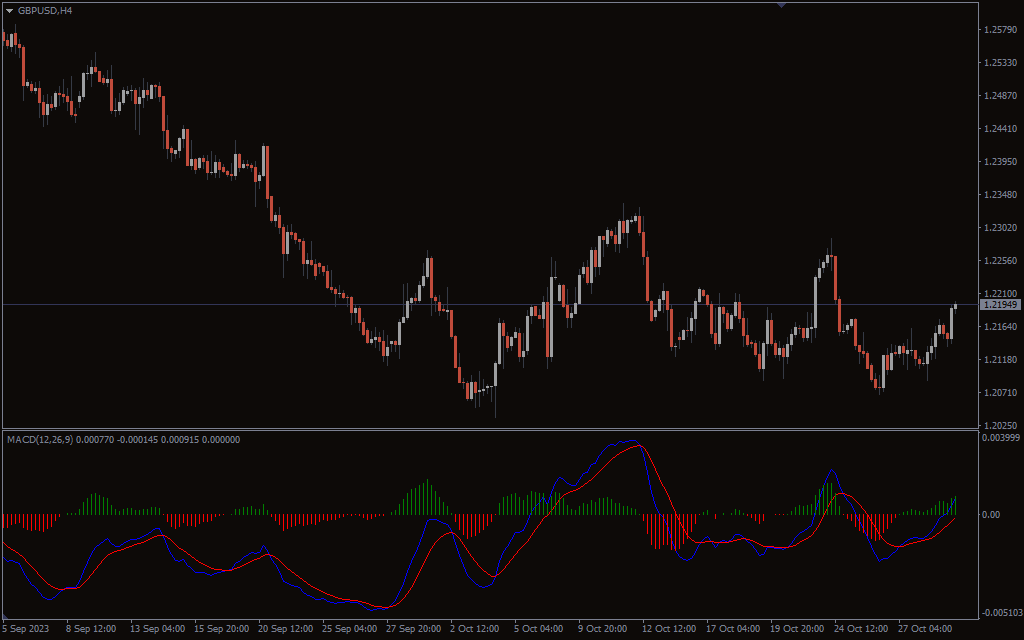

- Select a Reliable Indicator: Begin by choosing a reliable technical indicator. Some popular choices among traders include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the Full Stochastic indicators for MT4 which you can download for free.

- Analyze Price and Indicator: Compare the price action of the currency pair with the readings of your chosen indicator. Look for instances where the price and indicator show contrasting movements.

- Regular or Hidden: Determine whether you’re witnessing regular or hidden based on the direction of the price and the indicator. This classification is crucial as it will influence your trading decisions.

- Confirm with Additional Analysis: Divergence signals should not be taken in isolation. It’s essential to confirm your findings with other technical analysis tools, such as support and resistance levels, trendlines, or candlestick patterns.

Incorporating Divergence in Your Trading Strategy

Incorporating Divergence in Your Trading Strategy

Once you’ve identified it, you can use it to enhance your trading strategy:

- Entry Points. They can act as a powerful signal for entering or exiting trades. For example, in a bearish regular scenario, you might consider opening a short position when the divergence is confirmed.

- Risk Management. It can also help you set stop-loss and take-profit levels more effectively, reducing your exposure to potential losses.

- Always seek confirmation from other technical indicators or analysis methods to strengthen your trading decisions.

To wrap up, delving into the intricacies of recognizing divergence in the world of forex trading can be a game-changer for traders looking to up their trading ante. This valuable tool not only provides a window into potential trend reversals but also illuminates the path of trend continuations, ultimately bolstering your prowess in making well-informed trading decisions. However, like any trading tool, it’s essential to use divergence wisely and in conjunction with other analysis techniques.

Practice, backtest your strategies, and continually refine your approach based on market conditions to harness the full potential of divergence in your forex trading journey. So, start exploring this powerful tool and elevate your trading game to new heights.

Leave a Reply