Forex Correlation Pairs List: Positive and Negative Correlated

In the complex world of forex trading, understanding the relationships between currency pairs is crucial. The Forex Correlation Pairs List is an invaluable tool for traders seeking to navigate the intricacies of the foreign exchange market. In this comprehensive guide, we’ll explore the concept of forex correlations, their significance, and provide a detailed list of correlated currency pairs.

Understanding Forex Correlations

Forex correlations refer to the statistical measure of how two currency pairs move in relation to each other. These correlations can be positive, negative, or neutral. A positive correlation implies that the pairs move in the same direction, while a negative correlation suggests opposite movements. A neutral correlation indicates a lack of consistent relationship.

Significance of Forex Correlations

Risk Management: Correlations play a vital role in risk management. Knowing how currency pairs move in relation to each other helps traders diversify their portfolios effectively.

Market Sentiment: Correlations often reflect broader market sentiment. Positive correlations in certain pairs might indicate a prevailing risk-on sentiment, while negative correlations could signal a risk-off environment.

Forex Correlation Pairs List

Without delving into the not intricate formulas available online, I’ll provide a list of Forex currency pairs showcasing positive and negative correlations, with a day coefficients exceeding +85 or falling below -85.

Positive Correlation Pairs

1. EURUSD – GBPUSD, EURJPY, GBPJPY, GBPCAD, EURCAD, AUDJPY, AUDCAD, AUDUSD

2. GBPUSD – EURUSD, GBPJPY, AUDUSD

3. EURJPY – EURUSD, GBPJPY, GBPCAD, EURCAD, AUDJPY, CHFJPY

4. GBPJPY – EURUSD, GBPUSD, EURJPY, GBPCAD, EURCAD, AUDJPY

5. GBPCAD – EURUSD, EURJPY, GBPJPY, EURCAD, AUDCAD, CADCHF

6. EURCAD – EURJPY, GBPJPY, GBPCAD, AUDCAD

7. AUDJPY – EURUSD, EURJPY, GBPJPY, AUDCAD, AUDUSD

8. AUDCAD – EURUSD, GBPCAD, EURCAD, AUDJPY

9. AUDUSD – EURUSD, GBPUSD, AUDJPY

10. NZDCAD – NZDJPY

11. CHFJPY – EURJPY

12. NZDJPY – NZDCAD, NZDUSD

13. NZDUSD – NZDJPY

14. EURGBP – EURNZD

15. EURNZD – EURGBP, AUDNZD, GBPNZD

16. AUDNZD – EURNZD

17. EURCHF – GBPCHF

18. GBPNZD – EURNZD

19. GBPCHF – EURCHF, AUDCHF, NZDCHF

20. AUDCHF – GBPCHF, NZDCHF

21. NZDCHF – GBPCHF, AUDCHF

22. CADCHF – USDCHF

23. USDCHF – CADCHF

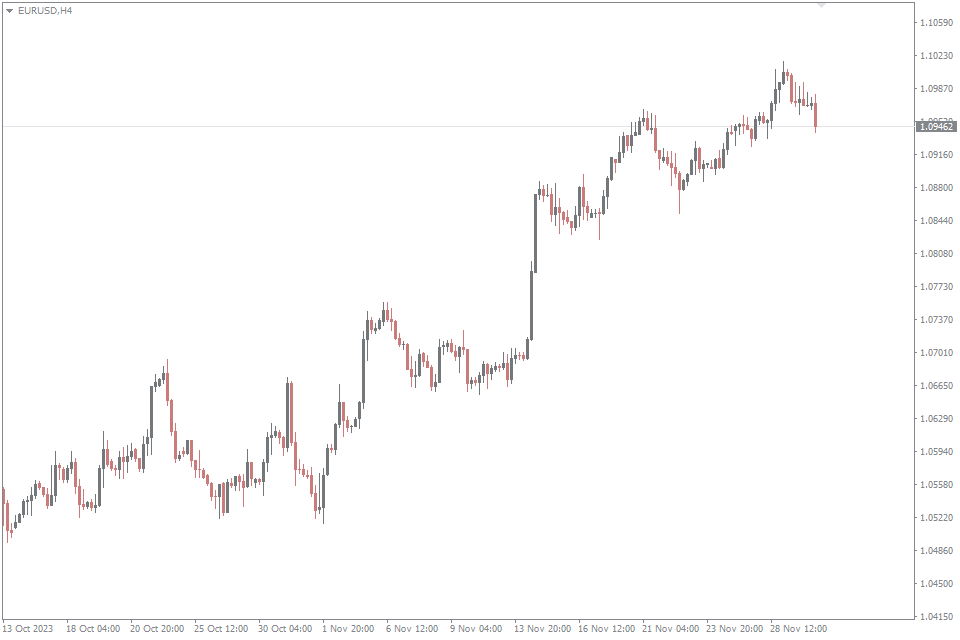

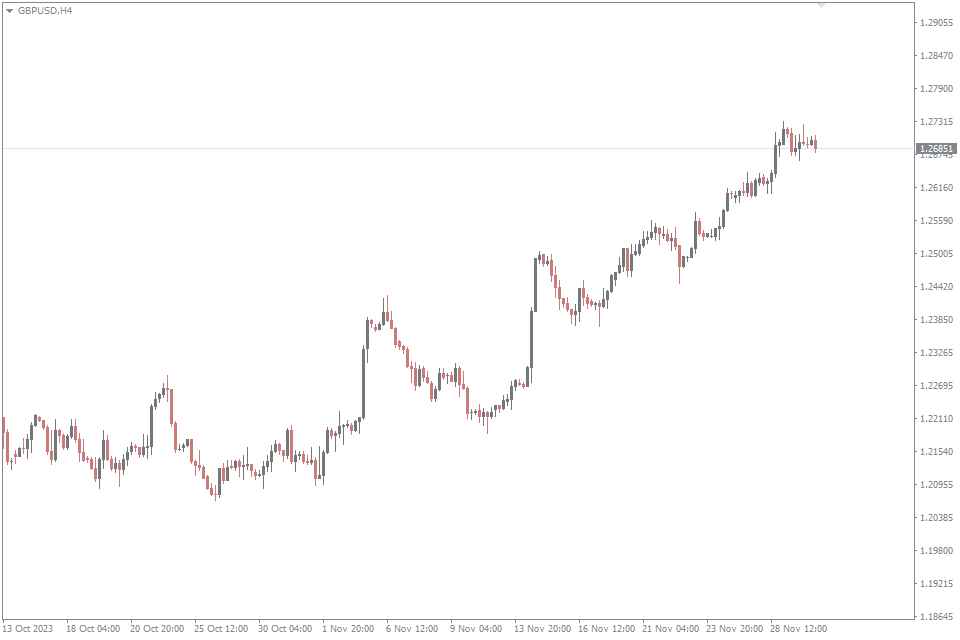

Example of positive correlation EURUSD – GBPUSD

Negative Correlation Pairs

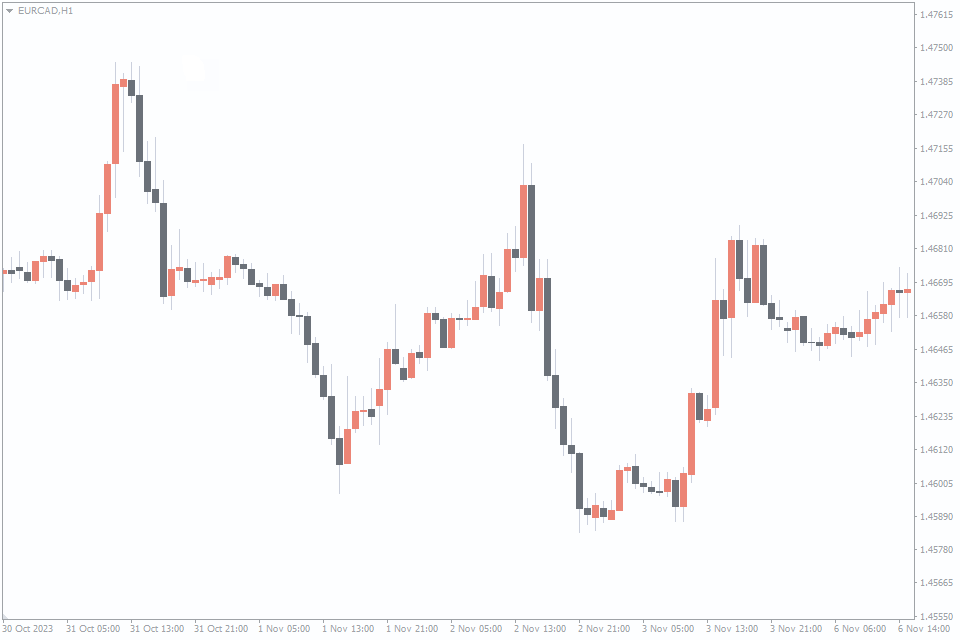

1. EURCAD – CADCHF

2. CHFJPY – CADCHF, USDCHF

3. EURNZD – NZDCHF

4. GBPNZD – NZDCHF

5. NZDCHF – EURNZD, GBPNZD

6. CADCHF – GBPCAD, EURCAD, CHFJPY

Example of negative correlation EURCAD – CADCHF

Trading Strategies

Traders can use correlated pairs to formulate strategies. For example, if a trader identifies a positive correlation between EUR/USD and GBP/USD, they may use this information to confirm trends and strengthen their trading decisions.

What indicators can I use?

To determine the correlation of currency pairs, you can use various indicators, with one of the most common being the Pearson correlation coefficient. Here are some freely available indicators for MT4 that you can download and use to assess correlations: Correlation Indicator, Market Correlation Indicator, Currency Correlation Indicator, Spearman Correlation Indicator .

Remember, correlation does not imply causation, and correlations can change over time. It’s crucial to use these indicators as part of a broader analysis and not rely solely on them for trading decisions.

How to Use the Forex Correlation Pairs List

Diversification: Utilize correlated pairs for effective portfolio diversification. Avoid overexposure to assets that move in the same direction.

Confirmation of Trends: Confirm trends by checking correlations. If two positively correlated pairs both show an uptrend, it strengthens the signal. Moreover, if you depend on indicators that are effective only on specific Forex pairs, like major currency pairs, when setting your objectives, you can leverage correlated pairs. Take, for instance, my use of the FXSSI.ProfitRatio indicator for identifying trend reversal points. While it not be applicable to the cross pair AUDCAD, which I trade, this pair correlates significantly with the EURUSD at a coefficient of 86.9. Consequently, when the Euro’s direction shifts, I receive a signal with a high likelihood of a directional change in cross pairs AUDCAD as well.

Example of using positive correlation currency pair

Risk Management: Consider correlations when setting stop-loss and take-profit levels. If holding long positions in two positively correlated pairs, a trend reversal in one may signal potential reversals in the other.

Conclusion

The Forex Correlation Pairs List is an indispensable tool for traders aiming to make informed decisions in the dynamic forex market. Understanding how different currency pairs correlate empowers traders with insights into market sentiment, risk management, and the development of effective trading strategies.

While correlations provide valuable information, it’s crucial to remember that market conditions can change rapidly. Moreover, historical correlations may not guarantee future movements. Traders should exercise prudence, conduct thorough analyses, and consider multiple factors in their decision-making process.

As you explore the Forex Correlation Pairs List, experiment with these relationships in your trading strategies. Adapt and refine your approach based on the ever-changing dynamics of the forex market. Remember, successful trading involves continuous learning, adaptability, and disciplined risk management.

Comment (1)

Nice information…