How to Use Bollinger Bands Indicators in Forex Trading

The realm of forex trading is a constantly shifting and multifaceted domain. To maneuver through it effectively, traders depend on an array of technical indicators and strategies to arrive at well-informed judgments. Among these indicators, one has garnered significant acclaim among traders: the Bollinger Bands indicator. In this article, we will delve into the world of Bollinger Bands and uncover how you can seamlessly integrate them into your forex trading strategy.

What Are Bollinger Bands?

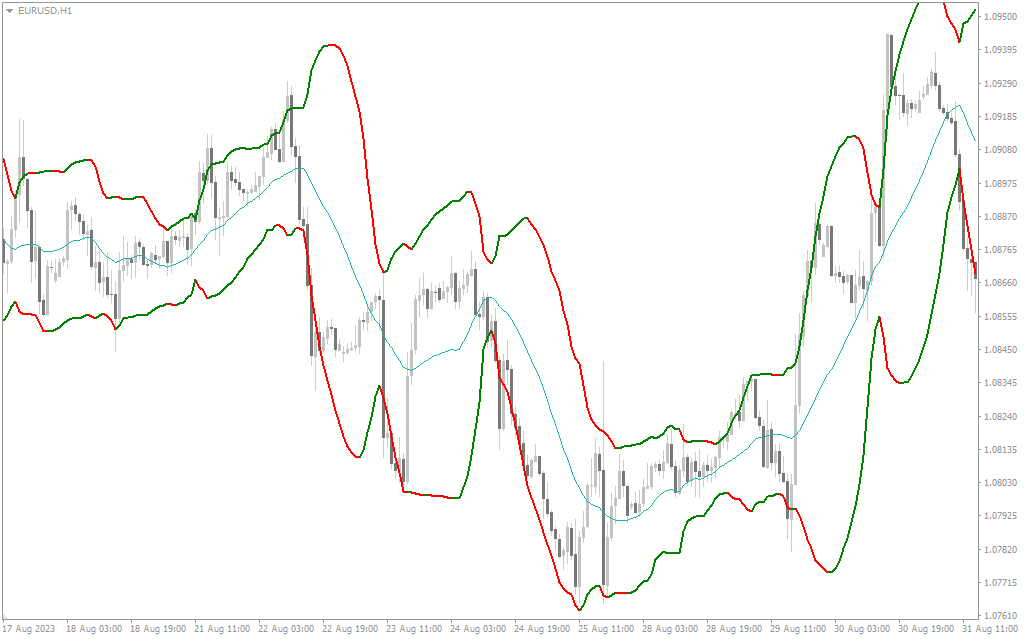

This versatile technical indicator was conceived by John Bollinger during the early 1980s. Its structure comprises three distinct bands or lines displayed on a price chart. These include the central band, which represents a simple moving average (SMA), along with two outer bands situated at a specific number of standard deviations from the central band.

As an example, we can cite such popular free MT4 indicators as Bollinger Bands Bicolor, Advanced Bollinger Bands, Bollinger Bands Stop v2.

Using Bollinger Bands in Your Trading Strategy

Using Bollinger Bands in Your Trading Strategy

They serve multiple purposes in forex trading, making them a valuable tool for traders. Here are some ways you can incorporate BB indicators into your trading strategy:

- Detecting Overbought and Oversold Conditions. Bollinger Bands excels at identifying overbought and oversold market When prices reach or surpass the upper band, it may indicate an overbought market, potentially suggesting an imminent reversal or correction. Conversely, when prices touch or dip below the lower band, it may signal an oversold market, potentially foreshadowing an upward reversal.

- Gauging Volatility. These bands expand and contract in response to market Widening bands indicate heightened volatility while narrowing bands imply decreased volatility. This information empowers traders to gauge market sentiment and adapt their strategies accordingly.

- Identifying Trend Bollinger Bands can be a harbinger of potential trend reversals. If the price ventures beyond one of the bands, it might indicate the emergence of a new trend. For instance, if prices breach the upper band following a downtrend, it could hint at a bullish reversal.

- Confirmation through Companion Indicators. Such indicators complement other technical indicators effectively. By combining them with tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD), traders can fortify their trading signals and garner increased confidence in their trades.

- Capitalizing on the Bollinger Squeeze. The Bollinger Squeeze unfolds when the bands constrict tightly, signaling reduced volatility. Traders often anticipate substantial price movements after a squeeze. They might initiate long positions when the price surges above the upper band or short positions when it descends below the lower band.

- Establishing Stop-Loss and Take-Profit Levels. They can assist in determining optimal levels for stop-loss and take-profit orders. Positioning a stop-loss slightly beyond the outer bands can help minimize potential losses in case of unforeseen price Setting your take-profit levels when trading with Bollinger Bands indicators can vary based on your specific trading strategy, risk tolerance, and market conditions, but it often involves targeting key support or resistance levels identified on the price chart.

Conclusion

Bollinger Bands are a powerful tool in forex trading, offering insights into price volatility, overbought or oversold conditions, trend reversals, and more. However, like any technical indicator, they are most effective when used in conjunction with other analysis methods and risk management strategies. As you incorporate into your trading arsenal, remember to backtest your strategies and continually refine your approach based on market conditions.

Mastering the skill of harnessing Bollinger Bands proficiently enables traders to elevate their decision-making abilities and boost their prospects for success in the demanding realm of forex trading. So, go ahead, download the Bollinger Bands indicator for MT4 free, and start exploring the myriad possibilities it offers in your trading journey.

Leave a Reply