Smart Money Concept – Best Strategy of Modern Traders

In the intricate world of investing, the ‘Smart Money Concept’ stands as a beacon for those seeking to navigate the tumultuous financial markets with a more informed, strategic approach. This concept, rooted in the actions and strategies of institutional investors and market insiders, offers a profound insight into how the movements of well-informed, experienced entities can serve as a guide for individual investors aiming to optimize their investment decisions. By understanding and leveraging the indicators of smart money presence, such as volume analysis, price movements, and accumulation patterns, retail investors can gain a competitive edge, aligning their strategies with the underlying currents shaping market trends. This introduction to the Smart Money Concept aims to demystify the practices of the financial elite, offering readers a roadmap to decipher market dynamics, anticipate shifts, and make investment choices that resonate with the wisdom of seasoned market participants.

Understanding the Smart Money Concept

Grasping the Smart Money Concept is pivotal for investors seeking to align their portfolios with the market’s power players. This concept revolves around deciphering the investment patterns of institutional investors, hedge funds, and market mavens whose significant capital and comprehensive research shape market trends. Understanding smart money means recognizing the subtleties of market liquidity, the intricacies of order books, and the strategic timing of trades that often precede major market moves. By analyzing the accumulation and distribution phases smart money navigates, investors can anticipate potential market shifts. Utilizing advanced tools like on-balance volume (OBV), market depth, and sentiment analysis, alongside monitoring regulatory filings for institutional holdings, can provide a window into smart money strategies.

Identifying Smart Money Movements

Identifying the elusive movements of smart money within the financial markets requires a keen eye and a deep understanding of various analytical tools and indicators. Key to this pursuit is the mastery of volume analysis, which can unveil the hidden tracks of institutional investors as they maneuver through the market. Observing unusual volume spikes alongside significant price changes can signal smart money’s involvement. Additionally, the analysis of order flow and block trades offers insights into large transactions typically associated with smart money activity. Technical analysts also rely on patterns in price action, such as sudden reversals or breakout movements, that suggest the strategic positioning of experienced investors. By synthesizing these indicators – volume spikes, order flow, price patterns, COT reports, and dark pool data – investors can piece together a clearer picture of where smart money is flowing, positioning themselves to make more informed decisions that align with the momentum of the market’s most influential players.

The Trading Psychology Behind Smart Money

In the Forex market, institutional investors such as banks, hedge funds, and large financial institutions play a critical role in shaping market mood and direction through their strategic decisions. The Forex market is particularly sensitive to the actions of these players due to its vast size and liquidity. Here’s how their decisions can impact the Forex market:

Currency Valuations – Institutional investors often engage in large foreign exchange transactions that can directly influence currency valuations. Their trades can move exchange rates, especially in less liquid currency pairs.

Interest Rate Expectations – These investors have access to sophisticated research and may make early moves based on anticipated changes in central bank policies or interest rate adjustments, which are primary drivers of currency strength.

Risk Appetite – The level of risk institutional investors is willing to take on can signal market sentiment. A shift towards safe-haven currencies may indicate a risk-off sentiment, while a move towards higher-yielding currencies suggests a risk-on feeling.

Carry Trades – Institutions might engage in carry trades, borrowing in low-interest-rate currencies to invest in higher-yielding ones. This can affect the direction of currency pairs as they reflect the differential in interest rates between economies.

Economic Data Reaction – Institutional reactions to economic data releases can be swift and significant, setting the tone for how the market interprets news events. Their trades post-data release can greatly influence short-term trends.

Liquidity Provision – By providing liquidity, institutional investors facilitate smoother transactions, which is vital for maintaining the efficiency of the Forex market.

Geopolitical Sensitivity – Institutional investors respond quickly to geopolitical events, and their strategic positioning in response to such events can lead to rapid changes in currency strength and market mood.

Smart Money and Market Phases

Smart money investors navigate through distinct phases of the market cycle, each characterized by different behaviors and strategies. The four primary phases are:

Accumulation Phase – This phase occurs after the market has bottomed out and is characterized by smart money investors quietly buying up undervalued or oversold assets. Retail investors are typically pessimistic during this phase, but smart money recognizes the long-term potential and begins to build positions.

Markup Phase – Following accumulation, the market starts to trend upwards as more investors recognize the value and begin buying in. Smart money’s early investments start to pay off during this phase, as increasing demand drives up prices and public participation grows.

Distribution Phase – After a sustained uptrend, smart money investors may deem the market overvalued and begin to sell their holdings to realize profits. This phase often sees prices plateau or fluctuate as smart money distributes assets to retail investors who are still optimistic about further growth.

Markdown Phase – Eventually, selling pressure overtakes buying momentum, leading to a downtrend in the market. Smart money has largely exited their positions by this point, and the market reflects the shift in sentiment with decreasing prices.

Understanding these phases allows smart money investors to enter and exit the market strategically, maximizing their profits and minimizing risks.

Synergy of Smart Maney Consept with Classical Technical Analysis

Forex traders can identify patterns in price consolidations and breakouts by closely monitoring currency price charts and applying technical analysis. Here’s how they can spot these critical market structures and get super forex signals to Buy or Sell:

Support and Resistance Levels – Traders look for horizontal lines where price has stopped and changed direction multiple times in the past. Consolidation is often found between these levels, indicating indecision. One of the best usefull and free indicator for trading platform Metatrader MT4/MT5 is here.

Candlestick Chart Patterns – Classic patterns like triangles, rectangles, and flags represent consolidation. These charts patterns have well-defined borders that, when broken, can lead to significant breakouts.

Bar Patterns – Certain candlestick formations, such as doji or spinning tops near support or resistance zones, can signal consolidation. A strong breakout is often preceded by such patterns.

Volume Analysis – A drop in volume during consolidation and a sudden increase on a breakout provides additional confirmation. Volume is a key indicator of the strength behind a breakout. Choose the best one from this useful analitical article .

Moving Averages – Traders use moving averages to smooth out price action and identify when a breakout is occurring. Consolidations may see price crisscrossing a moving average, while a decisive breakout will have price pulling away from the moving average line.

Momentum Indicators – Tools like the Relative Strength Index (RSI) or the Moving Average Convergence Divergence (MACD) help traders gauge the strength of a trend. During consolidation, these indicators tend to flatten out, while a breakout will show a sharp movement in one direction.

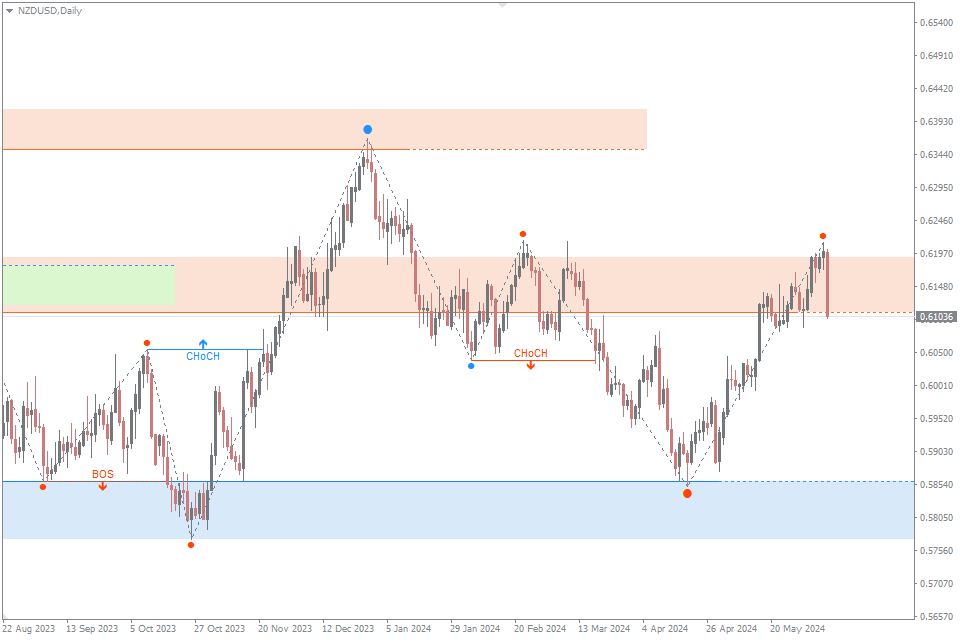

BOS and CHOCH – In the realm of the Smart Money Concept, the Break of Structure (BOS) and Change of Character (CHOCH) play pivotal roles in decoding the market’s narrative. BOS, a key indicator of a potential shift in market sentiment, occurs when price levels breach a significant high or low, suggesting a transition from one market phase to another. This moment captures the essence of smart money’s strategic repositioning, offering traders clues about impending trends. On the other hand, CHOCH, marked by an abrupt change in price action behavior, serves as a confirmation of the new direction, often following a BOS. It signifies the moment when smart money’s influence becomes overt, solidifying the trend’s foundation

By combining these techniques, traders both beginners and professionals can better identify when a currency pair is consolidating and when it’s poised for a breakout, allowing them to make more informed trading decisions to short position or long position.

The Impact of News and Events on Smart Money

The impact of forex news and events on smart money is a study in strategic reactivity and anticipation. Smart money investors, with their finger on the pulse of global economic shifts, often lead the market’s response to high-impact news events, including central bank announcements, geopolitical developments, and significant economic data releases. Their ability to process and act upon news with agility and insight can create immediate ripples across currency valuations and market trends. For instance, a surprise interest rate hike by a major central bank can trigger smart money to adjust currency holdings, prompting a swift reaction in currency pairs tied to that economy.

Forex traders who track smart money must therefore keep a vigilant watch on the news cycle, interpreting not just the news itself but also the nuanced market responses that follow. This includes monitoring financial news outlets, economic calendar, and policy statements for clues on how smart money might position their portfolios.

Traders can track smart money movements by monitoring these key sources

1. Commitment of Traders (COT) Report: Shows institutional positioning in Forex futures.

2. Central Bank Announcements: Influences currency values; smart money reacts to these.

3. Economic Data Releases: Key indicators that impact market feeling and smart money strategies.

4. Bank and Institutional Analysis: Market insights from financial institutions.

Challenges in Following Smart Money

Navigating the pursuit of aligning with smart money in the Forex market presents a unique set of challenges for individual traders.

Market Decentralization – The market’s decentralized nature means there’s no single source for volume data, making it harder to track the flow of institutional money.

Speed and Stealth – Institutional investors often execute trades quickly and discreetly, making it difficult for individual traders to spot their movements in real-time.

Complex Strategies – Smart money may use sophisticated trading strategies, such as using derivatives or engaging in high-frequency trading, which are not always transparent.

Access to Information – Institutional traders have access to superior technology, information, and research, giving them an edge over individual traders.

Market Noise – The high level of market noise in Forex can obscure the signals of smart money activity, leading to false positives.

Global Impact – Forex is influenced by global events, and smart money may react to forex news or economic data from various countries, requiring individual traders to monitor multiple sources.

Hedging and Diversification – Smart money often hedges their positions or diversifies across markets, complicating the task of tracking their Forex-specific activities.

Conclusion

The Smart Money Concept can provide traders with a best strategic advantage in the Forex market or Stock market by offering insights into the actions of institutional investors, whose large capital flows can significantly influence currency price movements. Here’s how understanding smart money can be advantageous:

Informed Entry and Exit Points – By tracking where smart money is likely entering or exiting the market, traders can align their trades with these movements, potentially entering at the start of a trend and exiting before a reversal.

Risk Management Strategies – Understanding smart money activity can help traders set more informed stop-loss order and take-profit order, managing risk in line with the market’s most influential players.

Market Sentiment Analysis – Institutional investors often have access to superior information and analysis. Observing their actions can give clues about the overall market feeling and future price trends.

Anticipating Market Reactions – Smart money often moves before major economic releases or announcements. By tracking these movements, traders can better anticipate market reactions to upcoming events.

Avoiding Herd Mentality – Retail traders often get caught in the herd mentality, which can lead to suboptimal trading signals and decisions. By following smart money, traders can avoid the pitfalls of trading with the crowd and instead capitalize on the more calculated moves of informed investors.

Improved Strategy Development – Incorporating smart money analysis into trading strategies can lead to a more disciplined and systematic approach to the market, focusing on solid evidence rather than speculation.

By leveraging the Smart Money Concept, Forex or stock traders can make more informed decisions, improve their trading strategies, and potentially increase their chances of success in the competitive world of currency trading.

If you trade Smart Money Concept, please share your key experience in the comments.

Leave a Reply