How To Forex News Trading

There are generally two approaches to trading forex. The first is technical analysis. The other is fundamental analysis, where a trader analyzes currencies and every important bit of information that relates to them before making speculations on the pairs involving the currencies. And one important piece of information that fundamental analysis relies upon is the news.

This article teaches how to trade the news in forex.

Why Trade the Forex News

There are many factors that drive the forex market, and the news is one of them. News in forex refers to regularly published reports and statistics that might affect the economies of the countries releasing the reports. We call these reports economic data releases, and examples are inflation and GDP reports.

Important news releases are often characterized by spikes in the volatility of currency pairs in the forex market. You could leverage this ability of the news to create volatility on the market to profit. And for this purpose, there are many news trading strategies that help you take advantage of the impact of news on the forex market.

How major news releases impact the forex market

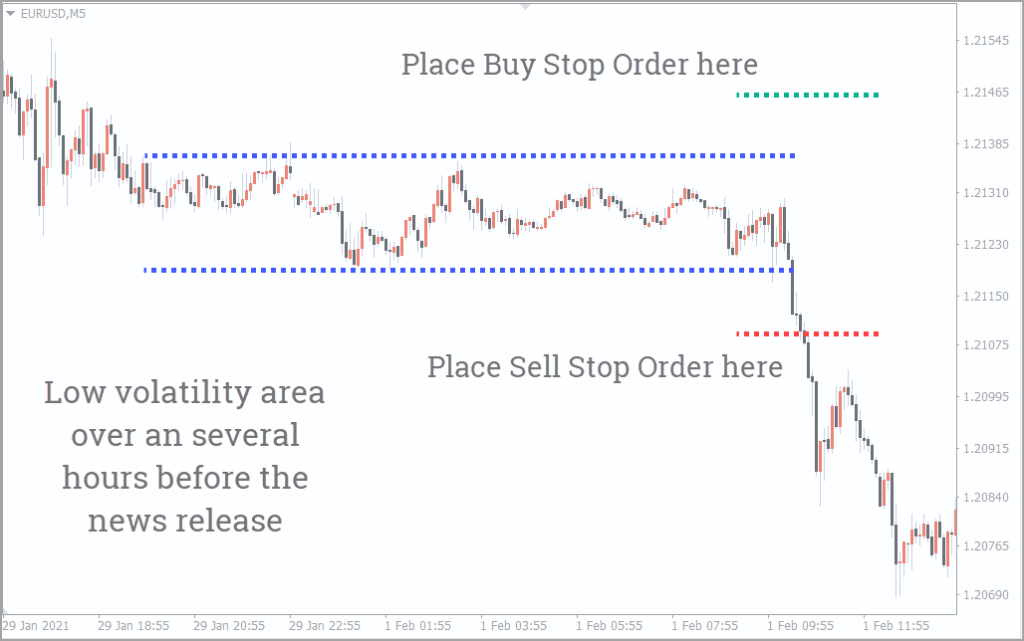

Usually, the hours before the scheduled release of important news releases are often characterized by low volatility. You would notice that a usually active currency pair suddenly looks dead and could even go into consolidation. This is because few traders are making trades at that moment, as most traders anticipate the results of the release until they are sure about the direction the news would drive the price. They don’t want to make trades and find their stop losses knocked out when the news drives the market against them.

Another impact of the important news releases on the forex market is that brokers widen their spreads. In other words, the risks expand for traders who are looking to trade the news.

Important News Releases

Not all news releases are important enough to affect currency pairs in forex. Some important news releases don’t even affect the currency pairs they should affect sometimes, especially when most traders already have a good guess of the result of the news. There is a seesaw effect to this, however, as surprising news releases could cause more than normal volatility. Despite this unpredictability, it is smart to anticipate and prepare for an upcoming important news release

So, how do you know the important news releases to trade in forex? You can use the FXSSI calendar indicator to check upcoming news right on your chart on MT4. The major news releases have three stars in front of them.

Here is a table containing the major news releases around the globe and details about them.

| Economic Data | Region | Release time (EST) |

| Australian Cash Rate | Australia | First Tuesday of every month apart from January at 10:30 PM |

| Australian Employment Change | Australia | Monthly at 7:30 PM |

| Bank of Canada overnight rate | Canada | Eight times in a year at 10:00 AM |

| Bank of England official bank rate | England | Monthly at 7:00 AM |

| Canadian employment change | Canada | Monthly at 8:30 AM |

| European Central Bank refinancing rate | Europe | Eight times in a year at 7:45 AM |

| Non-farm payrolls (NFP) | United States | Last Friday of the month at 8:30 AM |

| Reserve Bank of New Zealand official cash rate | New Zealand | Seven times in a year at 9:00 PM |

| US Federal Reserve Bank Federal funds rate | United States | Eight times in a year at 1:00 PM |

| US Gross domestic product (GDP) | United States | Every quarter of the year at 8:30 AM |

Pairs to Trade on the News

It is not enough to know the major news releases. You have to know where to anticipate the effects of the news.

Forex contains eight major currencies.

- Australian dollar (AUD)

- British pound (GBP)

- Canadian dollar (CAD)

- Euro (EUR)

- Japanese Yen (JPY)

- New Zealand dollar (NZD)

- Swiss franc (CHF)

- US dollar (USD)

These major currencies combine to form highly liquid currency pairs. Because of their liquidity, they are very sensitive to important news releases. So, you could trade the news on any of the currency pairs involving the major currencies in forex. However, some of the most liquid of them are:

- AUDUSD

- CHFJPY

- EURUSD

- EURCHF

- GBPJPY

- USDJPY

How To Trade the News in Forex

There are many news trading strategies for you to use to profit from the impact of news on forex. However, the most common way to trade the news involves trading the breakout after the consolidation before the news release. Here is a step-by-step guide on trading the news using this strategy.

Step 1

Open your chart about 5 to 10 minutes before the scheduled release of the news. Prepare yourself for trading by going to a liquid pair involving the news currency. For instance, Non-farm Payrolls affect USD currency pairs. So you may choose to trade the news on the EURUSD. For intraday traders, go to the 5M or 1M timeframe to catch the immediate impact of the news on the currency pair

Step 2

Try to observe the consolidation going on in the market and place support and resistance lines on it.

Step 3

Set buy stop and sell stop orders above and below the resistance and support levels, respectively. The reason for this is that you don’t know which direction the news could move the price. Don’t forget to only trade an amount you are willing to risk. A rule of thumb is to only risk 2% of your investment in the trade.

Step 4

When the news gets released, the breakout hits one of your stop orders and you’re in the trade.

Managing Risks

It is important that you manage the trade properly to keep you from deflating your account. Trades like this could be over in seconds or go on for as long as hours and even days. Stop losses are important in trades like this. And as the trade moves in your speculated direction, you could also trail the stop loss to protect your profits from sudden reversals (because they do happen).

Conclusion

Trade the news smartly. The characteristic high volatility of the news could burn out your account without risk management to mitigate losses. Never risk what you can’t afford to lose.

Comments (10)

Thanks for the important work provided

Hi, I wanted to know your price.

Hello.

Price for what exactly?