Top 10 Moving Average Indicator For MT4

The core of the technical analysis is to identify the trend direction. Traders globally traders use all technical tools and resources at their disposal to find answers to this question. What is the trend direction? Once the forex trader identifies the trend direction the next step is to find the best entry point and then come to the exit plan.

A multitude of technical indicators and tools are already available in addition to a constant flow of new technical indicators. Not to mention the unlimited revisions or modifications of existing technical indicators. However, almost all technical forex traders will agree that they had applied or currently incorporate moving averages in their trading arsenal.

A moving average is a simple tool that new and advanced forex traders apply. Not only the retail traders, but the institutional traders also follow the moving averages. The dreaded Death cross and the enthusiastic Golden cross make the trader’s mood swing from bullish to bearish and vice versa. The simplicity of this indicator has no wonder attracted an amazingly loyal fan base.

The moving average is the first identifier of trend direction changes for most forex traders. However, the indicator faces wide criticism as a lagging indicator. As the trading signals of the lagging indicator are a bit delayed due to the nature of the formula and mathematical calculation of this indicator. However, traders agree that the quality of the moving average trading signals is quite reliable in the long term.

Though there is a multitude of automated trading strategies that incorporate moving averages. There are various versions of this humble indicator which was formed by various mathematicians, technical strategists, and analysts. The sole purpose of these various versions is to address the issue of the lagging nature of the moving averages.

In this article, we will discuss the best moving averages and understand them. However, it is important to note that they all approach the same solution in different routes and techniques. So, forex traders should apply and familiarize themselves with the indicator before trading LIVE.

Top 10 Moving Average Indicator For MT4

- Triple Exponential Moving Average – TEMA

- Hull Moving Average – HMA

- Volume Weighted Moving Average – VWMA

- Exponential Moving Average – EMA

- TMA Line Indicator

- Arnaud Legoux Moving Average – ALMA

- Fractal Adaptive Moving Average – FRAMA

- MA Profit Indicator

- XP Moving Average

- MA Rainbow indicator

Triple Exponential Moving Average – TEMA

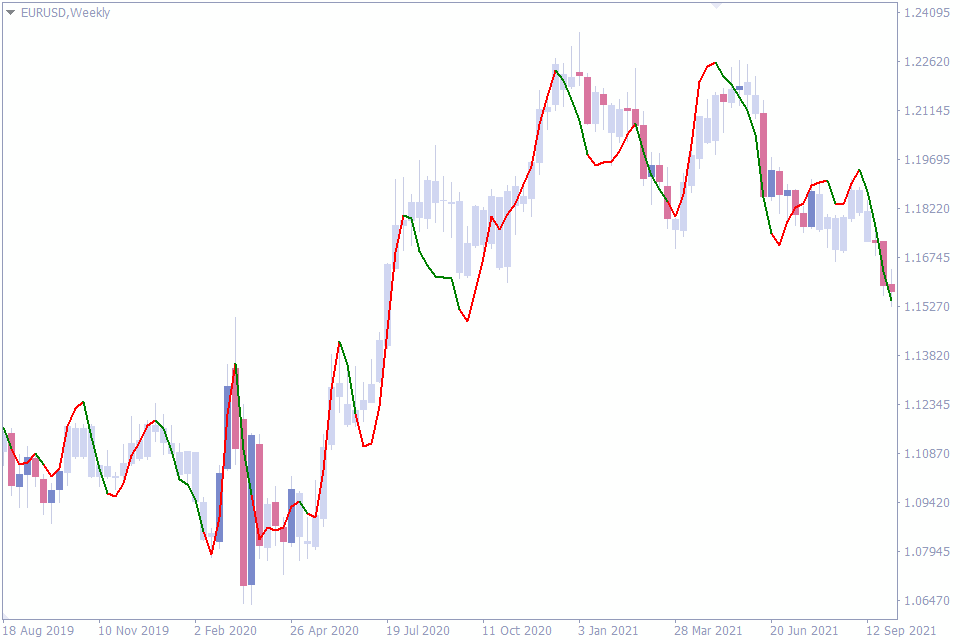

Our first indicator of this list is the Triple exponential moving average. This version of the moving average in combination with price action is an effective trend indicator. Forex trend traders can identify the trend direction easily using this indicator.

The Triple exponential moving average is quite successful in eliminating the lag. It is more responsive than the Simple moving average – SMA and the Exponential moving average – EMA. Moreover, the indicator is able to achieve reduced lag, since the EMA is subtracted thrice.

The important feature of the indicator is that it gives more weight to the recent values. So, the indicator provides increased responsiveness to the recent price changes. Therefore, the trend changes are reflected swiftly by the indicator.

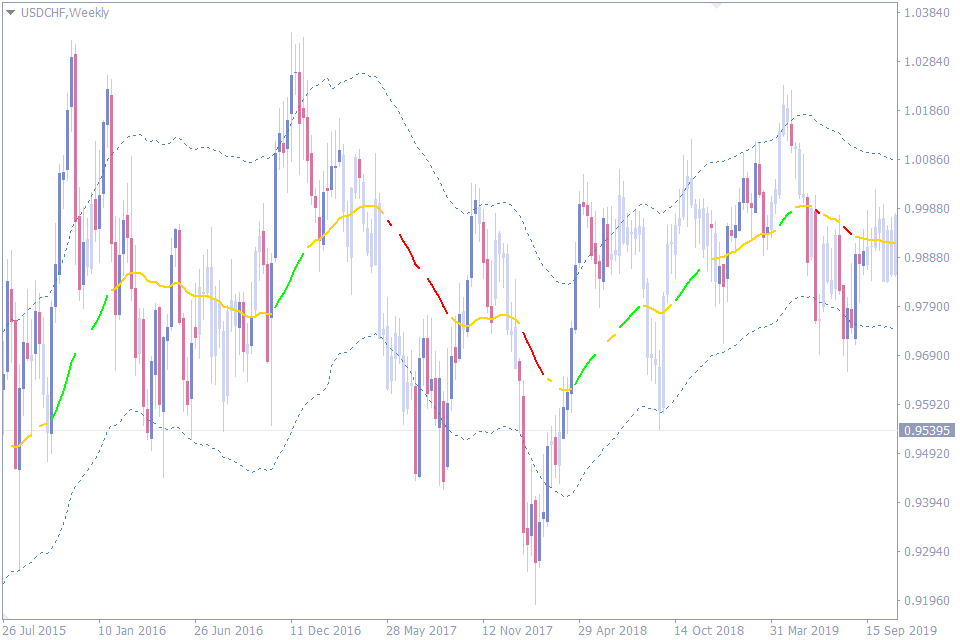

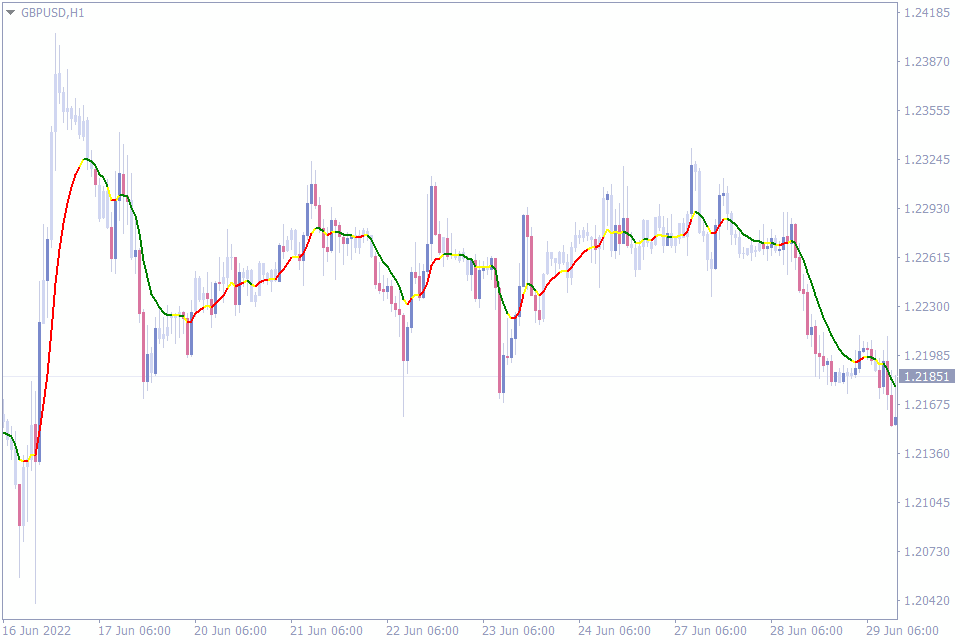

Forex traders can identify the trend by visually noticing the slope and the color of the indicator. A positive slope indicates a bullish market, while a negative slope indicates a bearish price trend. Similarly, the indicator color changes from green to red and vice versa. So, forex traders can identify the trend and effectively ride the trend as long as possible.

In effect, this indicator helps the trader to identify trend changes and ride the trend as long as possible. However, for best trading results, the indicator trading signals should be confirmed with price action.

Hull Moving Average – HMA

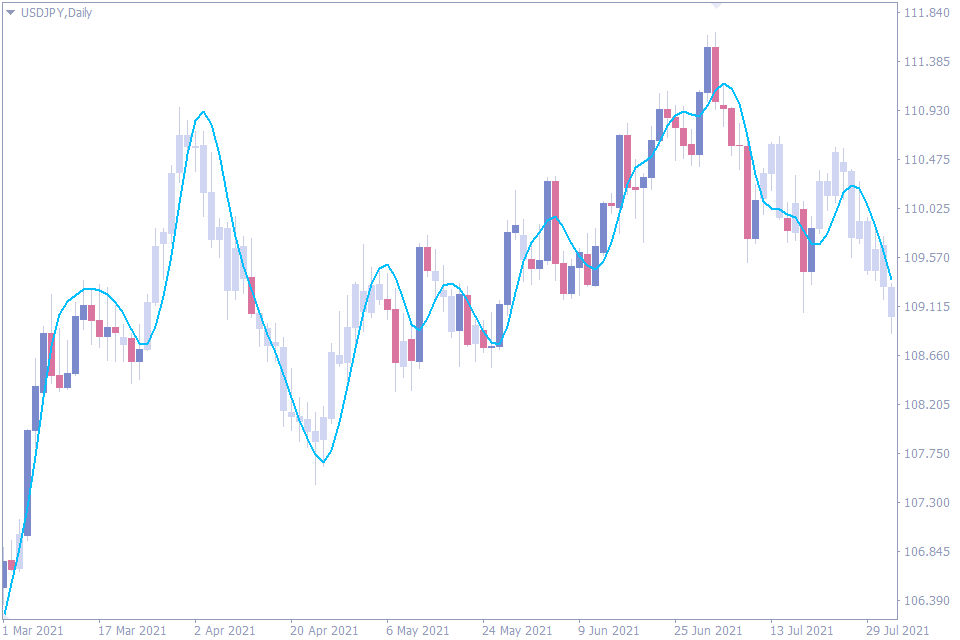

The next indicator on our list gives more weight to the recent data. As a result, it is very effective in identifying trend reversal signals in a short-term price chart. The Hull moving average is much more responsive to the Simple moving average – SMA and the Exponential moving averages- EMA.

Generally, forex traders widely use the Simple moving average – SMA. Due to the lagging trading signals from the SMA, the next preferred moving average is the EMA. The Hull moving average outperforms the SMA and EMA when it comes to identifying short-term trend reversals.

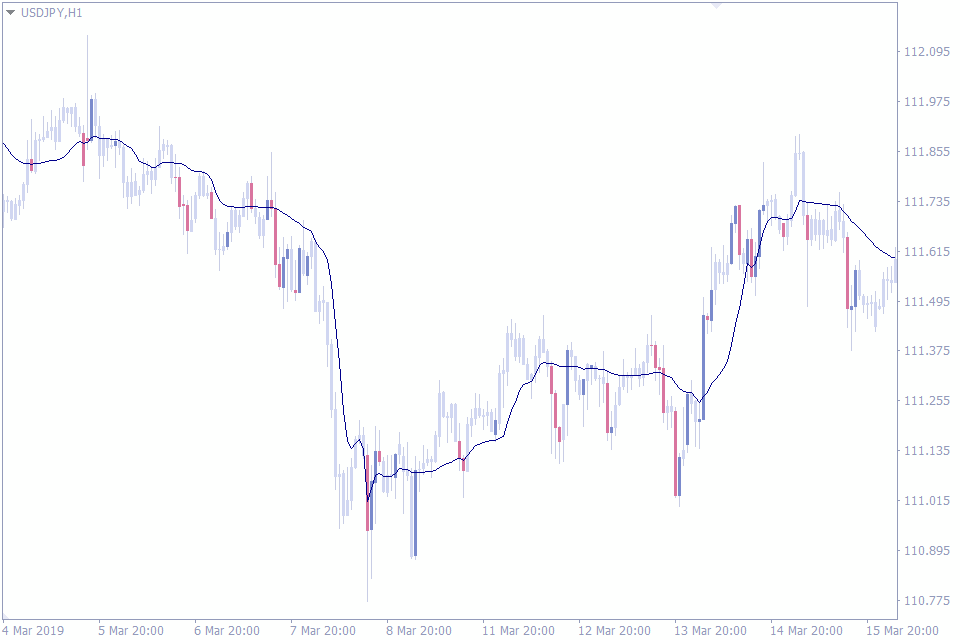

Another important feature of the Hull moving average is its proximity to the price. The Hull moving average line is very close to the price and reflects the price changes pretty quickly. Since the HMA indicator line is close to the price the candles tend to close across the HMA and signal a trend change swiftly.

However, this quick shift in the HMA tends to produce false signals. So, forex traders should use candlestick patterns to confirm the trend changes. Moreover, trend changes around pre-established support and resistance levels provide the best results in confluence with the Hull Moving average indicator.

The Hull moving average is specially designed for the short-term traders who look for trading opportunities during trend changes.

Volume Weighted Moving Average – VWMA

Now let’s discuss the third indicator on our list. The Volume weighted moving average- VWMA is not only a trend indicator but also doubles down to provide support and resistance. Interestingly, this indicator provides dynamic support and resistance. So, forex traders can use this indicator to identify the best entry and exit points.

Another important feature that differentiates the Volume weighted moving average from the rest of the moving average indicators. As the name suggests the indicator incorporates trading volume with the moving average calculation. The indicator gives more weight to the candles with high volumes than the low volume candles.

As a result of adding volume to the equation. The indicator is able to plot dynamic support and resistance. So, forex traders can use the support and resistance to trail the markets by moving the stop loss once the support or resistance changes.

Additionally, technical forex traders can use the indicator to trade break out trading strategies. If the price breaks out of the support and resistance then traders can look into trading in the breakout direction.

In effect, the Volume weighted moving average helps the traders to identify the trend direction. Moreover, traders can ride the trend by adjusting the stop loss according to the dynamic support and resistance.

Exponential Moving Average – EMA

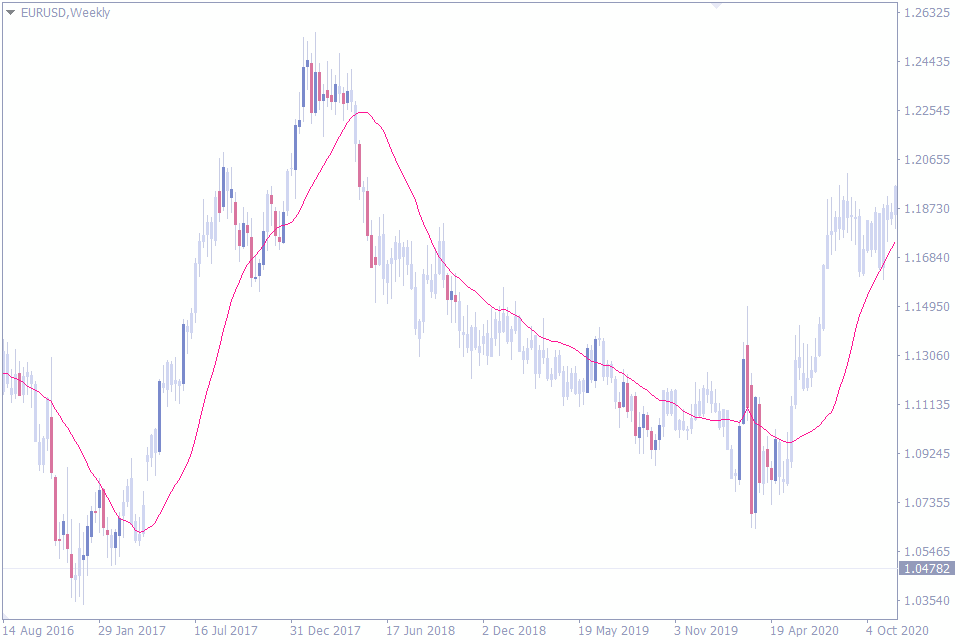

The fourth indicator on our list is the most popular version of the moving average indicators. The Exponential moving averages – EMA finds a permanent place in the trading arsenal of most moving average enthusiasts. The main objective of this indicator is to identify the trend changes as early as possible, by adding more weight to the recent price changes.

By reacting more to the recent price changes, than the earlier price movements. This indicator alerts the forex traders early enough to catch the trend and ride them. The trading signals of this indicator are pretty simple for new and advanced forex traders.

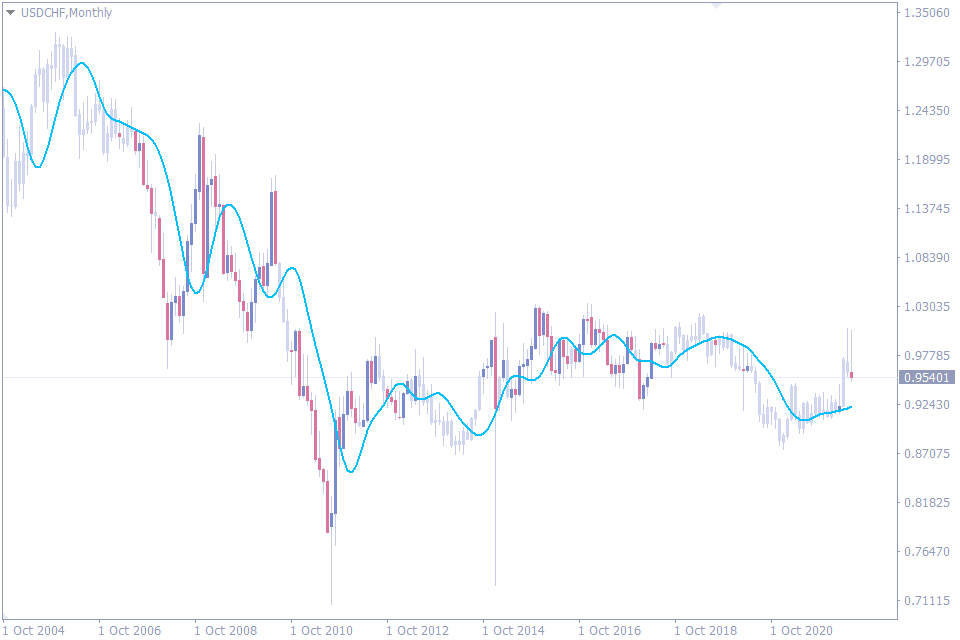

If the price is above the EMA it indicates a bullish price trend, on the other hand, if the price is below the EMA it indicates a bearish market trend. Another effective and profitable trading strategy using this indicator is widely appreciated by traders globally.

The crossover trading strategy with 2 or 3 moving averages of the Exponential moving averages is an amazingly simple and profitable trading strategy in the long run. The crossover of the fast- and slow-moving averages provides bullish or bearish trading signals and prompts the trader to buy or sell accordingly.

The EMA is the next widely used indicator after the simple moving average SMA. Forex traders should combine slow and fast-moving averages with various periods to match their trading style and strategy. Though this indicator may provide false signals with lower periods, trading with longer periods provides stable and profitable returns.

TMA Line Indicator

Here comes the fifth indicator on our list the Triangular moving average – TMA line indicator. This indicator is a very versatile trading tool that informs the technical forex trader about the trending and non-trending nature of the markets. So, forex traders can stay on the sidelines when the market is not trending and avoid trading losses.

Trading during a trending market provides the best trading results in terms of the number of profitable trades and also the magnitude of profits. No wonder, many forex traders enter the markets in a non-trending market only to hold the position for a longer period of time or to exit with a loss. The indicator shows the uptrend, no trend, and downtrend in different colors to assist the traders.

Another important aspect of this indicator is the ability to provide entry points and stop loss points. The indicator plots three lines that form a band similar to the Bollinger bands. The slope of the midline and the band altogether indicate the trend direction.

Many trading indicators do not provide stop-loss strategies. But the TMA line MetaTrader indicator provides a one. Forex traders can enter the market based on the location of the price in relation to the midline. However, the best stop loss to secure this trade is to place one at the outer bands.

The TMA line indicator provides solutions to multiple trading aspects and definitely assists the traders to become successful and profitable.

Arnaud Legoux Moving Average (ALMA)

We have covered half of the list, now let’s discuss the sixth indicator on our list. The Arnaud Legoux moving average – ALMA indicator helps forex traders to overcome the two main drawbacks found in other moving average indicators. The Alma indicator ignores minor price fluctuations, thereby enhancing the trader to identify the direction of the market trend.

As a result, the indicator adds responsiveness and smoothness to the moving averages. Thus, it helps forex traders to stay in the trend direction for a longer period of time by ignoring small fluctuations. So, traders can place trades with a better risk to reward ratio.

Alma indicator calculates the moving average in a unique method. It calculates the moving average in two types. One moving average is calculated from left to right, while the other is calculated from right to left. Both the moving averages are then combined to reduce the lag. Thereby, the Alma indicator calculates both the recent data and the previous data to identify a long-term trend.

The Alma indicator is neither aggressive nor lagging. This helps the trader with a stable moving average indicator much better than others.

Fractal Adaptive Moving Average – FRAMA

Now let’s move to the seventh indicator on our list of best moving average indicators. The Fractal adaptive moving average known as the FRAMA is the next indicator we will be discussing below. The indicator was developed by John Ehlers.

The important aspect of this indicator is the ability of the indicator to remain flat when there is no market momentum. On the other hand, the indicator reacts during a trending market once there is momentum. This helps forex traders to identify trending and non-trending markets and buy or sell during a trending market.

Since the indicator follows the momentum closely, it helps traders to enter the market with a high probability of trades. Moreover, the indicator gives more weight to recent price changes and reflects those changes quickly.

The Fractal adaptive moving average – FRAMA indicator also provides dynamic support and resistance as it follows the price changes closely. So, traders can use the indicator to identify trending markets or sideways markets, entry points, and stop loss.

MA Profit Indicator

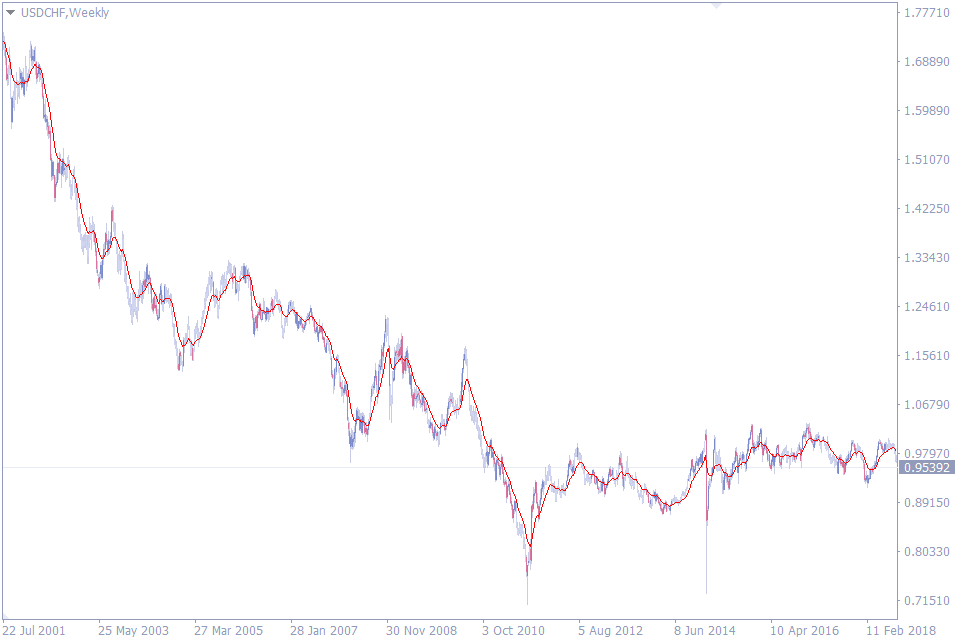

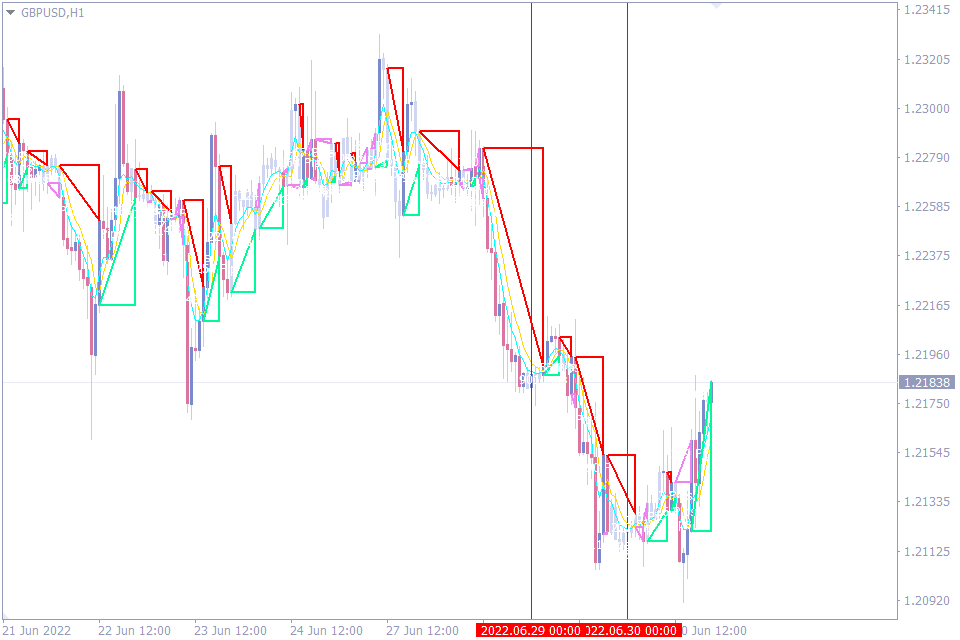

We are now getting to the lower end of our list of best moving average indicators. The MA profit indicator is based on the crossover of slow and fast-moving averages. The combination of these moving averages provides trading signals on trend changes.

Trading moving average crossover is a time-tested trading strategy to identify trend changes. However, the choice of period of the fast- and slow-moving averages holds the key to successful trading of different trading styles.

Generally, longer periods of moving averages tend to identify long-term trends, while the shorter moving average periods help the trader to navigate short-term trend changes. The MA profit indicator provides simple crossover signals that are beneficial for new and advanced forex traders.

The indicator plots the trading signals as triangles with the number of potentially profitable pips if that trade was executed. Moreover, the indicator also plots the failed trading opportunities.

XP Moving Average

This ninth indicator on our list is very interesting for the moving average enthusiasts. The XP moving average indicator is a Swiss knife for moving averages, it contains 11 types of moving averages. So, forex traders can choose the moving average type of their choice to identify the bullish and bearish market conditions and buy and sell accordingly.

Traders can choose the moving average of their choice from the input settings of the XP moving average indicator. Traders can choose from Simple moving average – SMA, Exponential moving average- EMA, Smoothed moving average- SMMA, Linear weighted moving average – LWMA, Double exponential moving average – DEMA, and Triple exponential moving average – TEMA among the common MA.

Additionally, the indicator also has some special moving average types. T3 moving average – T3MA, Jurik moving average – JMA, Hull moving average – HMA, DECEMA moving average, and the SALT indicator.

The XP moving average by providing multiple options proves to be an essential trading tool for technical forex traders.

MA Rainbow indicator

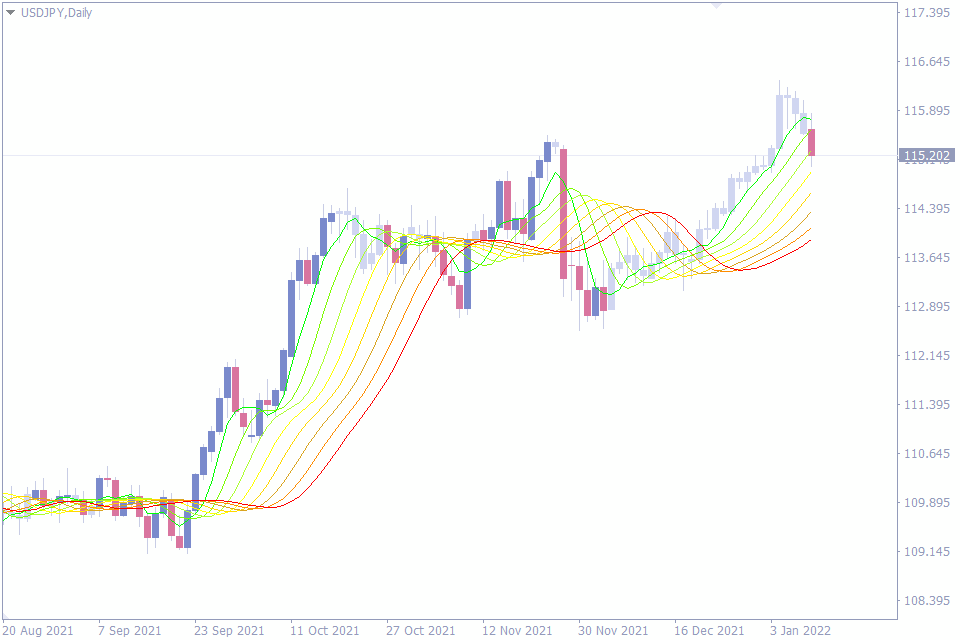

Our final indicator in the list is the Moving average rainbow indicator. Other multiple moving average-based indicators combine and compare a maximum of 3 different moving averages. These moving averages have different periods and they identify the trend direction. However, the MA rainbow indicator is quite different.

The MA rainbow indicator plots 8 moving averages. These Simple moving averages are derived from the value of the previous moving average. In effect, the moving averages are the moving averages of the previous ones. Thus, the indicator smoothens the values and is not affected by small price fluctuations. Because the more minor fluctuations are neutralized, the MA rainbow provides longer trend signals.

The trading signals of this indicator are more reliable in the long term. The best trading method is to enter the markets on the crossover of the moving averages. Moreover, the combination of 8 moving averages acts as the best stop loss. So, this indicator is widely used by forex traders due to the smooth trading signals.

Conclusion

The above list of best moving average indicators showcased the best. However, the moving average is probably the most loved indicator by new and advanced forex traders alike. Though there exists a huge list of custom-made moving averages, the above list provides an essential insight into the best of the world of moving average indicators.

All or most of the moving average indicators focus on solving the lag. So, forex traders should be aware of this fact and incorporate the moving average indicators into their trading strategy. Moreover, traders should experiment and identify the best moving average to suit their trading requirements. However, the best trading strategy would be to add every element of technical analysis rather than depending on one.

Leave a Reply