Mastering Momentum – Optimal Settings for the Stochastic Oscillator

The Stochastic Oscillator stands as a cornerstone in the toolkit of many traders, renowned for its ability to identify potential trend reversals and overbought or oversold conditions in the Forex market, crypto, stock and other markets. However, harnessing its full potential requires a nuanced understanding of its settings. In this article, we delve into the optimal settings for the Stochastic Oscillator and explore how traders can use them to enhance their trading strategies.

Understanding the Stochastic Oscillator

Before delving into the settings, it’s essential to grasp the basics of the Stochastic Oscillator. This momentum indicator compares the current closing price of a security or currency pair or another financial instrument to its price range over a specified period. It consists of two lines: the %K line, which represents the current price relative to the range, and the %D line, a moving average of the %K line. The Stochastic Oscillator oscillates between 0 and 100, with readings above 80 indicating overbought conditions for short position and readings below 20 suggesting oversold conditions for long position.

Stochastic Oscillator Indicators

The Stochastic Oscillator Indicators are an essential trading software instruments working with MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms, offering insights into market momentum and potential turning points in price trends. This dynamic indicator gauges the current price level relative to its range over a specific period, providing a clear picture of the market’s overbought or oversold state. Traders have the ability to refine the Stochastic Oscillator’s parameters, including the %K and %D periods, to enhance accuracy in both swing and day trading. Customizing these settings allows for a more precise alignment with various timeframes and market scenarios, facilitating the detection of trend continuations or reversals, and aiding in the determination of strategic entry and exit positions. The financial markets’ ongoing fluctuations are thus more intelligibly navigated with the Stochastic Oscillator’s tailored application.

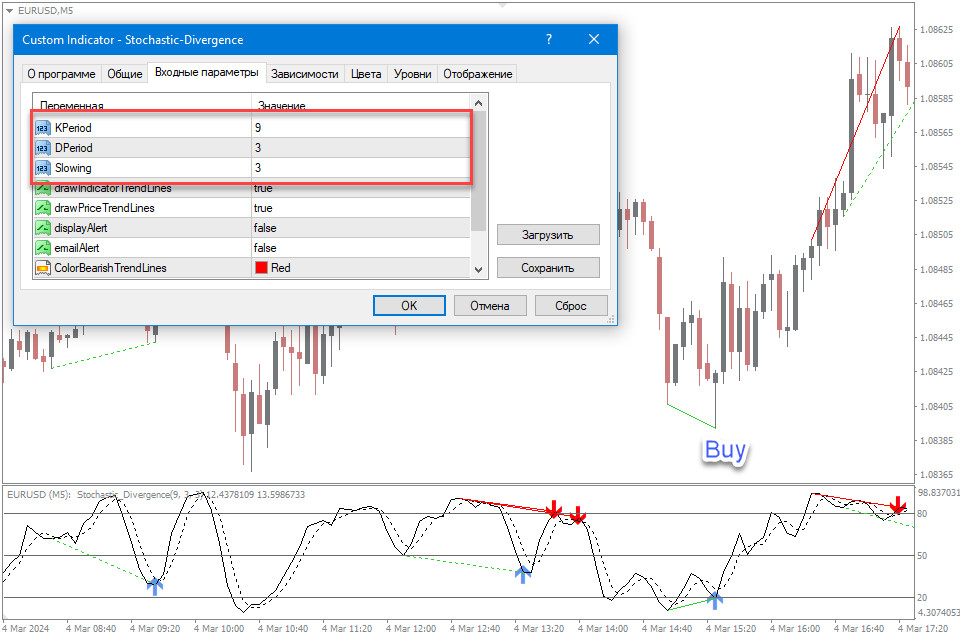

A wide array of Stochastic Oscillator variants for trading platform are readily available at free of costs, offering different visual interpretations and signal alerts for buy or sell, and can be easily downloaded and use. Among these options, I have chosen to utilize indicators such as the Stochastic Divergence Indicator and Color Stochastic Indicator for enhanced trading alerts and market analysis.

Standard Settings and Adjustments

Lookback Period: The lookback period, typically set at 14 periods by default, determines the number of bars used to calculate the Stochastic Oscillator. Shortening the lookback period increases the oscillator’s sensitivity to price changes, making it more responsive but also prone to generating false signals. Conversely, lengthening the lookback period smoothens out the oscillator’s movements but may result in delayed signals. Experiment with different lookback periods to find the optimal balance between responsiveness and reliability.

Smoothing Period: The smoothing period, which determines the length of the moving average applied to the %K line to derive the %D line, plays a crucial role in filtering out noise and improving signal accuracy. While the default smoothing period is often set at 3 periods, traders may adjust it to match their trading objectives and timeframes. Shorter smoothing periods result in a more responsive %D line but may lead to increased noise and false signals. Conversely, longer smoothing periods produce smoother %D lines but may lag behind price movements. Test different smoothing periods to find the optimal balance between responsiveness and accuracy.

Overbought and Oversold Levels: While the default overbought and oversold levels are typically set at 80 and 20, respectively, traders may adjust these levels based on the specific characteristics of the asset being traded and prevailing market conditions. Assets with high volatility may require higher overbought and oversold levels to filter out noise and avoid premature signals. Conversely, assets with lower volatility may warrant lower overbought and oversold levels to capture more significant price movements. Consider adjusting these levels based on the asset’s historical price range and the prevailing market environment.

Each adjustment carries its own risk management strategies and reward balance, with tighter settings offering early signals at the cost of potential false positives, and looser settings providing more confirmed signals with the risk of entering the market too late.

Fast, Slow and Full Stochastic Oscillators

The Stochastic Oscillator comes in three distinct variations—Fast, Slow, and Full—each with its unique settings and applications.

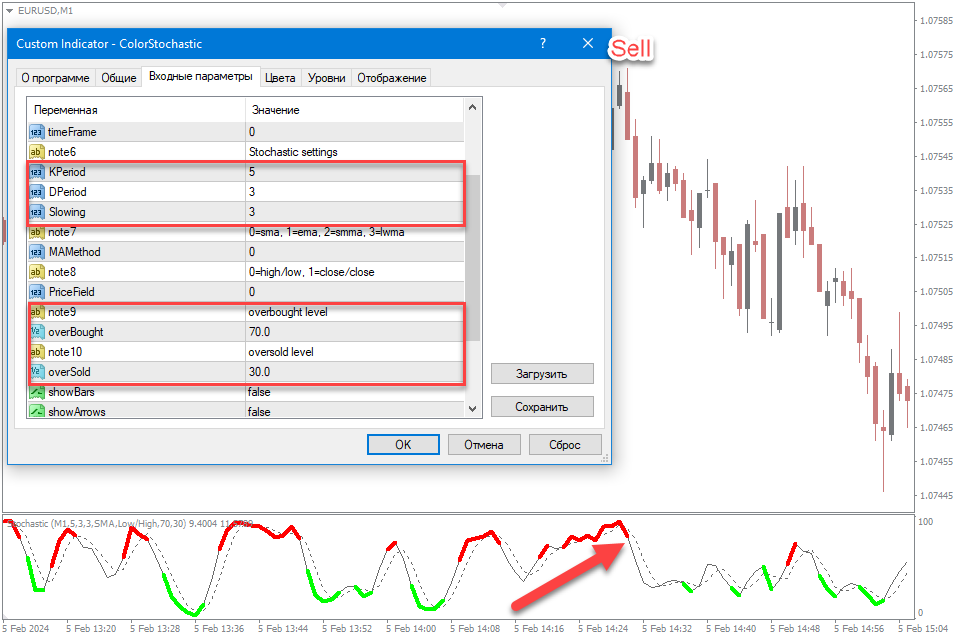

The Fast Stochastic is characterized by its highly sensitive reaction to market movements, which can be beneficial for identifying rapid changes in price momentum but may also lead to false signals due to its volatility. When employing the Stochastic Oscillator for scalping or intraday trading, traders often adjust the settings to better suit the shorter timeframes and rapid price movements characteristic of intraday trading. One common modification involves reducing the lookback period to capture more recent price action. By shortening the lookback period, such as to 3, 5 or 7 periods, traders can obtain more timely signals that reflect the latest market developments. Additionally, a shorter smoothing period may be preferred to enhance responsiveness without sacrificing signal accuracy.

Tightening the overbought and oversold zones, such as setting them to 70 and 30 respectively, can also help filter out noise and generate more precise entry and exit signals in volatile intraday markets. Overall, adapting the Stochastic Oscillator settings for intraday trading requires striking a balance between responsiveness and reliability to effectively capture short-term price movements.

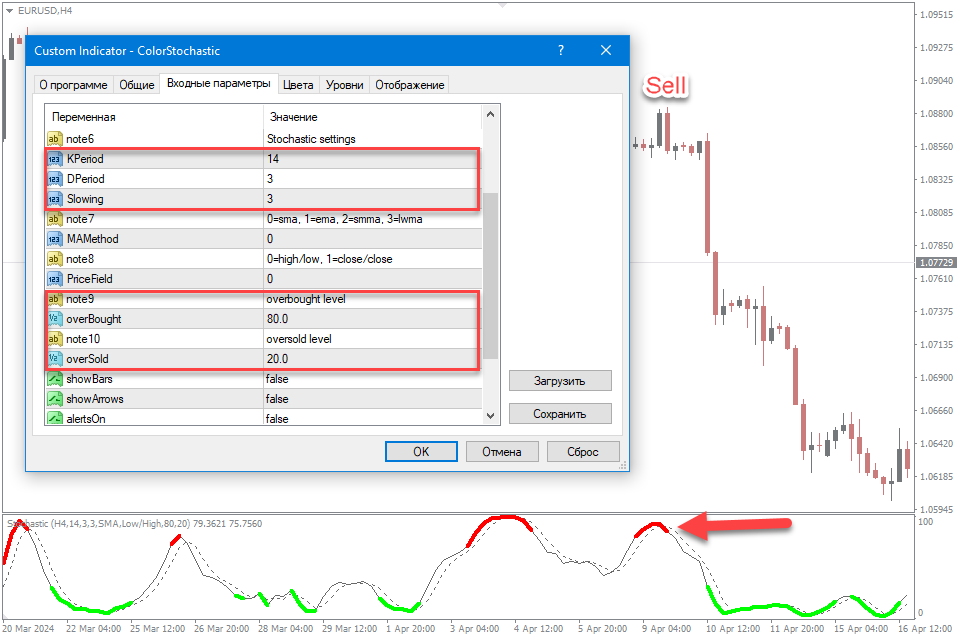

The Slow Stochastic, when configuring the Stochastic Oscillator for swing trading, traders often adjust the settings to align with the longer timeframes and broader price swings characteristic of swing trading strategies. One common modification involves increasing the lookback period to capture more significant price movements over extended periods. By extending the lookback period, such as to 14 or 21 periods, traders can smooth out short-term fluctuations and focus on identifying larger trends and reversals. Additionally, a longer smoothing period may be preferred to reduce noise and generate more stable signals suitable for swing trading.

Widening the overbought and oversold levels, such as setting them to 80 and 20 respectively, can help identify potential reversal points with greater confidence in swing trading scenarios. Overall, adapting the Stochastic Oscillator settings for swing trading involves prioritizing stability and trend identification over short-term fluctuations to capitalize on broader market movements.

Tailoring the Full Stochastic settings to suit specific sectors can optimize its effectiveness in generating accurate trading signals. Each sector possesses distinct volatility levels and trend behaviors, necessitating adjustments to the oscillator parameters for enhanced performance.

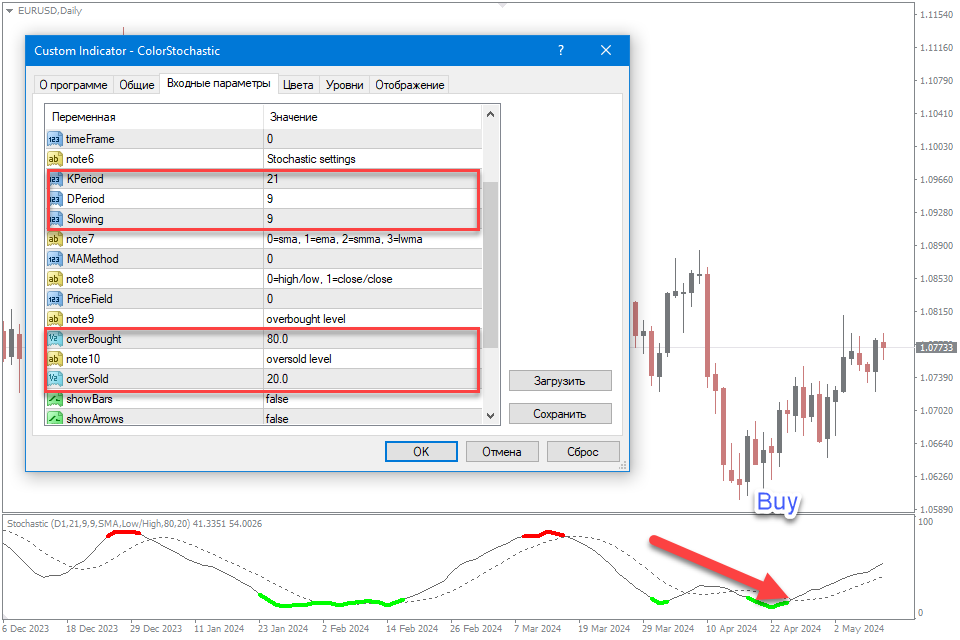

Currency pairs by high volatility, or crypto a slightly faster setting like 9, 3, 3 may be preferable. This configuration allows the oscillator to react more promptly to price changes, capturing rapid movements and providing timely signals for traders. Conversely, in stable currency pairs, such as utilities, a slower setting such as 21, 9, 9 might be more appropriate. This slower configuration smooths out short-term fluctuations, enabling the oscillator to focus on identifying longer-term trends with greater accuracy and reducing the likelihood of false signals.

By customizing the Stochastic Oscillator settings based on sector-specific characteristics, traders can better align their strategies with the unique dynamics of each market segment, leading to more informed trading decisions and improved overall performance.

Choosing the Right Time Frame

Selecting the appropriate time frame is a critical step in effectively utilizing the Stochastic Oscillator within various trading strategies. The time frame using for the oscillator should resonate with the trader’s style and the typical holding period of their trades. Day traders might opt for shorter time frames, such as 5-minute or 15-minute charts, where the Stochastic Oscillator can help identify quick, intraday trends and potential reversal points. Swing traders or those looking for medium-term signals may find the hourly or 4-hour price charts more aligned with their needs, offering a balance between signal frequency and quality. For long-term investors, daily or weekly charts can be beneficial, as they help filter out the noise of short-term price fluctuations and provide a clearer view of the market’s overarching momentum. It’s essential to remember that the Stochastic Oscillator’s sensitivity will vary across different time frames; shorter time frames may lead to a higher number of trading signals, which could include more false positives, while longer time frames chart may generate fewer but potentially more reliable signals. Traders should experiment with various time frames in conjunction with their Stochastic Oscillator settings to find the combination that best suits their money management and risk-reward ratio and trading objectives.

Conclusion

The Stochastic Oscillator is a powerful technical analysis tool that, when fine-tuned, can significantly enhance a trader’s ability to read market momentum and identify potential trade opportunities. The process of adjusting the oscillator’s settings—choosing between the Fast, Slow, and Full versions, setting the right time frame, and customizing the price field settings—requires a thoughtful approach that considers the trader’s individual style, risk tolerance, and the specific market sentiment. It’s not about finding a universal setting that works in all scenarios, but rather about understanding the underlying principles that govern the oscillator’s behavior and applying this knowledge to create a personalized setup. Traders should be prepared to experiment with different configurations and continuously assess the effectiveness of their chosen settings, making adjustments as necessary to align with evolving market dynamics. Ultimately, the goal is to achieve a balanced oscillator that provides timely and reliable signals.

Combining the Stochastic with trend indicators like moving averages, or with volume-based tools such as the On-Balance Volume (OBV), can help confirm forex signals and reduce the likelihood of false positives. Divergence with momentum indicators like the Relative Strength Index (RSI) can also uncover hidden market movements. It’s essential to remember that no single indicator provides all the answers; rather, a synergistic approach that employs a blend of indicators is often more effective in creating robust trading strategies. By doing so, traders can enhance their analytical framework, leading to more informed decisions and potentially more successful trading outcomes.

Leave a Reply