Types of Forex MT4 Indicators: Comprehensive Overview

Traders utilize forex indicators as instruments for market analysis and to make well-informed trading choices. This article centers on widely used MetaTrader 4 indicators employed by traders

around the world. Essentially, these MT4 indicators comprise mathematical calculations derived from historical price data, enabling the identification of trends, confirmation of market conditions, and the generation of buy/sell signals. Forex MT4 indicators encompass diverse types, each designed for a specific function. Let’s delve into several notable types of forex indicators.

Two Main Categories of Indicators

Forex indicators can be broadly categorized into two groups: leading indicators and lagging indicators. Leading indicators offer signals to traders before a price movement initiates, allowing for proactive decision-making. On the other hand, lagging indicators provide signals after a price movement has already commenced, serving as tools for confirmation. The MT4 platform offers a

wide range of pre-installed indicators, which are classified based on the specific aspect of price they assist traders in interpreting.

Trend Indicators

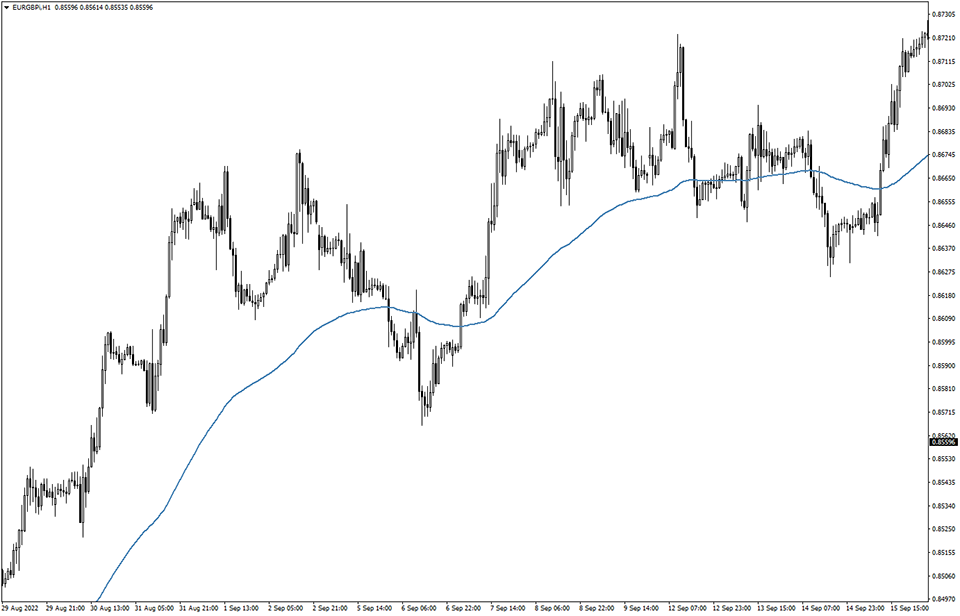

Trend indicators are specifically designed to assist traders in identifying and capitalizing on opportunities within trending markets. Traders utilizing trend MT4 indicators aim to determine the

existence of a trend, as well as the optimal entry and exit points to ride the trend. The objective is to consistently execute trades that align with robust trends. Trend indicators enjoy widespread

popularity, with notable examples such as moving averages. The slope of moving averages plays a crucial role in determining the prevailing trend. An upward slope indicates an uptrend, while a downward slope suggests a downtrend. Trend reversals are confirmed by moving average crossovers. For instance, in an uptrend, the conclusion of the trend and the possibility of a reversal are indicated when the faster moving average crosses downward through the slower one.

Oscillators Indicators

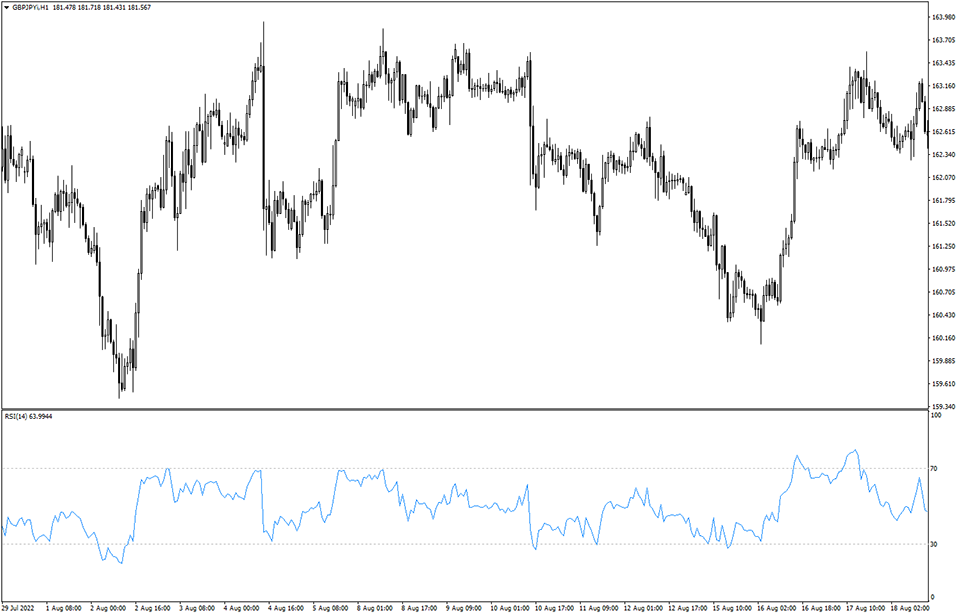

Oscillators are a type of forex indicator specifically designed to monitor the interplay of supply and demand forces within the market, hence their alternative name, momentum indicators. Their

primary function is to gauge overbought and oversold conditions in the market. When a market is deemed oversold, traders seek opportunities to initiate buy orders, while in overbought markets,

traders seek opportunities to initiate sell orders. Examples of oscillators include the RSI (Relative Strength Index) and Stochastics. The RSI typically indicates a reading of 30 or below to signal an oversold market, and a reading of 70 or above to signal an overbought market. The Stochastic oscillator operates in a similar manner, providing insights into market conditions based on overbought and oversold levels.

Volume Indicators

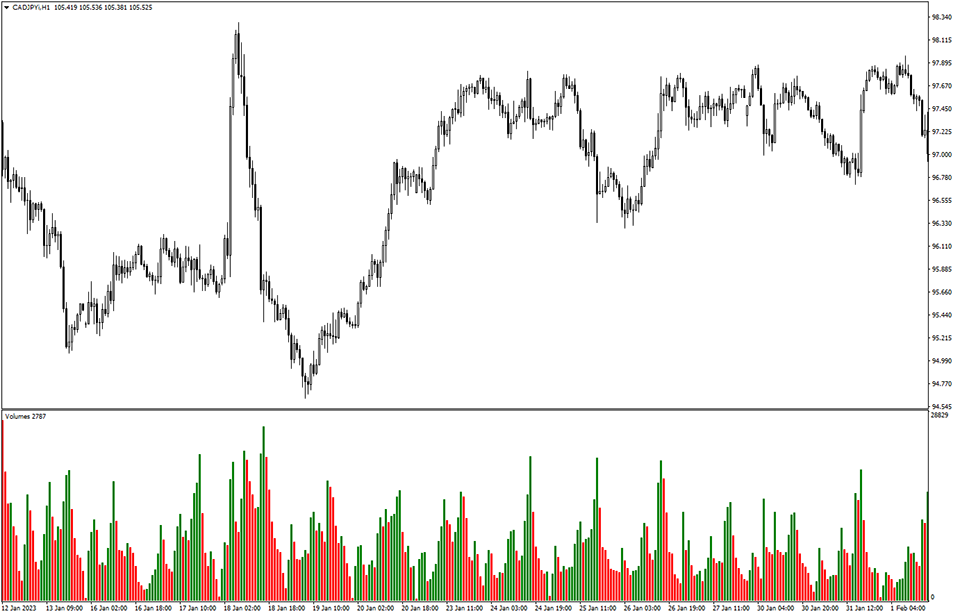

Volume indicators serve as valuable tools for traders to assess the level of trading activity accompanying a specific price movement in the market. By analyzing volume, traders can

determine whether a price movement is supported by strong conviction or not. These forex indicators aid in qualifying trends or potential reversals in the market. Moreover, they help traders avoid falling for false signals or deceptive price movements. Prominent examples of volume MT4 indicators include the Money Flow Index and the Volumes indicator. Traders employing the Money Flow Index typically pay attention to the centerline at 50. A reading above 50 indicates buying pressure in the market, while a reading below 50 suggests selling pressure.

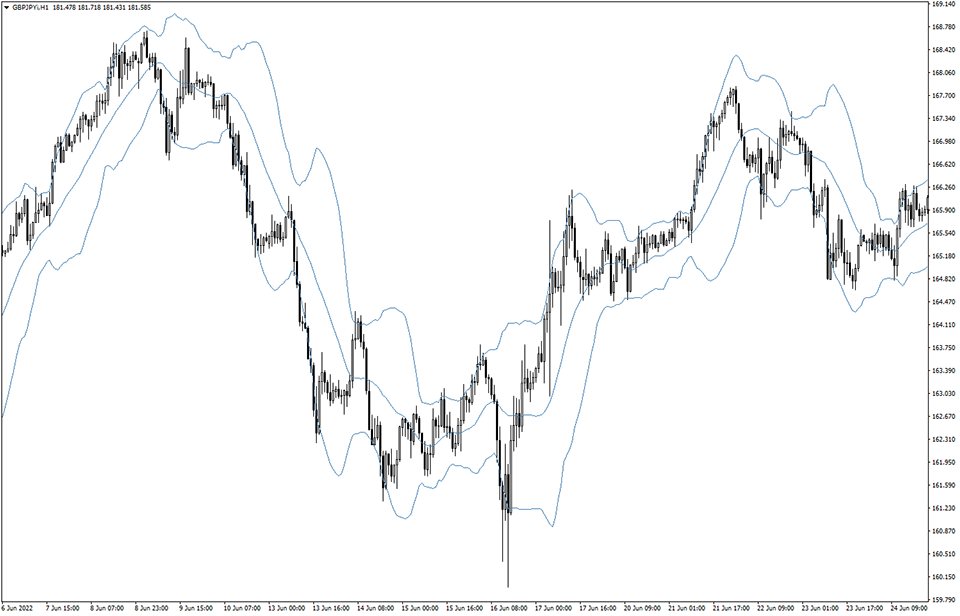

Volatility Indicators

Volatility indicators refer to the frequency and intensity of price movements within a given market. It is a crucial aspect for traders in determining which markets to trade and how much to invest.

Highly volatile markets offer both lucrative opportunities and increased risk, often prompting traders to allocate smaller stake amounts. Conversely, less volatile markets exhibit lower price

activity, allowing traders to potentially trade with higher investment amounts. Volatility MT4 indicators play a vital role in assessing the inherent price volatility of preferred markets. Notable examples of volatility indicators include Bollinger Bands and Average True Range (ATR). Bollinger Bands, characterized by channel-like bands, expand during periods of high volatility and contract during low volatility phases in the underlying market. On the other hand, the ATR presents a single line resembling an oscillator, providing insights into market volatility.

How To Use Forex MT4 Indicators Effectively

Utilizing forex MT4 indicators effectively requires integrating them with other forms of analysis, such as fundamental analysis or price action analysis. While these indicators offer valuable insights into market trends, consider the following tips to optimize their usage:

Employ multiple indicators: Combining multiple indicators provides a more comprehensive perspective on market trends and helps to validate signals.

Comprehend the strengths and weaknesses: Recognize that each forex indicator possesses specific strengths and limitations. Understanding how they operate and what they can and cannot predict is crucial.

Integrate indicators with other analyses: Avoid relying solely on indicators in isolation. Instead, incorporate them alongside other forms of analysis, such as fundamental analysis or price action analysis, for a well-rounded approach.

Guard against excessive reliance: Depending excessively on forex indicators may lead to analysis paralysis, impeding decisive action. Treat indicators as tools rather than crutches, maintaining a balanced approach.

By following these guidelines, traders can harness the full potential of forex indicators while

maintaining a holistic perspective on the market.

Bottom Line

Within this article, we have introduced the primary categorization of forex MT4 indicators, enabling traders to gain a comprehensive understanding of their distinct characteristics. By familiarizing oneself with these categories and their specificities, traders can make more informed decisions, capitalizing on the advantages provided by these indicators while being aware of their limitations.

Leave a Reply